Hedera

Institutional interest in tokenized real-world assets (RWA) is accelerating—from an $18.87M tokenized-gold purchase to rising demand for Sui and Hedera tokenization. This article examines what these events mean for product teams and asset managers evaluating custody, settlement and regulatory risk.

McLaren Racing’s partnership with Hedera is a high‑profile pilot that tests blockchain for live fan engagement, loyalty and token utility. This case study dissects why Hedera’s hashgraph architecture suits sports use cases, what commercial KPIs to track, and the likely short‑ and long‑term impacts on HBAR demand and fan risk exposure.

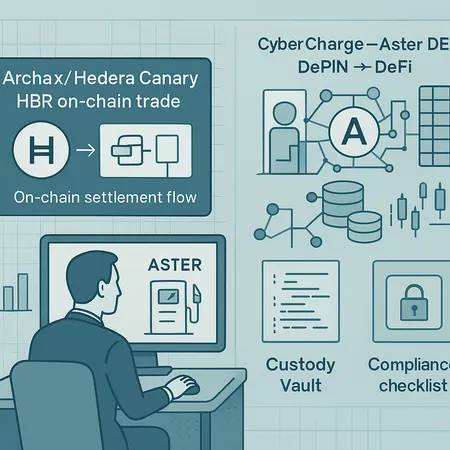

The Archax on‑chain trade of the tokenised Canary HBR ETF on Hedera and the CyberCharge–Aster DEX alliance show how tokenized ETFs and DePIN rewards are moving from concept to production. Institutional builders must weigh mechanics, custody, regulation, and liquidity as real‑world assets become natively tradable on blockchains.