Why Tokenized U.S. Treasuries Will Reshape Institutional Crypto Infrastructure by 2026

Summary

Executive snapshot

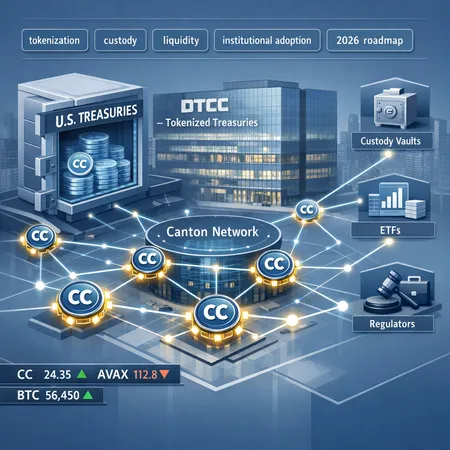

The Depository Trust & Clearing Corporation (DTCC) moving to tokenize U.S. Treasuries on the Canton network (CC) is not a boutique experiment — it’s an infrastructure statement. Tokenization of the primary risk-free asset for global markets changes how institutions think about settlement, collateral, and on-chain liquidity. This feature unpacks why tokenized treasuries matter, how recent capital and ETF filings reflect an institutional buildout, and what custody, stablecoins, and regulators must consider through 2026.

What the DTCC plan means in practice

Blockchains promise programmable, near-instant finality; market utilities promise safety, scale and regulatory alignment. The DTCC's plan to issue tokenized U.S. Treasuries on the Canton network bridges both: an institutional hub issuing on a permissioned, interoperable ledger that can talk to other networks and settlement systems. For more detail on the DTCC rollout, see the reporting on the plan.

Tokenized treasuries are not just "digital receipts": they represent a redefinition of how legal title, settlement finality and custody are organized. On a permissioned network like Canton, trade lifecycle events (delivery versus payment, repo, coupons) can be represented as on-chain state transitions, reducing reconciliation and settlement latency.

Why institutions care: custody, liquidity and balance-sheet efficiency

- Faster settlement and reduced counterparty exposure: Tokenized treasuries can settle near-instantly or on a scheduled atomic basis with other tokenized assets, enabling lower intraday credit risk for clearing houses and banks. That changes intraday funding dynamics for treasury desks and repo markets.

- Fractionalization and new pools of liquidity: Large treasuries can be fractionally represented, enabling smaller institutions and DeFi players to access ultra-safe collateral without bespoke custody or minimums.

- Programmable collateral for on-chain credit: Tokenized treasuries can be used as collateral inside smart contracts or cross-chain protocols, enabling lower-cost stablecoin minting, automated repo processing, and instant liquidation rules — all while preserving the asset’s credit characteristics.

These advantages imply a structural shift in how custodians and treasury managers design workflows: custody is no longer just "holding a certificate" — it must deliver secure key management, on-chain settlement responsibilities, and attestations tied to legal title.

Institutional signals: Matador and Grayscale — not isolated moves

Tokenization of core market instruments will only reach scale if institutions expand both capital and regulatory tooling. Two recent corporate filings highlight that push.

Matador, a regulated Canadian bitcoin firm, secured a CAD 58M shelf prospectus as it expands custody and treasury-related operations — a concrete example of firms raising flexible capital to scale custody, trading and on-chain product offerings. This is not just fundraising; it’s forward planning for balance-sheet-intensive activities that an on-chain treasury market will demand (reporting on Matador's prospectus).

Grayscale’s updated S‑1 for a spot Avalanche ETF (AVAX) shows how asset managers are preparing regulatory-grade wrappers for Layer‑1 exposure. The filing underscores continued interest from long-only and institutional allocators in regulated, tradable products built atop public blockchains — these products depend on reliable custody, settlement rails and compliance flows (Grayscale S‑1 coverage).

Taken together, these moves aren’t random. Capital raises provide scale and liquidity; ETF filings provide market-access frameworks that need custody and settlement partners. Tokenized treasuries are a missing piece that links institutional cash and traditional securities to on-chain instruments and products.

Implications for stablecoins and on‑chain collateral

Tokenized treasuries create a better-quality asset for insured, regulated stablecoin issuers and algorithmic infrastructure:

- Reserve quality and transparency: Stablecoins that claim to be fiat-backed can use tokenized treasuries as high-grade collateral with cryptographic proof sets and on-chain attestations. That could narrow the regulatory argument over reserve quality if legal title and custodial assurances are solid.

- Lower-cost minting and redemption rails: On-chain treasuries can be programmatically used in mint/redemption engines to minimize settlement lag and FX hop costs when circulating across rails.

- New repo and money-market operations: Tokenized treasuries can enable automated repo transactions between custodians, market makers and lending protocols, but this requires robust off-chain legal agreements mirroring on-chain state transitions.

