Options

January’s sell‑off was not just spot panic — options flow and concentrated monthly expiries amplified squeezes and liquidations. This guide explains the Deribit positioning that signaled bearish hedging, the expiry mechanics that create squeezes, the metrics to watch, and practical hedging tactics for options traders and risk managers.

A closer look at why Bitcoin options open interest has eclipsed futures, how that shifts liquidity and gamma dynamics, and why macro shocks like tariff escalations can still ignite outsized BTC moves despite ETF flows.

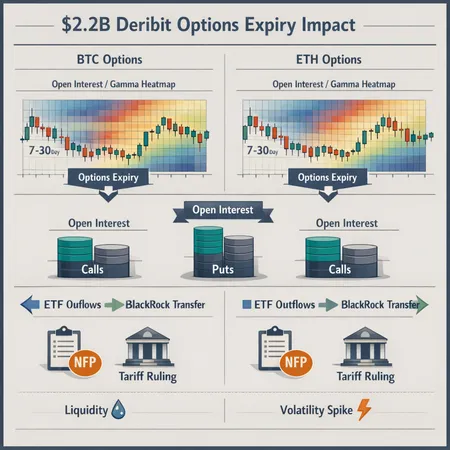

A detailed look at the $2.2B Deribit options expiry, the open interest backdrop, and how looming U.S. NFP and a Supreme Court tariff ruling amplify gamma, liquidity risk, and ETF flows in BTC and ETH. Practical trade and desk-level risk-management scenarios for the next 7–30 days.

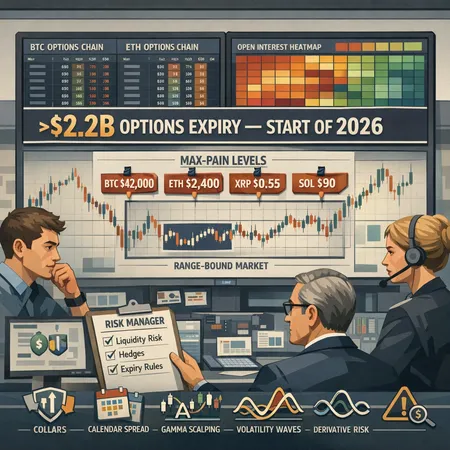

A tactical guide for options traders and crypto risk managers on how the early‑2026 >$2.2B BTC/ETH options expiry, max‑pain anchoring and range‑bound structure should inform hedging and trading decisions. Practical strategies and an expiry‑day liquidity checklist included.

A tactical look at macro and market-structure signals — Fed repo injections, record spot‑ETF outflows, >$2.2B options expiry and recent on‑chain bearish flips — that will shape BTC’s short-to-medium term path.

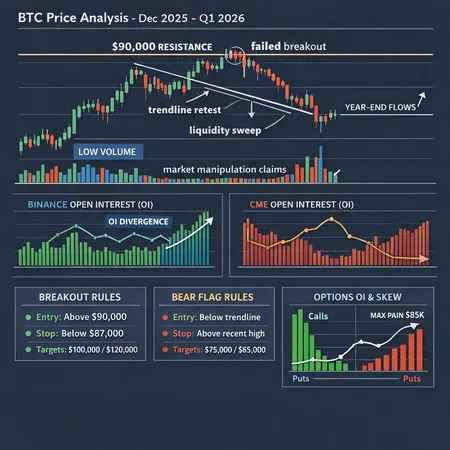

A technical-market-structure deep dive into Bitcoin's late‑December 2025 failed $90k breakout, unpacking resistance, trendline retests, futures/options open interest dynamics, manipulation claims, and actionable trade frameworks for Q1 2026.

A detailed explainer of the record‑sized $27B+ Bitcoin and Ethereum options expiry, why it amplified short‑term volatility, and practical hedging tactics for traders and desks before and after expiry.

A $28B options expiry, holiday thinness and ETF flow dynamics have created a tension: suppressed realized volatility amid bullish macro positioning. Here’s how that squeeze works, likely price paths into Q1 2026, and practical trade and portfolio adjustments.

As exchanges open options-writing to more users, ETH markets are shifting — more premium supply, shifting implied volatility, and new risks from concentrated holders. This explainer breaks down mechanics, whale activity, and actionable hedging and income strategies for semi-professional traders and portfolio managers.

The Dec. 22–24 Deribit year‑end options expiry, a bullish 0.38 put‑call ratio and $27bn of notional open interest will collide with nearly $497m in weekly spot ETF outflows and rising margin longs to create concentrated year‑end volatility. This piece parses the expiry skew, liquidity clusters around $90K, institutional cues and practical hedges for traders and treasury managers.