Visa’s USDC Settlement Pilot: What It Means for Banks, Merchants, and Stablecoin Adoption

Summary

Executive snapshot

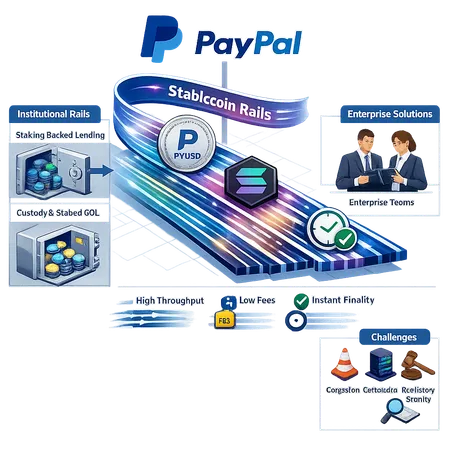

Visa’s announcement to expand its USDC settlement pilot to U.S. banks is a clear signal that the largest card network is testing stablecoins as a practical settlement layer, not merely a marketing experiment. The pilot reframes stablecoins—particularly USDC—as a potential alternative to existing intraday netting and correspondent banking arrangements that underlie card settlement. If this pilot moves beyond proof-of-concept, it could compress merchant funding timelines, change intraday liquidity needs for banks, and create new operational dependencies for card networks and issuers like Circle.

What Visa is actually doing and why it matters

Visa’s effort is not a promise to replace fiat rails overnight; it is a targeted test to see whether USDC can be used to settle card transactions or elements of the clearing chain more cheaply and quickly. The coverage on this extension frames it as an effort to modernize card-network plumbing and the settlement layer by reducing reliance on legacy correspondent banking and intraday credit. See the reporting on this expansion for details and scope: Visa brings USDC settlement to U.S. banks.

Why this matters to payments teams: card networks are built on predictable settlement cycles and risk offsets. Introducing a tokenized settlement asset like USDC changes that calculus — it introduces a 24/7 programmable settlement medium and the possibility of near-instant finality between participants who accept the tokenized unit of account. That has implications for funding, reconciliation, and capital usage across the value chain.

How merchant settlement flows could change

Traditional merchant settlement: merchants accept card payments; acquirers net transactions and, after interchange and fees, remit funds to merchants on a T+0 to T+2 cadence depending on contracts and bank practices. Under a USDC-enabled settlement model, imagine the following shifts:

- Faster availability: merchants could receive tokenized settlement positions near real-time or at least same-day if acquirers and issuing banks support token movement and liquidity conversion. Faster availability reduces merchant float and could shrink working capital needs.

- Fee reallocation: lowering reliance on correspondent banks for final settlement can reduce certain banking fees, but networks and custodians will likely add new fees (token custody, on/off ramps, FX conversion) that redistribute revenue rather than eliminate it.

- Optionality for merchants: merchants in some geographies or verticals might opt to hold tokenized settlements briefly (to arbitrage FX windows, for treasury optimization, or for instant payouts to vendors) — something impractical with legacy rails.

Operationally, acquirers will still need predictable liquidity to fund chargeback reserves and refunds. Tokenized settlement does not remove that need; it changes where the liquidity sits (on-chain vs. bank ledger) and how quickly it can be mobilized.

Operational and technology questions for banks and card networks

Adopting USDC settlement isn’t plug-and-play. Banks and networks must solve at least five operational problems simultaneously:

Custody and secure key management. Banks will need qualified custody (or partnerships with institutional custodians) that meet their operational and regulatory risk frameworks. Who holds the private keys? How are multisig and recovery governed?

Liquidity and intraday funding mechanics. Tokenized settlements change timing but not the need for liquidity. Banks will require pathways to convert USDC into fiat on short notice and to manage intraday positions across accounts. That implies new treasury functions and intra-day FX management.

Reconciliation and accounting. Ledgers on-chain and off-chain must reconcile automatically. That requires new middleware, ISO 20022-compatible messaging adaptations, or bespoke reconciliation engines with full audit trails.

