Polygon

Regional fiat stablecoins arriving on Polygon could nudge on-chain volume and payments use cases, but meaningful token re-rating hinges on liquidity, fees capture, and developer incentives. This piece assesses KRW1’s launch, Polygon’s architecture, tokenomic pathways for MATIC, and the KPIs investors should watch.

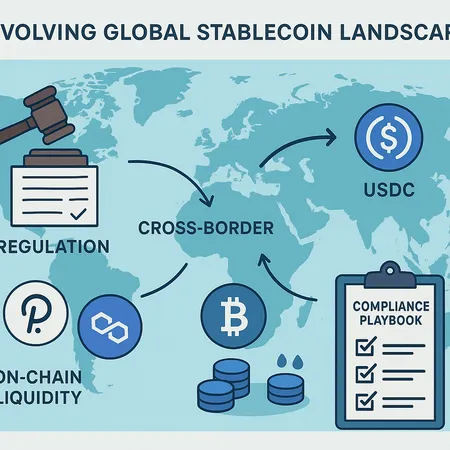

This guide explains how recent U.S. stablecoin moves are altering cross-border flows, exchange behavior, and on‑chain liquidity, with practical compliance and operational checklists for issuers and integrators. Case studies include Bybit’s USDC push and KRW1 on Polygon to illustrate market responses.

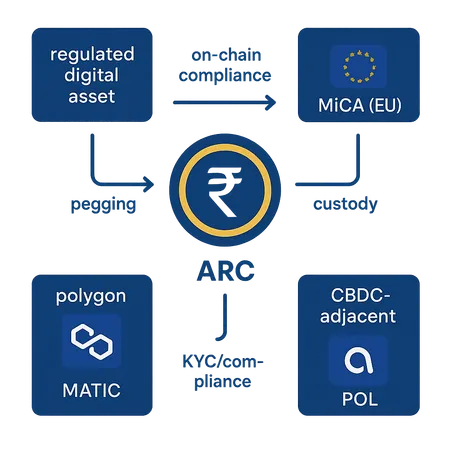

India’s announced rupee‑pegged Arc token built with Polygon and Anq marks a milestone in regulated digital assets — it forces a fresh look at custody, pegging models, and on‑chain compliance. This analysis unpacks architecture options, why Polygon was chosen, implications for MATIC and partner chains, and how Arc fits into a MiCA‑shaped global mosaic.

Binance's recent migration has significantly influenced Polygon's POL token surge, highlighting intricate dynamics within the crypto market. This shift opens new avenues for investors, especially with platforms like Bitlet.app offering flexible crypto installment services.