Why Solana and Major Altcoins Are Testing Critical Support Levels — Tactical Playbook for Traders

Summary

Intro: Why today's drop matters

The recent move that pushed Solana (SOL) below the $100 mark isn't an isolated glitch — it's a symptom. When a large-cap altcoin breaks a round-number support, it often forces algorithmic sellers and human traders to reassess market structure across the whole altcoin complex. In short: this is where narrative risk meets technical risk, and both are amplified by liquidity dynamics.

Market-watch coverage shows SOL losing ground and slipping under $100 amid persistent bearish pressure, a move mirrored by other majors as Bitcoin struggles to hold its own. See reporting from Invezz and CryptoPotato. XRP and several altcoins are likewise flirting with or retesting structural supports, according to Invezz’s altcoin coverage.

For traders and altcoin investors, the key question is tactical: how much downside is priced in, what are credible recovery paths, and how do you manage position sizing and liquidity risk while the market decides?

Market snapshot: correlation, momentum, and liquidity

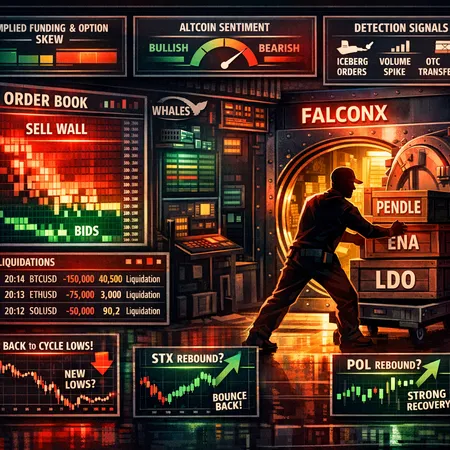

Broadly, we see three simultaneous forces at work:

- Compressed liquidity in altcoin order books: shallow bids around round numbers lead to outsized moves when stops trigger.

- Rising cross-crypto correlation with BTC: many altcoins now follow Bitcoin’s direction more tightly, so BTC weakness propagates quickly. For context on macro correlation, consider how Bitcoin acted during the last squeeze — it often dictates risk-on/off flows.

- Elevated leverage and crowded options/derivatives positions that fuel forced deleveraging.

The observable outcome: once SOL and other majors fail to defend obvious supports, mechanical liquidation cascades and market makers widen spreads. That amplifies realized volatility and can drag fundamentally different projects into the same “sell” bucket.

Technical breakdown — Solana (SOL)

Short-term structure

SOL’s breach below $100 is important for two reasons. First, $100 is a psychological and round-number liquidity zone where many stop orders cluster. Second, it’s often used as a baseline by algos to size risk.

- Immediate support: $88–$92 (prior consolidation lows and visible on-chain trading overlays).

- Secondary support: $70–$75 (2019–2022 accumulation area and longer-term fib confluence).

- Resistance turned support that failed: $100 (now supply zone).

Momentum indicators: RSI is likely in neutral-to-oversold territory, but momentum divergence must be confirmed before calling a bottom. A breach of the $88 area on heavy volume would open a path toward the $70 zone.

Market-structure read

Short-term bias flips to bearish whenever price breaks a clear higher-low sequence. SOL’s move under $100 created a lower low vs. the previous swing, which often forces traders out of marginal long positions.

Key tactical cues for SOL traders:

- Watch daily close below $92 — confirmations on daily timeframes matter.

- Intraday bounces into $100–$110 with high-volume rejection can be shortable if BTC remains weak.

Technical snapshot — other top-10 altcoins

Rather than analyze each coin in exhaustive detail, here's a concise tactical read for major caps that typically move with the market rhythm: ETH, BNB, XRP, ADA, DOT, DOGE, MATIC, AVAX, LINK.

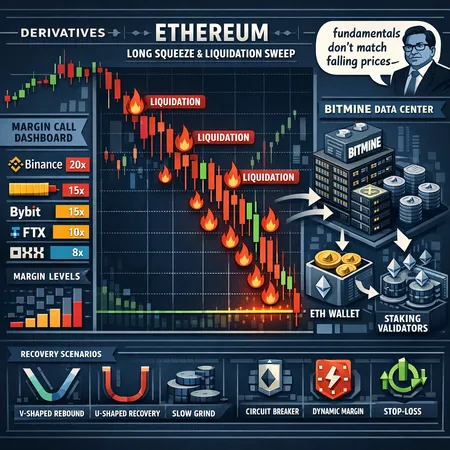

- ETH: If ETH chops below the 50-day MA and fails to reclaim it on a bounce, expect rotational selling into smaller caps. Watch $2,800–$3,000 range as the next structural support in many scenarios.

- BNB: Often provides temporary stability due to exchange utility demand, but a break under recent multi-week lows invites more downside to prior consolidation near $220–$240.

