Real‑World Assets

Tokenizing Stocks and ETFs on Solana: Lessons from Ondo Finance’s Launch

Ondo Finance’s move to Solana is a practical test of tokenizing real‑world stocks and ETFs on a fast layer‑1. This long‑read examines settlement, custody, retail access (including mobile distribution), technical and regulatory hurdles, and a developer roadmap for on‑chain securities on Solana.

Published at 2026-01-23 15:55:08

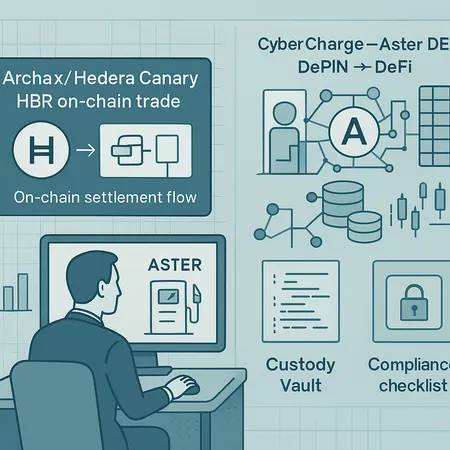

Tokenized ETFs and Real‑World Primitives: What Archax/Hedera and CyberCharge–Aster Reveal About On‑Chain Execution

The Archax on‑chain trade of the tokenised Canary HBR ETF on Hedera and the CyberCharge–Aster DEX alliance show how tokenized ETFs and DePIN rewards are moving from concept to production. Institutional builders must weigh mechanics, custody, regulation, and liquidity as real‑world assets become natively tradable on blockchains.

Published at 2025-12-06 17:18:36