However, tokenizing treasuries doesn’t obviate the need for regulated stablecoin frameworks. Regulators will still ask who holds legal title, how insolvency is managed, and what protections exist for retail participants.

Custody and operational requirements for 2026

Custodians will need to evolve along several axes:

- Hybrid custody models: Institutions will prefer custodians offering both traditional safekeeping and on-chain key custody, with provable control of tokenized assets.

- Attestation and reconciliation automation: Regular, machine-readable attestations tying on-chain tokens to legal records will be necessary for auditors and regulators.

- Interoperability and settlement guarantees: Custodians must integrate with permissioned networks like Canton and public chains that feed into clients’ workflows. Expect increased demand for connectors and token bridges that preserve compliance constraints.

- Insurance, SLAs and governance: Institutional adoption depends on clear liability frameworks, cyber insurance products and defined operational SLAs for losses or chain events.

Platforms such as Bitlet.app and institutional custody desks will likely add tokenized securities modules, but they must also coordinate legal documentation, recovery processes and governance to manage smart-contract risk and chain outages.

Regulatory engagement: what needs to be clarified by 2026

Tokenized treasuries expose gaps in law and regulatory practice:

- Legal finality and priority: Regulators and courts must accept that an on-chain transfer can effect legal transfer of a security. Until legal frameworks explicitly align, counterparties will demand additional guarantees.

- Custody and trust law updates: Custody regimes must adapt to cover cryptographic keys, tokenized assets and cross-border enforcement.

- AML/KYC and privacy tradeoffs: Permissioned rollouts like Canton can embed compliance, but public chain integrations will need standards for transaction monitoring and sanctioned-entity blocking.

- Securities vs. commodities questions: Tokenized assets that replicate securities need clarity on whether they fall under securities laws or market-utilities exemptions.

The DTCC’s involvement is an encouraging sign: a systemically important entity engaging regulators often accelerates legal precedent. Still, market participants should expect a multi-year path to comprehensive legal certainty.

Risks and open technical questions

- Smart-contract and bridge risk: Tokenized treasuries are only as safe as the code and cross-chain infrastructure that represents them.

- Liquidity fragmentation: Different token representations (native Canton tokens vs. wrapped tokens on public chains) could fragment liquidity unless standards or liquidity fabrics emerge.

- Settlement vs. market structure change: Faster settlement alters dealer funding models and market‑making incentives — there can be unintended consequences for market liquidity if not carefully designed.

What institutional ops and fintech strategists should do now

- Map counterparty dependencies: Identify custodians, market utilities and settlement partners that plan to integrate tokenized treasuries.

- Stress-test custody models: Build hybrid key-management playbooks and insist on attestation APIs and cryptographic proof of reserves tied to legal title.

- Factor tokenized treasuries into stablecoin and repo strategies: Model collateral haircuts, redemption latencies and cross‑chain settlement costs.

- Engage regulators proactively: Participate in industry working groups to help shape legal finality, custody law updates and AML/KYC standards.

- Watch precedent: Monitor DTCC pilots and early deployments, Matador-style capital moves, and ETF filings (including AVAX S‑1 developments) as leading indicators.

Conclusion

Tokenized U.S. Treasuries are not a niche innovation — they are a plumbing upgrade with outsized consequences for institutional custody, liquidity and digital-asset product design. The DTCC’s Canton rollout, corporate capital plays like Matador’s shelf prospectus, and continued ETF activity signal that institutions are building the regulatory, custody and market infrastructure needed for on-chain finance. The next two years will determine whether these efforts produce interoperable, legally certain rails that let tokenization deliver on promises of efficiency without trading away investor protections.

For institutional teams planning 2026 roadmaps: prioritize custody design, regulatory engagement, and interoperable integration with permissioned networks and public chains — and track how tokenized treasuries become accepted as programmatic collateral across DeFi and trad-fi corridors. For many trading desks and treasury teams, the question is no longer whether tokenization will matter — it’s how quickly they can adapt.

Sources

- DTCC to launch tokenized U.S. Treasuries on Canton network: https://blockonomi.com/dtcc-to-launch-tokenized-u-s-treasuries-on-canton-network-by-2026/

- Matador shelf prospectus and expansion reporting: https://news.bitcoin.com/canadian-bitcoin-firm-matador-secures-58m-shelf-prospectus-amid-treasury-expansion/

- Grayscale updated S‑1 for a spot Avalanche ETF (AVAX): https://coinpedia.org/news/grayscale-files-updated-s-1-for-spot-avalanche-etf/

Note: this analysis references public market tickers and networks (CC/Canton, AVAX, BTC) and draws on reporting sources above. For context on on-chain credit and market plumbing, see commentary on Bitcoin and integrations between tokenized assets and DeFi.