- XRP: Already flagged as vulnerable to retesting $1.44 support—continued pressure could drive it toward earlier demand zones. (See the XRP note from Invezz.)

- ADA/DOT/MATIC/AVAX/LINK: Watch correlation with ETH and liquidity gaps; these names often face the steepest intraday drawdowns when Bitcoin wobbles.

Across the board, technicals show increased correlation and thinner bid-side liquidity. That makes idiosyncratic strength harder to sustain during a market-wide reset.

Primary drivers of the sell-off

- Liquidity mismatches

- Altcoin order books are shallower than BTC/ETH; concentrated stops near round numbers make moves discontinuous. When SOL slid under $100 the resulting order flow pulled bids lower quickly.

- BTC weakness and macro flow

- Bitcoin remains the primary risk asset anchor. When BTC falls or fails to hold prior supports, risk-off funds exit altcoin exposure first. CryptoPotato’s market watch noted BTC recovering from a 15‑month low, but that chop still transmits stress into alts.

- Forced deleveraging and derivatives

- Options expiries, concentrated call/put positions, and margin calls force sales in underlying tokens to meet collateral calls, increasing contagion.

- Narrative rotation and headline risk

- News cycles that re-focus attention on solvency, regulation, or macro weakness can remove marginal buyers, widening sell windows.

Cross-crypto contagion: mechanism and evidence

Contagion in crypto often travels via three routes:

- Direct correlation (BTC-led moves).

- Liquidity channel (market makers widen spreads across multiple pairs).

- Funding and margin calls (one liquidation cascades across derivatives books).

Evidence of contagion appears when previously uncorrelated tokens trade in lockstep with SOL or BTC intraday. Traders should monitor funding rates, open interest changes, and exchange-level order book depth to anticipate spillovers.

Likely recovery scenarios (short to medium term)

- Shallow rebound (most bullish)

- Quick capitulation, washout of weak hands, then consolidation into a range. SOL reclaims $100, forms higher lows, and altcoins recover with BTC. This scenario needs supportive macro headlines and stable spot buying.

- Range-bound repair (moderate)

- Price grinds sideways for several weeks while liquidity rebuilds. Volatility declines, but no decisive break higher until macro catalysts arrive.

- Deeper retest (bearish)

- Failed bounces, continued BTC weakness, and persistent sell-side pressure force a retest of lower structural supports (SOL toward $70s, other alts to their respective prior lows).

Probability is dynamic: if BTC can stabilize and buy-side liquidity returns, the shallow rebound becomes likelier. If funding rates spike negative and derivatives flows remain one-directional, the deeper retest becomes the base case.

Actionable risk management for altcoin holders (tactical checklist)

- Re-assess position sizing: reduce exposure to a size you can hold through a 30–50% drawdown on low-liquidity names.

- Define explicit stop rules: use time-and-price stops rather than emotion-driven exits. For swing trades, prefer daily closes as confirmation.

- Layered hedges: buy BTC or ETH as a hedge if you expect a market-wide drawdown, or use inverse ETFs/derivatives where available. Options can hedge tail risk — small out-of-the-money puts can be cost-effective protection.

- Convert a portion to stablecoins on meaningful breakdowns: this preserves optionality and lets you buy lower liquidity dips with less slippage.

- Reduce concentration risk: avoid large single-token bets during heightened cross-crypto correlation.

- Monitor on-chain liquidity and staking flows: sudden spikes in withdrawals or drops in TVL can precede price moves. Consider locking less capital in time-locked instruments during volatile environments.

- Watch funding rates and open interest: explosive moves in funding can afford early warning of forced deleveraging.

On platforms such as Bitlet.app traders often use installment and P2P features to rebalance exposures; use these tools cautiously and avoid levering into falling markets.

Tactical trade ideas (risk-aware)

- Range short: fade rallies up to $100–$110 on SOL if BTC remains weak, with tight stops above the daily VWAP and scaled sizing.

- Put-buy hedge: small size (1–5% portfolio) OTM puts on SOL or a BTC hedge during anticipated volatility windows.

- Re-entry plan: set limit buy ladders into structural support zones (conservative buys at $85–$75 for SOL) rather than market orders.

Conclusion: structure, liquidity, discipline

The SOL break under $100 is a signal, not a verdict. It highlights fragile market structure, thin altcoin liquidity, and high cross-crypto correlation — especially when BTC is volatile. Traders should focus less on predictions and more on a repeatable playbook: size conservatively, use explicit risk rules, and have a clear hedging plan.

Markets heal when liquidity returns. Whether the recovery is sharp or grinding will depend on BTC stabilization, macro flow, and whether leverage is cleaned out. Keep alerts for daily closes under the key levels discussed, monitor funding and open interest, and prepare to act decisively when liquidity reappears.

Sources