Sovereign Stablecoins and Stablecoin 2.0: Market, Compliance, and Custody Implications After KGST’s Binance Debut

Summary

Executive overview

The recent launch of Kyrgyzstan’s som‑backed KGST on Binance and public advocacy from Binance CEO Changpeng Zhao for a renewed stablecoin architecture have put sovereign stablecoins and stablecoin 2.0 back on the agenda for exchanges, custodians, and compliance teams. For market and risk teams, the immediate questions are practical: how do sovereign stablecoins differ from dollar‑pegged incumbents, what does an exchange listing imply for on‑ramp liquidity and AML exposure, and how do emerging algorithmic designs change custody and legal responsibilities?

This article is written for compliance officers and product leads building risk frameworks at exchanges and payment platforms (including providers such as Bitlet.app). It maps market drivers, contrasts the technical and legal profiles of sovereign versus algorithmic or hybrid stablecoins, and offers operational recommendations for custody, monitoring, and regulatory engagement.

Why sovereign and regional stablecoins are gaining traction now

Several converging factors explain the renewed momentum behind sovereign and regional stablecoins. First, governments and central banks in smaller economies see tokenised fiat as a way to expand remittance efficiency, improve domestic digital payment adoption, and exert monetary policy influence across diasporas and regional corridors. Listing KGST on Binance gave that concept immediate global distribution, illustrating how a national token can leap from policy piloting to liquidity provisioning almost overnight (see reporting on the Binance listing).

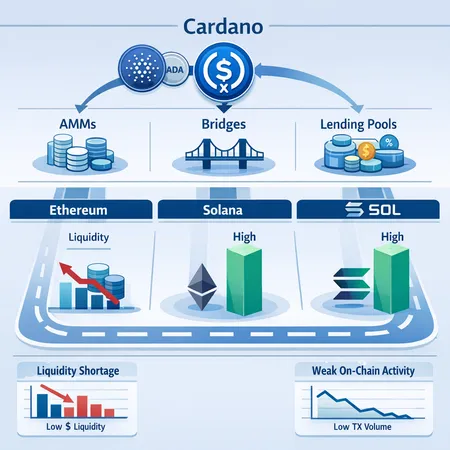

Second, market structure has matured: on‑chain infrastructure, cross‑chain bridges, and custodial services have lowered operational barriers to issuing and listing native fiat tokens. Third, tactical incentives for states—access to commerce without depending solely on correspondent banking, revenue capture via seigniorage, and improved AML/CBR transparency—make sovereign tokens politically and economically attractive now. Finally, private‑sector pushes for innovation—exemplified by CZ’s comments about Stablecoin 2.0 and the BNB agenda—are accelerating product development and raising expectations about new protocol‑level guarantees that could complement or compete with sovereign offerings.

Technical and compliance differences: sovereign stablecoins vs. stablecoin 2.0

Reserve backing, legal promise, and custody

Sovereign stablecoins are typically explicit promises backed by a state’s central bank reserves or a government‑designated asset pool. That legal framing creates a different risk profile than many market‑issued dollar tokens. With sovereign backing, holders may have clearer claims (depending on issuer law) and potentially better recourse than holders of private or algorithmic tokens. However, that presumes robust legal frameworks, segregated reserves, and enforceable custody arrangements—conditions that vary dramatically across jurisdictions.

By contrast, stablecoin 2.0 is an umbrella for designs that combine partial reserve backing, dynamic re‑peg mechanisms, and protocol incentives (liquidity staking, on‑chain governance) to sustain stability without full fiat reserves. These models aim to reduce capital inefficiency but introduce smart‑contract, oracle, and game‑theory risks that require specialized audit, monitoring, and contingency planning.

Operational and KYC/AML implications

From a compliance perspective, sovereign stablecoins can be both easier and harder. Easier because an issuer backed by a sovereign may offer official channels for verification, source‑of‑fund checks, and cooperation with regulators. Harder because cross‑border flows of a national currency token can raise geopolitical questions—sanctions screening, FX controls, and branchless distribution into jurisdictions that have different AML/CFT rules.

Stablecoin 2.0 constructs, especially algorithmic components, push an exchange into a role closer to protocol risk management. Product teams must vet oracles, examine re‑peg histories, and build surveillance for on‑chain stabilizer operations. Compliance teams must understand how to treat protocol incentives and programmatic reserve actions under existing KYC/AML, custody, and prudential frameworks.

Smart‑contract risk vs. sovereign legal risk

Algorithmic or hybrid tokens concentrate operational risk in code: exploits, failed stabilization cycles, or oracle manipulation can rapidly de‑peg a token. Sovereign tokens instead concentrate legal and political risk: sudden FX policy changes, reserve mismanagement, or state freezes can affect redeemability. For exchanges, these are not symmetrical risks; they demand different coverage, insurance, and contract terms with issuers and custodians.

On‑ramps and market impact: the Binance listing case study

A major exchange listing functions as a force multiplier for any new token. Binance’s listing of KGST acted as an instantaneous on‑ramp liquidity device: it enabled global trading pairs, order‑book depth from diverse liquidity providers, and easier fiat ramps via established flows. That dynamic was highlighted in reporting on KGST’s Binance debut.

Practically, a high‑profile listing does three things:

- Creates immediate convertibility and pricing discovery, which encourages merchant acceptance and market‑making.

- Shifts custody and settlement flows onto the exchange and its partners, concentrating counterparty exposure.

- Triggers rapid compliance workload: sanctions checks, jurisdictional assessment, and enhanced due diligence on issuer reserves and redemption mechanics.

