Interoperability

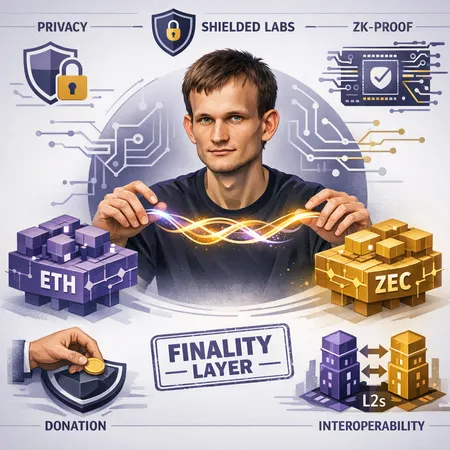

Vitalik Buterin’s recent donation to Shielded Labs for a Zcash crosslink finality upgrade and his clarified views on Layer-2s signal a subtle but important shift in how leading architects think about privacy, scaling, and cross-protocol cooperation.

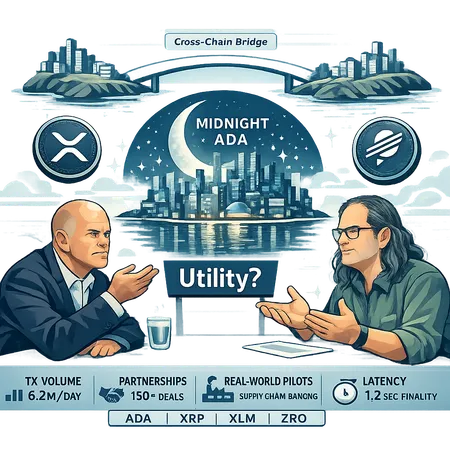

As markets demand measurable utility, critics single out XRP and Cardano — but cross‑chain primitives and partnerships are shifting what 'utility' even looks like. This piece unpacks the Novogratz critique, Ripple CTO responses to Cardano Midnight, and a pragmatic metric set for judging on‑chain utility.

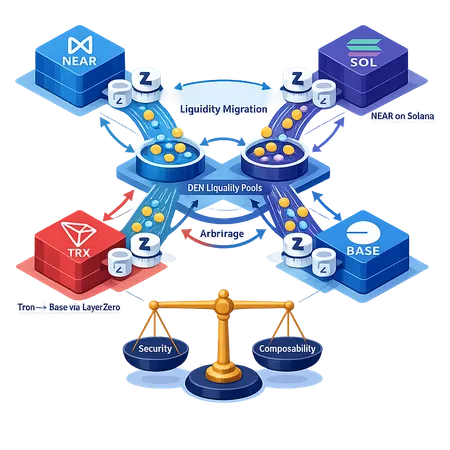

Cross‑chain connectivity is accelerating liquidity migration and changing how DeFi products are designed. This feature explains recent integrations (NEAR on Solana, TRX to Base via LayerZero), the liquidity and arbitrage dynamics they create, security vs composability trade‑offs, and practical strategies for projects and LPs.

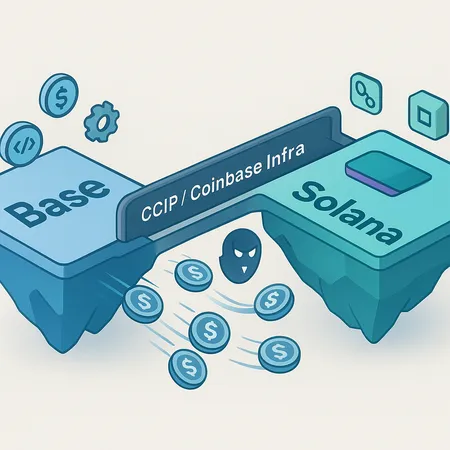

Base’s new bridge to Solana has divided builders: some call it a liquidity‑siphoning ‘vampire attack,’ others see pragmatic multichain engineering. This article breaks down the technical design, the claims and counterclaims, and the real implications for Solana liquidity and developer strategy.

Solana is posting a string of product launches and institutional wins that suggest accelerating adoption; cross‑community endorsements—like a Ripple exec urging the XRP community not to ignore Solana—are reshaping its narrative. This piece unpacks the concrete milestones, how interoperability and sentiment affect market positioning, and the metrics developers and DAOs should track to judge durability.

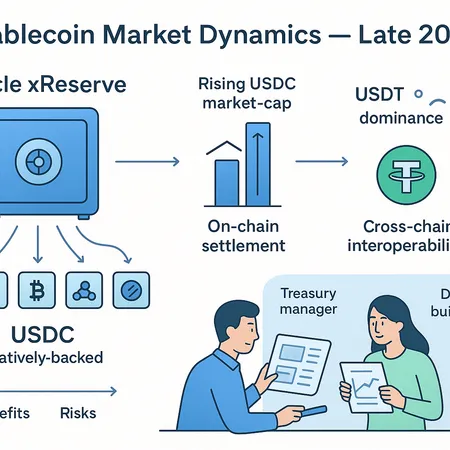

Late‑2025 stablecoin infrastructure is shifting: Circle’s xReserve pushes native USDC issuance across chains while USDT’s market share has climbed above 6%, reshaping liquidity and settlement choices for treasuries and DeFi builders.

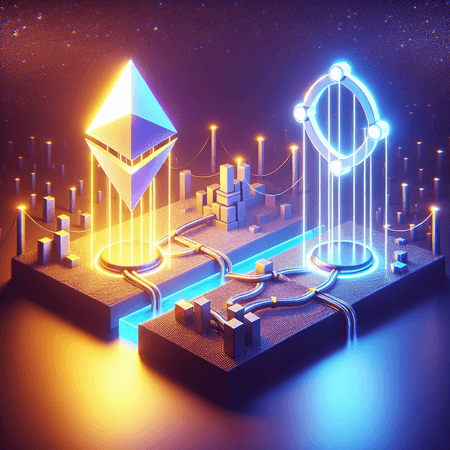

Uniswap has achieved a major milestone by enabling interoperability between Solana and Ethereum blockchains. This breakthrough promises enhanced DeFi user experiences, broader access to liquidity, and seamless cross-chain asset swaps by October 2025. Platforms like Bitlet.app stand to benefit by offering improved crypto services and installment options.