Stablecoins as November 2025’s Liquidity Backbone: USDC Growth, Tether Surge, and Custody Upgrades

Summary

November 2025: stablecoins as the market’s plumbing

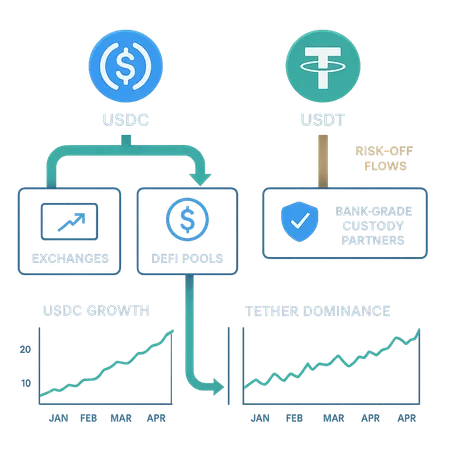

The market’s recent tremors have made one thing clear: stablecoins are no longer peripheral rails — they are the plumbing. In November 2025, two linked trends stood out. First, USDC growth continued at pace as Circle reported record Q3 metrics and rising circulation. Second, Tether dominance spiked as risk-off flows chased the largest, most liquid stablecoin pools. At the same time, custody and settlement upgrades — including institutional integrations with Coinbase custody and exchange partners — are lowering the hurdle for on-chain settlement and large transfers.

This matters for anyone running institutional operations or designing DeFi strategies. On-chain liquidity is now not just a trading convenience; it is a settlement layer that determines how quickly fiat exposure can be parked, how AMMs and lending markets rebalance, and how market makers size inventory during stress.

USDC’s surge: numbers, drivers, and institutional signals

Circle’s Q3 reporting and on-chain tallies tell a consistent story: USDC circulation is expanding materially as institutions and platforms increase holdings. Circle’s Q3 disclosure — which documented record activity and a notable uptick in institutional engagement — aligns with other data showing USDC supplies rising to new levels in 2025. The trend is not solely retail-driven; large spot desks, OTC venues, and regulated counterparties are parking more cash on-chain.

Why does this matter operationally? Institutions value predictable rails. When a ledger balance in USDC can be moved, settled, and reconciled quickly — and when custody is provided by regulated entities — treasuries and trading desks treat USDC like a working account. That dynamic is supported by the recent moves to secure reserve arrangements and custody integrations that make on-chain USDC suitable for institutional settlement.

For further reading on Circle’s results and the Q3 context, see Circle’s coverage in their Q3 overview and reporting. The way Circle frames growth in Q3 is a useful lens on why USDC has become a dominant tool for treasury and trading operations.

Why investors rotate into stablecoins during turmoil

When markets pull back, the rotation into stablecoins follows a predictable logic. Traders and institutions reduce directional risk and increase liquidity buffers. Several mechanisms drive the flow:

- Margin and collateral adjustments: derivatives desks and lenders deleverage, converting volatile assets to stablecoins to meet margin calls and prevent forced liquidations.

- Counterparty flight-to-safety: in uncertain conditions, on-chain stablecoins act as near-cash that can be redeployed quickly across exchanges and DeFi primitives.

- Arbitrage and market-making rebalancing: market makers shift inventory into the deepest, most fungible stablecoins to preserve tight spreads and manage balance-sheet exposure.

This rotation emphasizes function over yield. In a stress environment the priority is rapid settlement, minimal slippage, and wide acceptance — which is why liquidity depth (not yield) becomes the primary asset attribute. For ops teams, the key operational KPI becomes settlement speed and custody certainty, not just token availability.

Tether dominance spikes — what it means for market structure

November’s jump in Tether’s market share is a textbook risk-off footprint: when liquidity is scarce, traders and platforms cluster around the largest pools to guarantee execution. Recent reporting shows Tether’s share rising to levels not seen since spring, a clear sign that market participants compressed into the deepest orderbook and liquidity pools.

That shift has immediate implications:

- Market-making concentration: with more volume in USDT pools, market makers may tighten spreads on USDT pairs and widen them elsewhere, altering profitability across venues.

- DeFi pool dynamics: AMMs and lending markets that rely heavily on USDT see increased utilization and fee generation, but also heightened single-stablecoin exposure for liquidity providers.

- Counterparty risk repricing: some institutions prefer USDC for regulated custody and explicit reserve statements; others accept USDT’s deeper liquidity for execution immediacy, creating differentiated risk-return choices.