For product leaders, a listing therefore is not just commercial: it forces a re‑calibration of settlement risk limits, liquidity provisioning rules, and reserve confirmation cadence with the issuer. If the token sits on BNB Chain or another smart‑contract platform, the exchange must add operational monitoring for on‑chain stabilization mechanics and bridging events.

BNB Chain, CZ’s stablecoin 2.0 push, and protocol responses

Binance’s executive signals about a Stablecoin 2.0 focus and the prominence of BNB in that narrative suggest protocol‑level coordination might accelerate products that mix on‑chain automations with off‑chain reserves. CZ’s comments positioned stablecoin innovation as both a product and a competitiveness lever for BNB Chain, which could attract issuers and market makers to its ecosystem rather than Ethereum‑centric rails.

That shift creates opportunities and headaches: protocol incentives may encourage liquidity migration, but chains and validators are increasingly part of the compliance equation when stabilization mechanisms execute on‑chain. Exchanges should track these developments because chain‑specific integrations (e.g., validators, bridge operators) often become de facto counterparties for settlement finality and forensic tracing. Reporting on CZ and BNB Chain frames this strategic context well.

Competition with USDC/USDT and the SBI USDC pilot lesson

Despite enthusiasm for national coins and new algorithmic designs, established dollar stablecoins—USDC and USDT—retain deep network effects: liquidity, broad merchant acceptance, banking partnerships, and robust KYC/AML tooling. Large payment players and banks often default to dollar‑pegged rails for retail pilots. A recent testing example shows SBI using USDC for a payments pilot in Japan rather than token options tied to other digital assets, which underscores institutional preference for well‑known dollar rails in production payments.

Sovereign coins must therefore build two things to compete meaningfully: reliable on‑ramp/off‑ramp corridors (banking and FX partners) and a value proposition beyond simple tokenization—e.g., cheaper cross‑border settlement in regional corridors, currency‑specific utility, or government incentives for local adoption. Without those, many merchants and financial institutions will continue to prefer the depth and predictable compliance posture of USDC/USDT.

Likely regulatory responses and what compliance teams should expect

Regulators will not treat sovereign and algorithmic stablecoins the same. Anticipated responses include:

- Reserve transparency and attestations: Expect demands for periodic reserve attestations or certified proof‑of‑reserves regimes for sovereign coins, possibly with on‑chain proofs for parts of the backing.

- Licensing and issuer accountability: Jurisdictions will push for licensing schemes for issuers and major custodians, especially for tokens that serve as retail money substitutes.

- AML/CFT enforcement: Cross‑border token flows will heighten expectations for transaction monitoring, sanctions screening (including OFAC/EU lists), and enhanced due diligence for high‑risk corridors.

- Technology audits for algorithmic models: Where protocol logic materially affects value stability, supervisors may require code audits, stress‑testing, and contingency playbooks.

From a practical standpoint, compliance teams should prepare for more granular supervisory reporting and contractual clauses requiring cooperation for investigations, freezing capabilities (where legally permissible), and clarity on the legal status of token holders’ claims on issuer reserves.

Practical checklist for exchanges and product leads

For quick operationalization, consider this prioritized checklist:

- Legal review and issuer warranties: Obtain clear, jurisdiction‑specific legal opinions on redeemability and reserve segregation.

- Reserve attestations and frequency: Require independent, regular attestations and define on‑chain/off‑chain proof expectations.

- Custody segmentation: Avoid concentration risk—segregate reserves and use multi‑custodian strategies where possible.

- AML/KYC mapping: Extend transaction monitoring to capture cross‑border FX flows and set enhanced rules for issuer‑linked corridors.

- Smart‑contract surveillance: If a token operates on BNB Chain or similar, instrument chain monitoring, oracle health checks, and stabilization event alerts into your ops stack.

- Market‑making and liquidity limits: Define order‑book exposure caps and withdrawal limits tied to proof‑of‑reserves latency.

- Contractual breach and contingency: Include clauses for pausing trading, emergency delisting, and clear procedures for repayment or redemption failure.

These items should be embedded in product onboarding playbooks and exercised in tabletop drills with legal, custody, and AML teams.

Conclusion — balancing opportunity and prudence

Sovereign stablecoins like KGST have shifted from theory to practice through exchange listings that provide immediate on‑ramp liquidity, but they bring a distinct matrix of legal, custody, and geopolitical risks. Meanwhile, stablecoin 2.0 proposals—pushed publicly by influential participants and targeted toward efficiency gains on chains such as BNB Chain—introduce novel protocol risks that demand strong operational controls.

For exchanges and compliance leaders, the right posture is pragmatic: enable liquidity and innovation where commercial sense exists, but insist on contractual clarity, frequent reserve evidence, and robust surveillance. The interplay between sovereign tokens, big dollar rails like USDC, and emergent algorithmic designs will shape the next phase of stablecoin economics—regulators and market infrastructure will adapt quickly, and firms that prepare now will avoid scrambling when the next market test arrives.

Sources

- Announcement of Kyrgyzstan’s KGST listing on Binance: Kyrgyzstan launches som-backed stablecoin KGST on Binance

- CZ and BNB Chain commentary on stablecoin innovation: Changpeng Zhao bets on Stablecoin 2.0 as BNB Chain sheds undervalued label

- SBI’s USDC payment pilot context: Why Ripple’s RLUSD was not used in SBI’s Japan payment test despite XRP ties

For broader background reading on stablecoin mechanics and market adoption, refer to coverage of on‑chain liquidity and regulatory developments. For practitioners, consider linking this analysis to your internal onboarding process and to ecosystem resources such as DeFi and other market overviews — and remember that for product integration, platforms like Bitlet.app and exchange partners will play a central role in operationalizing these tokens.