ETF Outflows

Massive daily outflows from US spot Bitcoin ETFs coincided with a liquidation wave and miner stress as BTC approached $70k. This article unpacks drivers, on-chain signals, and pragmatic trade and portfolio rules for intermediate traders and allocators.

GameStop's transfer of its entire 4,710 BTC stash to Coinbase Prime triggered debate: custodial housekeeping or prelude to a corporate exit? This article parses the timeline, motives, market signal, ETF outflows, whale accumulation, tax/regulatory angles, and practical trading scenarios.

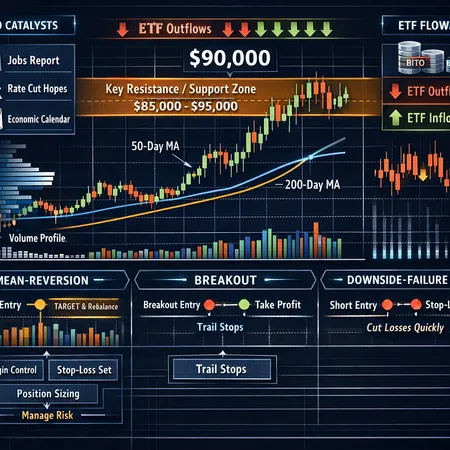

Bitcoin is trapped in a critical $85k–$95k band in early 2026, where technical structure, ETF flow dynamics and macro signals will dictate the next major leg. This piece synthesizes levels, orderflow implications of ETF outflows, macro drivers and actionable scenario-based trade plans for intermediate-to-advanced traders.

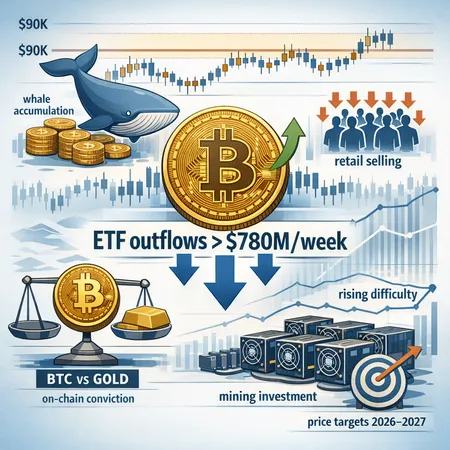

At the close of 2025, on-chain signals show large Bitcoin holders accumulating in the $80k–$90k band even as weekly spot ETF outflows topped $780m. This piece synthesizes whale metrics, ETF flow dynamics, macro narratives and miner behavior to frame plausible price trajectories for 2026–2027.

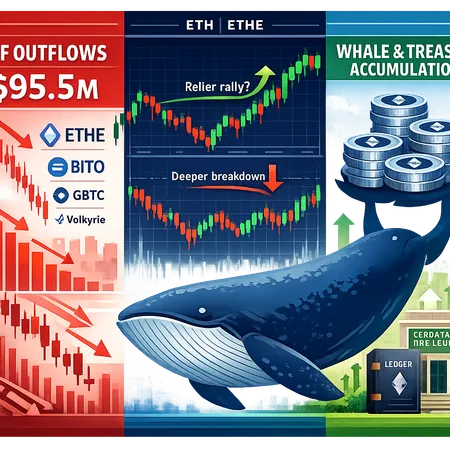

Ethereum shows conflicting on-chain and capital-flow signals: roughly $95.5M in recent ETF outflows led by ETHE/ETHA, while selective whale and private purchases suggest accumulation. Traders and allocators must weigh immediate selling pressure against longer-term strategic buys.

A six-day outflow streak from U.S. Ether ETFs has pressured ETH price action, even as whales withdraw ETH from Binance and accumulate on-chain. This deep-dive reconciles those forces and lays out plausible recovery and downside scenarios, plus implications for staking yields, DeFi collateral, and institutional demand.

A deep dive into how large ETF outflows, collapsing hashprice and shifting institutional positioning are feeding a feedback loop that amplifies Bitcoin volatility. Practical scenarios and hedging options for miners and institutional traders.