Settlement finality and legal frameworks. Networks and banks must agree on legal finality of token transfers. Is on-chain transfer treated as final for regulatory capital and ledger purposes? Contractual updates and amendments to settlement agreements will be necessary.

Operational resiliency and outages. What happens if a smart contract or an underlying ledger faces congestion? Card networks are risk-averse; fallback rails and contingency plans will need to be baked in.

Each of these areas creates integration projects that are long on testing and short on margin for error. Banks that are conservative on risk may prefer to use custodial fiat conversion services rather than hold token inventories themselves.

Regulatory overlay: a live backdrop

The operational decisions will be taken under a microscope. Stablecoin regulation and market-structure changes are active agenda items in U.S. policy circles: Congress is moving on market-structure legislation and hearings that could touch settlement, liquidity, and the role of non-bank intermediaries in payments. Coverage of upcoming Congressional activity highlights that regulatory scrutiny will increase when major networks start testing crypto-powered settlement: Bitcoin and crypto market-structure bill set for Congressional markup.

For banks, the key regulatory questions include whether tokenized settlement changes capital or liquidity treatment, how customer protection and dispute resolution are handled if the settlement unit is a stablecoin, and whether banks must obtain new charters or permissions to custody and move tokenized dollar units between counterparties. Card networks will also face prudential questions about counterparty exposure to stablecoin issuers and custodians.

What this means for USDC demand and Circle

If card networks lean into USDC as a settlement medium, demand for USDC as an operational liquidity instrument will rise. That has a few immediate implications:

- Increased issuer liquidity needs. Circle will need predictable reserves and sweep arrangements to back increases in on-chain USDC holdings tied to settlement positions. That may force Circle to expand its short-duration Treasury or banking counterparties and enhance liquidity facilities.

- Revenue and product opportunities. Circle could monetize settlement services (custody-as-a-service, instant fiat rails, liquidity management APIs) for banks and acquirers. That gives Circle a pathway from retail-centric stablecoin issuance to institutional settlement services.

- Market concentration risks. If USDC becomes a de facto card-network settlement token, network effects may concentrate demand on Circle and its banking partners, raising antitrust and systemic-resilience questions for regulators and market participants.

In short, adoption by Visa-style players scales USDC beyond a trading or payments token into a core treasury instrument for financial institutions, changing both demand dynamics and operational expectations.

Cross-border commerce and correspondent-bank disintermediation

One of the most interesting potential benefits is in cross-border flows. Today, cross-border card settlement can involve many rails and time zones; correspondent banking relationships add latency and fees. Tokenized settlement offers:

- Reduced intermediaries. If both endpoints agree on a token (USDC, for example) and trust a set of custodians, a single on-chain transfer can replace several correspondent steps.

- Faster liquidity reuse. Funds tokenized on-chain can be re-routed, swapped, and used in Treasury operations more quickly than waiting on Nostro/Vostro reconciliations.

- Programmability for FX and rail choices. Smart routing for FX swaps, instant FX hedges, and conditional settlement logic become possible.

But the frictions are real: FX execution risk, AML/KYC and sanctions screening across jurisdictions, and the patchwork of local currency convertibility limit immediate wholesale replacement of correspondent banking. For many cross-border corridors, tokenized settlement will be a complement — faster for some flows, but not yet a universal replacement.

Liquidity management for issuers and banks

Liquidity management is the unsung core of settlement infrastructure. If USDC becomes a settlement unit for high-volume networks, Circle and bank partners will need robust liquidity playbooks:

- Pooling and netting. Large banks will likely implement multilateral netting where possible to reduce the aggregate token transfers required.

- Sponsored liquidity providers. Banks might partner with market makers to underwrite temporary token positions, similar to current intraday credit lines.

- Reserve composition and transparency. Circle will face pressure to hold highly liquid short-duration instruments to back issuer liabilities and to provide transparent reporting suitable for bank counterparty risk assessment.

