Native DVT for Ethereum: Technical Guide for Stakers, Node Ops, and Institutional Custodians

Summary

Introduction — why this matters now

Ethereum staking is no longer an edge case for hobbyists. Institutional interest in tokenization and on-chain settlement—highlighted by BlackRock’s 2026 outlook—makes reliable, auditable, high-uptime staking infrastructure a business requirement, not just an operational nicety. For many validators and custody teams, the question is simple: how do you make staking resilient without bloating costs or centralizing control?

Vitalik Buterin’s proposal to integrate native Distributed Validator Technology (DVT) into Ethereum’s staking protocol is a practical answer. By building DVT as a protocol-native capability rather than an add-on, Ethereum can natively support multi-node validator control, lower single-node failure risk, and improve the platform’s appeal as a settlement layer for tokenized assets. For background on the proposal, see Vitalik’s outline summarized in this piece on CryptoNews: Vitalik's native DVT proposal.

For many teams architecting staking products and custody solutions—whether retail-focused or servicing institutional order flow—this explainer walks through the technical outline, the economic impacts, and practical migration choices.

What is native DVT (high level) and how it changes validator control

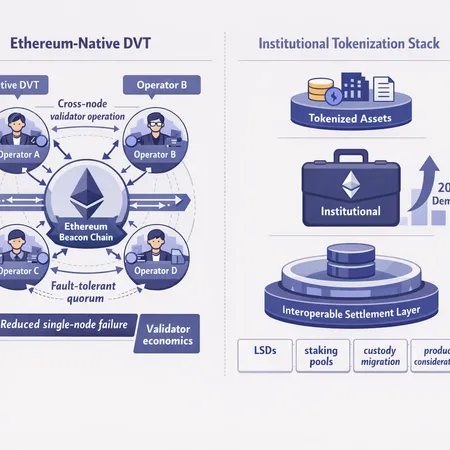

At its core, Distributed Validator Technology splits validator responsibilities across multiple operator nodes using threshold cryptography and distributed key generation (DKG). Instead of one operator holding the full signing key for a validator, n nodes collectively hold shares; any t-of-n subset can sign blocks or attestations without reconstructing the whole secret.

Native DVT means those DVT primitives and assumptions are supported directly by Ethereum’s staking protocol (rather than via external orchestration layers). Practically, that implies changes to how validator signing is expected to work and how the protocol recognizes and accepts signatures from aggregated threshold schemes.

Key effects:

- Reduced single-node failure risk: No single operator outage immediately disables a validator; other nodes can step in to sign.

- Cross-node validator operation: Operators can be geographically distributed, run by different providers, or split between an institutional custodian and an external reliability operator.

- Lower trust and custody friction: Institutions can avoid handing one counterparty unilateral signing power; custody models become more composable.

Technical outline: components and protocol-level changes

A native DVT integration involves several interacting pieces. Below are the practical components staking engineers should plan for.

Core cryptographic building blocks

- Distributed Key Generation (DKG): Generate a collective validator key without any party ever seeing the full secret. This is the bootstrap step for creating t-of-n control.

- Threshold signatures: Use threshold BLS-like signatures so that the protocol can verify a single compact signature produced by cooperating nodes.

- Share management and rotation: Secure storage, periodic resharing, and secure key rotation mechanisms to maintain long-term security.

Networking and latency considerations

- Gossip and aggregation layers: Nodes must exchange partial signatures quickly for proposer duties and attestation windows; aggressive latency tuning matters.

- Fallback and liveness strategies: If insufficient shares respond within a slot, a predetermined fallback signer or delegated warm key may be used to avoid missed proposals.

Protocol and client integration

- Acceptance of aggregated threshold signatures: Clients need to verify threshold signatures as if they were standard BLS signatures (compact on-chain representation).

- Validator lifecycle updates: Staking contracts and client APIs must support DVT-capable validator registrations and provide metadata about operator sets and threshold parameters.

Operational tooling

- Slashing protection across operators: A unified slashing protection database or interoperable protocol guarantees double-sign protection even when shares are distributed.

- Observability and alerts: Multi-node dashboards that surface partial-signature liveness, network partitions, and latency slippage.

Vitalik’s writeup frames many of these trade-offs; it’s worth reading the proposal to understand the design constraints and priorities Vitalik's native DVT proposal.

Benefits for stakers and node operators

Native DVT provides quantifiable operational advantages:

- Higher effective uptime: With t-of-n signing, the effective probability of missing a proposal or attestation drops sharply relative to single-node setups. For high-stakes institutional validators, even fractions of a percent in uptime improvement are material.

- Lower slashing exposure: Distributing duties lowers correlated failure and reduces the need for expensive cold backups or hot standbys.

- Flexible operator models: Institutions can co-control validators with third-party reliability operators, enabling new custody-plus-service business models.

These are not just theoretical. Improved uptime translates to predictable reward streams for large staked positions and reduces the need for conservative over-allocation of capital to redundancy.

Why BlackRock’s tokenization thesis makes DVT timely

BlackRock’s 2026 outlook explicitly names cryptocurrency and tokenization as key themes, and calls out Ethereum as a central infrastructure piece for tokenized assets. See the coverage of BlackRock’s view here: BlackRock names Ethereum a tokenization player.

Institutional tokenization implies two linked effects:

- Higher settlement volumes and on-chain flows: Tokenized securities, funds, and payment rails will generate predictable on-chain settlement activity that needs a secure settlement layer.

