What YouTube's PYUSD Payouts Mean for Mainstream Stablecoin Adoption

Summary

Why YouTube paying creators in PYUSD matters

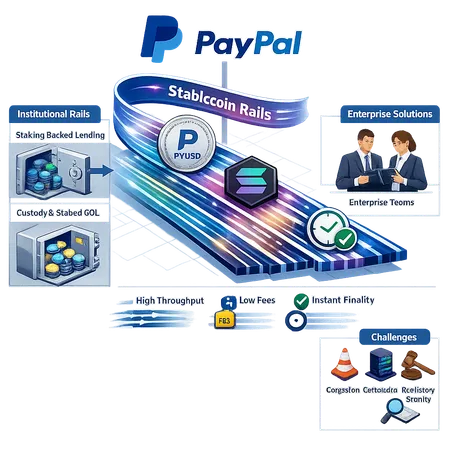

YouTube’s expansion to let U.S. creators receive payouts in PayPal USD (PYUSD) isn’t a niche experiment — it’s a visible, high-volume real-world use case for stablecoins inside mainstream platforms. The move (reported here) signals a broader willingness among big tech platforms to treat stablecoins as a settlement and store-of-value layer for creator payments rather than an exotic crypto toy. For payments strategists and fintech product managers, that shifts the conversation from “if” to “how.”

How PYUSD payouts work in practice

At a basic level, creators who opt in are credited in PYUSD instead of fiat when YouTube issues earnings: ad revenue, channel memberships, Super Chats, or other monetization streams. Practically this means:

- Payable units are denominated in PYUSD, an on-chain stablecoin pegged to USD.

- Creators can either hold PYUSD, transfer it on-chain, or convert it back to USD via PayPal/partner rails.

- Settlement and custody are handled by PayPal’s chosen providers and on the blockchain layer where PYUSD exists.

Operationally, platforms like YouTube will need to implement opt-in flows, UX that explains conversion timing/fees, and clear statements for tax and accounting. Creators will see balances denominated in PYUSD and should expect different UX for withdrawals compared with traditional fiat bank transfers.

Implications for fiat rails and PayPal/YouTube strategy

PayPal’s strategic rationale is straightforward: capture more transactional volume, expand its stablecoin’s utility, and reduce reliance on slower, more expensive fiat rails for micro‑payments. For YouTube, enabling PYUSD payouts can lower payout fees, reduce settlement friction across geographies, and create new features (instant on‑chain transfers, programmable payouts, tipping mechanics).

But this also reshapes relationships with banks and payment processors. Instead of pushing every transaction through ACH or card networks, platforms can net positions off-chain and settle with fewer fiat movements — or let partners like PayPal handle on/off-ramp liquidity. For product teams, the result is a new set of partner integrations to manage: stablecoin issuers, custodians, liquidity providers, and compliance middleware.

Merchant, creator and tax considerations

Accepting PYUSD as a payout method raises several practical questions creators and merchant-facing teams must answer.

Tax and accounting

In the U.S., virtual currency is treated as property for tax purposes, meaning creators generally must recognize income equal to the fair market value of the crypto at the time it’s received and establish a cost basis for future disposals. That implies creators receiving PYUSD should:

- Record the USD-equivalent value at receipt as ordinary income.

- Track subsequent sales or conversions for capital gains/losses.

- Seek bookkeeping or platform-provided statements that show time-of-receipt valuations.

Platforms should provide clear earnings statements reflecting PYUSD receipts and conversions to make tax compliance straightforward for creators and their accountants.

Merchant acceptance & spendability

For creators who run businesses (merch, services, agencies), the choice to hold PYUSD can reduce FX and banking friction when paying contractors or purchasing services that accept stablecoins. But for everyday expenses, conversion back to bank currency is likely necessary. So expect demand for:

- Instant fiat conversion rails with predictable fees.

- Card- and bank-linked rails that let creators spend PYUSD-derived balances without manual crypto steps.

KYC, AML and payouts controls

PayPal and YouTube will need to ensure satisfactory KYC/AML for payouts, especially when creators route funds off-platform to external wallets. This increases compliance overhead for product managers — but also centralizes control that helps mitigate illicit finance risks.