Banks will also revisit capital and liquidity buffers to account for new tokenized exposures. Expect conservative banks to require over-collateralization or insured custody arrangements before shifting operational cash positions on-chain.

Likely next steps for bank partners (practical roadmap)

Adoption will be phased and pragmatic:

- Limited pilot corridors: banks will test USDC routing for a subset of low-risk merchants or corporate treasuries where KYC and counterparty risk are pre-cleared.

- Dual-rail operations: most banks will operate both tokenized and traditional settlement rails in parallel, using tokenized rails for specific speed-sensitive or cross-border corridors.

- Third-party outsourcing: early bank adopters may rely on specialist custodians and liquidity providers rather than build full in-house token operations.

- Contracting and legal updates: settlement agreements, network rules, and merchant terms will be updated to specify legal finality and dispute resolution in tokenized contexts.

- Scale or rollback: outcomes from pilots will dictate broader rollout. If operational costs and regulatory clarity align, banks can incrementally scale; otherwise they will sunset pilots.

Practical timeline: expect pilots and quiet production use within 12–24 months for specialized corridors, and a broader commercial consideration within 3–5 years — contingent on regulatory guidance and realized cost/benefit analysis.

Strategic takeaways for payments and crypto-strategy teams

- Treat USDC settlement as an infrastructure choice, not merely a payments option. It affects treasury, credit, and reconciliation operations.

- Build cross-functional project teams: legal, treasury, risk, operations, and IT must evaluate custody, conversion, and contingency strategies together.

- Measure not just fees saved but liquidity and capital impacts. Real savings come from reduced intraday funding and faster cash availability — not just lower per-transaction interchange.

- Monitor policy closely. Legislative and regulatory developments will materially shape what parts of tokenized settlement are permissible and how exposures are treated.

- Consider vendor partnerships. Market-ready custody and liquidity services can accelerate pilots without demanding full internal capability buildouts.

For payments professionals used to legacy rails, it helps to think in treasury units (how cash flows are timed and hedged) rather than transaction counts. Crypto teams should map on-chain operational risk to existing legal and compliance frameworks — and lean on custody and settlement providers to bridge gaps.

Conclusion

Visa’s USDC settlement pilot is an important signal: major payments infrastructure players see tokenized dollars as a plausible settlement layer. The practical impact will depend on how quickly banks solve custody, liquidity, reconciliation, and regulatory issues. For Circle and USDC, broader adoption by card networks could shift demand from retail rails to institutional treasury functions, creating new operational scale and new scrutiny.

Payments organizations should prioritize pilots that reveal real treasury and capital effects, not just transaction-level savings. If the pilot proves resilient and regulators provide clearer guidance, tokenized settlement could evolve from a niche tool into a core complement to traditional rails — but the path will be incremental, risk-focused, and governed by operational discipline.

Bitlet.app’s teams and crypto strategy groups should watch the pilot progress closely: the next 12–24 months will be revealing for whether stablecoins become routine settlement instruments for mainstream financial institutions.

Sources

- Visa brings USDC settlement to U.S. banks in push to modernize card network plumbing

- Bitcoin and crypto market-structure bill set for Congressional markup next month

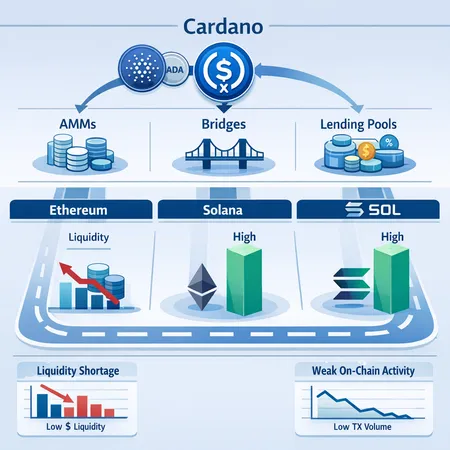

For broader context on on-chain market dynamics and settlement conversations, teams often track developments in Bitcoin and DeFi as complementary ecosystems shaping liquidity and infrastructure choices.