- Stronger counterparty and custody demands: Institutions require auditable, low-trust settlement primitives and clear custody boundaries.

Taken together, these trends raise demand expectations for ETH staking capacity and push institutions to prefer staking architectures that minimize single-counterparty risk. Native DVT directly answers that second requirement by enabling multi-party control of validators while keeping the settlement layer interoperable and final.

If tokenized assets drive more capital onto Ethereum, staking demand (both direct and via liquid staking) will grow—and the marginal value of highly resilient validators increases accordingly.

Impacts on liquid staking providers and validator economics

Native DVT will not be a neutral event for liquid staking token (LST) providers and validator economics; it will reshape incentives and product design.

For liquid staking providers (LSPs)

- Lower operational insurance cost: Improved resilience reduces expected slashing/loss tail risk, potentially lowering capital reserved for insurance or risk buffers.

- New competitive entrants: Easier multi-party custody means non-traditional custodians and modular service stacks can offer staking with institutional-friendly SLAs, increasing competition.

- Fee compression vs. market expansion: Some fee compression is likely as operational risk premiums fall, but the total market for liquid staking could expand as institutions deploy capital more confidently.

For validator rewards and MEV dynamics

- Uptime-driven rewards uplift: Better liveness increases share of block and attestation rewards across the network—an economic win for validators using DVT.

- MEV capture coordination: DVT groups must coordinate proposer responsibilities and MEV relays without leaking private info or undermining threshold signing workflows. This coordination can be a product differentiator (and risk).

Overall, validator economics will become more about product design (SLAs, governance, fee splits) and less about purely mechanical redundancy.

Practical migration and product considerations

Moving from single-key validators to DVT-enabled validators requires careful orchestration. Below are concrete steps and considerations for staking pools, node operators, and custody teams.

Recommended migration path (phased)

- Research & simulation: Run DVT clusters on testnet and controlled environments to measure signing latency, resilience, and recovery workflows.

- Hybrid validators: Start with hybrid models—t-of-n where one share is an institutional cold wallet kept offline and the rest are hot reliability nodes—so fallback modes are available.

- Pilot with limited capital: Deploy a small percentage of the pool under DVT and gather metrics (missed slots, attestation timeliness, MEV interaction).

- Expand and standardize: After pilots, migrate more validators and publish operational SLAs, runbooks, and customer-facing disclosures.

Architecture and configuration pointers

- Choose sensible threshold parameters: t should balance liveness and security (common choices are t = ceil(n/2) or slightly higher depending on adversary model).

- Geographic and operator diversity: Put signer nodes across cloud providers and regions; consider mixing operators (custodian + reliability provider).

- Slashing protection federations: Implement cross-operator slashing protection or a shared protocol so double-sign mistakes are prevented.

- Observability: Monitor partial-signature latencies, node health, and end-to-end validator performance in one pane.

Product & legal considerations for institutional custodians

- Governance and consent: Clear policy for who can trigger key rotations, emergency procedures, and incident reporting.

- Compliance & audit trails: Ensure DKG ceremonies, share distributions, and rotations are auditable for regulators and internal compliance.

- Contracts & SLAs: Define responsibilities, uptime guarantees, and fee mechanics when validators are co-operated by multiple parties.

Bitlet.app teams and architecture-focused firms should consider adding DVT-specific dashboards and custody connectors to differentiate product offerings.

Operational risks and open questions

Native DVT reduces some risks but introduces others. Teams should assess these trade-offs before full migration.

- New attack surface: DKG protocols and share-exchange phases have complexity and may introduce denial-of-service or coordination attacks if not hardened.

- Latency and consensus timing: Aggregation delays could affect proposer or attester performance; careful engineering is required to meet slot timing.

- Standards and interoperability: Without widely-adopted standards, fragmented DVT implementations could complicate third-party tooling and slashing protection.

- Regulatory clarity: Institutions will demand clarity on custody responsibilities and legal exposure when keys are shared across entities.

Action checklist for teams today

- Run DVT pilots on testnets and collect latency/uplift metrics.

- Model economic impacts on fee schedules and MEV strategies under improved uptime scenarios.

- Draft legal templates for co-signed validator governance and emergency procedures.

- Build or integrate cross-operator slashing protection and monitoring.

- Engage with client software maintainers and protocol contributors to track the exact specification changes required for native DVT.

Conclusion

Native DVT is a pragmatic and timely evolution for Ethereum staking: it answers institutional demands for low-trust, high-uptime validators while aligning the protocol with tokenization-driven growth expectations. As BlackRock and other institutions flag tokenization and Ethereum as core pieces of capital markets infrastructure, the value of resilient validator architectures increases.

For ETH node operators, staking protocol engineers, and custody teams, the prudent approach is to pilot now, standardize operational patterns, and update product and legal frameworks. The technical work (DKG, threshold signatures, signing latency optimization, slashing protection) is non-trivial, but the upside—safer, more auditable staking for a tokenized future—is large.

Sources

- Vitalik’s native DVT proposal summary: https://cryptonews.com/news/vitalik-native-dvt-ethereum-staking-risk/

- BlackRock’s tokenization thesis and Ethereum mention: https://coinpedia.org/news/blackrock-names-ethereum-key-tokenization-player-in-2026-outlook/

For deeper protocol design discussion, refer to the above links and join client-specific DVT working groups. Also see how Ethereum community proposals evolve and consider integrating DVT pilots into your Staking product roadmap.