Where PYUSD fits into the stablecoin and RWA story through 2026

PYUSD is one piece of a larger evolution: stablecoins are moving from niche crypto payments into mainstream payments rails, and tokenization of real-world assets (RWA) is expected to accelerate the same trend. Analysts foresee a continued expansion of stablecoin utility and increased tokenization of assets — from real estate fractions to short‑duration debt — through 2026, which will create more use cases for on‑chain cash equivalents and programmable payouts.

That outlook is echoed in broader industry analysis forecasting faster adoption of stablecoins and RWA tokenization in coming years. Such tokenized liquidity could let platforms automate royalties, split revenue streams instantly, and underwrite new micropayment models that were previously uneconomic using fiat-only rails. For many fintech teams, the real design question is how to make tokenized cash as operationally safe and legally sound as existing payment rails.

Risks: regulatory, custody, and depegging

Mainstreaming stablecoin payouts brings clear advantages, but it also concentrates three core risks:

Regulatory risk: Stablecoins are under intense scrutiny. Policymakers are debating reserve requirements, issuer licensing, and AML obligations. Platforms that build product plans around PYUSD must be ready for potential changes in issuer oversight, settlement rules, or secondary-market restrictions.

Custody and counterparty risk: Receiving PYUSD means relying on PayPal’s custody model and liquidity partners. Creators who self-custody trade operational convenience for control; those who rely on custodial solutions trade autonomy for fewer operational burdens. Product teams should document custody guarantees, redemption mechanics, and contingency plans for insolvency events.

Stability and liquidity risk: While PYUSD aims to hold a USD peg, stressed-market events can cause temporary depegs or liquidity squeezes. Platforms need to design fail-safes (automatic conversion to fiat rails, notifications about conversion limits) and test scenarios where redemption windows shorten or fees spike.

Practical recommendations for product and payments teams

- Offer PYUSD as an opt-in, not default. Giving creators a clear choice reduces surprise tax and liquidity issues.

- Build transparent conversion UX. Show projected fees, typical settlement times, and tax implications before creators opt into payouts.

- Partner for liquidity. Integrate with established custodians and on/off-ramps to guarantee predictable conversion to fiat with SLAs.

- Provide accounting exports. Exportable records showing timestamps and USD valuations at receipt simplify creator tax compliance.

- Prepare regulatory playbooks. Map what happens if regulatory constraints tighten (e.g., temporary suspension of PYUSD payouts, increased KYC thresholds).

For creators: three quick decision checkpoints

- Liquidity needs: Do you need fiat immediately, or can you tolerate holding a USD-pegged token?

- Risk tolerance: Are you comfortable with custodial counterparty exposure versus self-custody responsibilities?

- Tax readiness: Can you capture and report fair-market-value income when PYUSD is received?

Answering those will guide whether to opt in, convert immediately, or use hybrid strategies (hold a portion on-chain, convert the rest).

Closing perspective

YouTube’s adoption of PYUSD is a high‑visibility pilot that pushes stablecoins into mainstream creator payments. For product managers and payments strategists, this is a chance to rethink settlement architecture and value-added services — but it also demands robust compliance, clear UX, and contingency planning. The trend toward tokenized assets and broader stablecoin adoption is likely to accelerate through 2026, reshaping how platform economics, royalties, and micropayments function in practice.

Platforms and creators should treat PYUSD as an opportunity to experiment responsibly: design for optionality, automate accounting, and build strong liquidity partnerships. And as the space evolves, tools and marketplaces — including products in the Bitlet.app ecosystem — will play a role in smoothing conversion, custody, and compliance for creators.

Sources

- YouTube expands creator monetization to allow U.S. creators to receive payouts in PayPal USD (PYUSD)

- 3 Predictions for Crypto in 2026 — stablecoins and RWA tokenization outlook

For context on broader market drivers, many teams still watch how on-chain activity on DeFi and macro flows around Bitcoin influence demand for stablecoin liquidity.