Put simply: Tether dominance affects where liquidity is deepest, and that shapes trading costs, slippage, and how quickly capital can move in a crisis. For DeFi strategists, it means monitoring pool composition and the relative depth of USDC vs USDT pairs when sizing positions or designing hedges.

For contemporaneous market share analysis, the recent coverage on Tether’s market share provides useful data points on how investor flows concentrated in November.

Custody and settlement upgrades: institutional on-chain integration accelerates

A critical structural change this cycle is the maturation of custody and settlement plumbing. Institutional adoption depends less on token economics and more on counterparty and operational controls: audited reserves, regulated custodians, insurance arrangements, and integrated settlement flows between exchanges, clearing venues, and institutional wallets.

The recent wave of custody integrations — for example, partnerships that bring USDC reserve protections and direct custody into exchange settlement stacks — are reducing friction for institutional flows. One notable story describes how new custody pairings aim to secure USDC reserves and provide clearer settlement pathways for institutional volumes. These integrations allow institutions to execute large trades, settle OTC transactions, and move cash on-chain without exposing treasury teams to bespoke reconciliation headaches.

Operationally, that means institutions can treat on-chain USDC as part of a reconciled balance sheet: transfers between custodians and counterparties can be matched with off-chain accounting systems, and settlement finality happens in minutes rather than hours or days. Platforms like Bitlet.app that manage flows between fiat rails and crypto rails benefit from clearer settlement and custody rules because they reduce execution risk and operational overhead for counterparties.

What this means for market-making and DeFi

The combined effect of USDC growth, Tether’s depth, and better custody is a re-test of market structure assumptions. A few practical implications:

- Liquidity bifurcation: expect a two-tier landscape where USDT is the immediate execution vehicle and USDC becomes the preferred settlement asset for regulated flows. This bifurcation affects quoting strategies and collateral management.

- Protocol risk exposure: DeFi protocols with concentrated exposure to one stablecoin must reassess reserve strategies, insurance, and oracle dependence. Protocols that natively support multi-stablecoin routing will be at an advantage in stress scenarios.

- Fee and yield dynamics: higher utilization of a particular stablecoin pool increases fee capture for liquidity providers, but also concentrates systemic risk if that peg or reserve basis is questioned.

For market-makers, the playbook is clear: maintain balanced inventories across USDC and USDT, prioritize venues with trusted custody links for settlement, and price in counterparty liquidity risk. For DeFi strategists, the priority is ensuring composability while minimizing single-point-of-failure exposure.

Operational checklist for institutional ops teams and DeFi strategists

If you run treasury operations or design protocol risk controls, here are pragmatic steps to consider now:

- Reassess custody counterparty risk: confirm reserve transparency, insurance scope, and legal recourse for each custodian you use — and prioritize custodians that have direct integrations with exchanges you trade on.

- Diversify settlement rails: split working balances across USDC and USDT according to execution needs versus settlement certainty; retain some off-chain fiat corridors for large sweeps.

- Monitor on-chain liquidity and pool depth: have real-time metrics for slippage across USDC/USDT pairs on major venues and AMMs.

- Update margin and liquidation playbooks: simulate stress scenarios where one stablecoin becomes less fungible and test your unwind thresholds.

- Use regulated custody integrations for large settlement flows: partner with custodians that support automated reconciliation and direct exchange settlement to reduce operational latency.

These actions reduce the chance that a technical liquidity event becomes an operational crisis.

Bottom line

November 2025 reinforced a simple truth: stablecoins are the market’s liquidity backbone. USDC growth — fueled by institutional adoption and better custody — is expanding the settlement fabric, while Tether dominance concentrates execution liquidity during risk-off episodes. Custody and settlement upgrades are the critical enablers that let institutions use on-chain dollars at scale.

For ops teams and DeFi strategists, the imperative is to treat stablecoins not as interchangeable tokens but as distinct instruments with different trade-offs in liquidity, settlement, and counterparty risk. Monitor on-chain liquidity, vet custodians, and design protocols and desks that can pivot between USDC and USDT when the market demands it.

For further reading on the Q3 circulation and institutional signals, see Circle’s Q3 coverage. For context on custody integrations that secure USDC reserves and expand institutional settlement options, see reporting on recent custody partnerships. And to understand the market-share dynamics behind recent flows, review coverage on Tether’s market-share movement.

External sources referenced:

- Circle’s Q3 circulation overview and record activity: Circle Q3 report and USDC circulation surge

- Custody and reserve integration coverage (Coinbase/Kalshi context): Custody partnerships securing USDC reserves

- Market-share data showing Tether’s dominance surge: Tether market-share surge analysis