Aave

Aave surpassing $1 billion in tokenized real‑world asset deposits signals a structural shift for DeFi, moving lending markets toward hybrid on‑chain/off‑chain capital and new counterparty models. This analysis explains tokenization mechanics, the risk and liquidity implications, regulatory considerations, AAVE token dynamics, and plausible 3–5 year adoption scenarios.

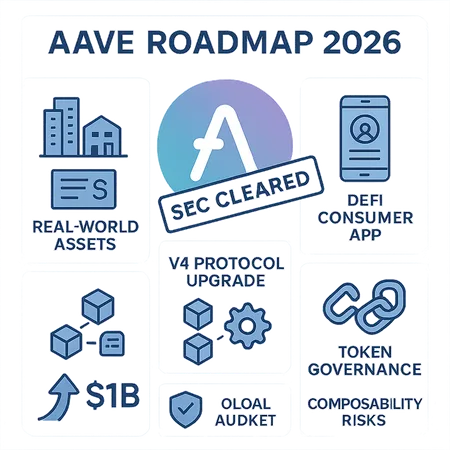

Grayscale’s move to convert its AAVE trust into a 1940 Act-style spot ETF raises complex questions about custody, liquidity, and governance. The SEC review will shape not only AAVE tokenomics but the roadmap for future altcoin spot ETFs.

Aave's decision to wind down the Family wallet and retire the Avara brand reflects an intersection of governance friction and regulatory risk that many DeFi teams now face. This case shows how consolidation under a single engineering/legal umbrella can reduce regulatory exposure while reshaping product roadmaps and community dynamics.

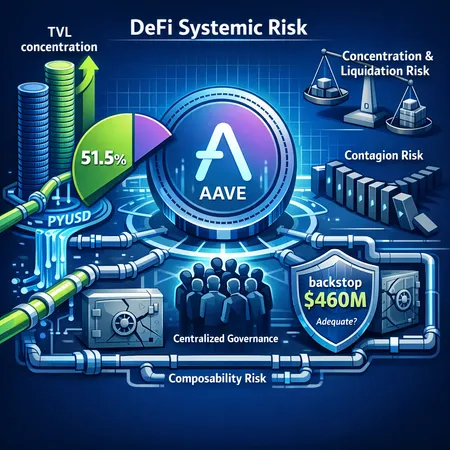

Aave now controls a majority of DeFi lending — an investigation into how it got there, what a $460m backstop really means, and protocol and policy fixes to decentralize lending markets.

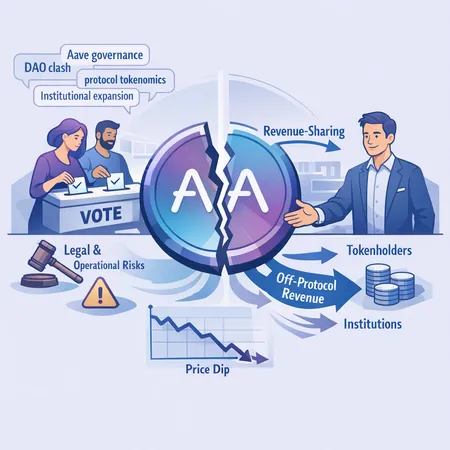

Recent disputes at Aave and Jupiter expose recurring governance failure modes — from brand/front-end control to buyback trade-offs. This article extracts practical fixes for DAO operators, governance researchers and tokenomics designers to harden DAOs against similar crises.

Aave’s recent DAO clash over an IP-transfer sparked a new proposal from the founder to share off‑protocol revenue with AAVE holders. This article breaks down the timeline, mechanics, incentives, legal risks, market reaction, and what other DeFi teams should watch.

Aave’s token-alignment Snapshot vote and Aave Labs’ escalation sparked a $50M+ sell-off and a 10–20% AAVE collapse, exposing governance fragilities. This post dissects the timeline, mechanics, liquidity impact, and concrete risk-management lessons for token holders and builders.

Aave’s SEC probe closure and its 2026 master plan—targeting real‑world assets, v4 upgrades and a consumer mobile app—mark a turning point for DeFi legitimacy and capital flows. This analysis assesses the regulatory signal, protocol mechanics, governance implications and the practical risks that remain.

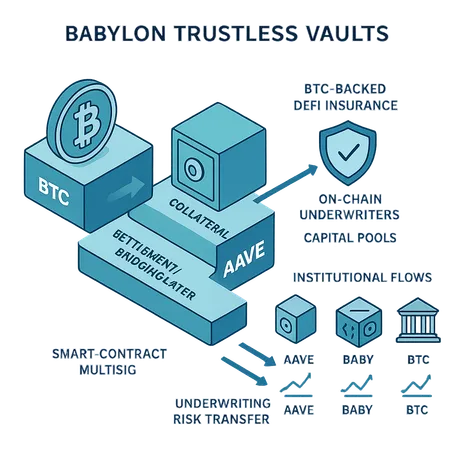

Babylon’s trustless vaults — enabling native BTC‑backed lending via Aave and planning BTC‑backed DeFi insurance — create a bridge between on‑chain liquidity and institutional capital, but they also introduce novel technical and economic trade‑offs. This piece unpacks the mechanics, insurance economics, implications for AAVE/BABY and practical steps for builders and allocators.

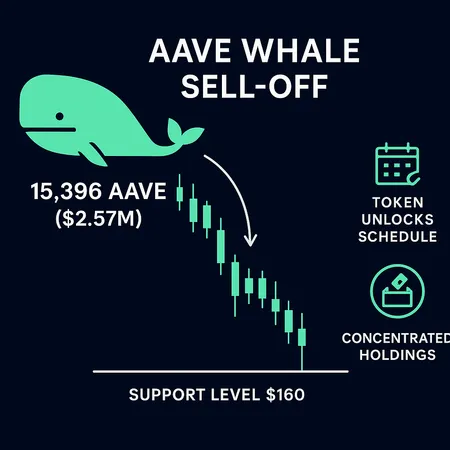

A 15,396 AAVE ($2.57M) whale sale has renewed downside risk for AAVE, putting the $160 support level in focus. Traders and governance participants should track exchange inflows, unlock schedules and on-chain concentration to gauge whether this was an isolated dump or the start of a broader capitulation.