Anatomy of the $10k Bitcoin Crash: How ETFs, Derivatives and 'Paper BTC' Changed Market Mechanics

Summary

Executive summary

Bitcoin suffered an unprecedented intraday shock — a drop that exceeded $10,000 from peak to trough — and it exposed structural fragilities that go beyond simple supply-and-demand on spot exchanges. This post-mortem walks through the timeline, isolates the roles of ETF flows and ‘paper Bitcoin’ (derivatives and synthetic supply), quantifies who bore the pain in liquidations, and translates the episode into concrete risk-management actions for institutions and sophisticated retail traders. For many traders, Bitcoin remains the primary market bellwether, but the plumbing that now moves price is more derivatives-heavy and more fragile than most realize.

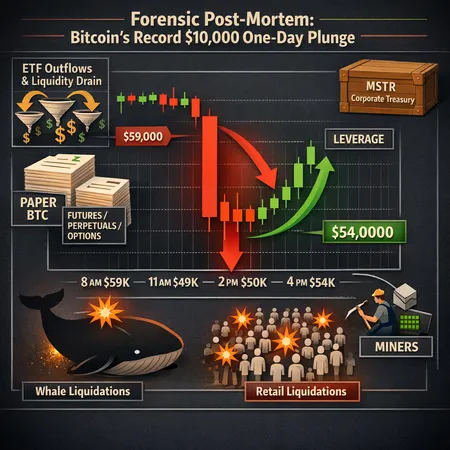

Timeline: how the $10k plunge unfolded

The drop began as a sudden bout of selling pressure that coincided with heavy outflows from Bitcoin ETFs and a spike in derivative stress. Intraday, prices which had been trading in an elevated zone — news reports noted activity as BTC approached the $60k area — moved sharply lower as selling cascaded through futures and margin books. The unprecedented single-day decline of more than $10k triggered mass liquidations and rapid deleveraging. On-chain analysts flagged a defensive support zone near roughly $42k as buyers stepped in and the initial cascade slowed.

Market coverage at the time captured two linked themes: heavy ETF outflows as spot pain intensified and an accelerated unwind of leveraged positions that amplified downstream effects. Reporting from on-the-ground and market-focused outlets documented the mass liquidations and corresponding leverage unwind that turned a big sell day into a record-price event ([Cointelegraph], [DailyCoin]).

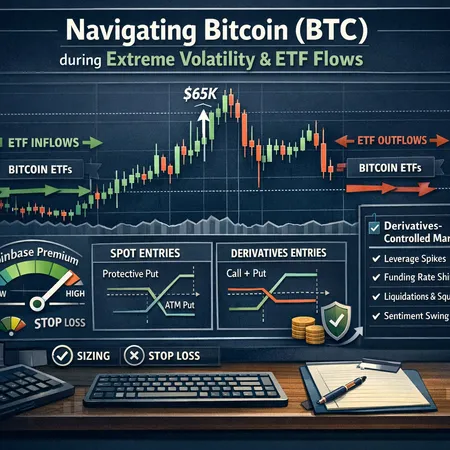

How ETF flows amplified the move (and where 'paper Bitcoin' fits in)

Bitcoin ETFs were designed to provide spot-like exposure to institutional and retail buyers, but the creation/redemption mechanics and secondary-market flows mean ETFs can both absorb and transmit liquidity stress quickly. In the days around the plunge, several ETFs registered heavy weekly outflows, shrinking the amount of spot BTC sitting on custodian ledgers and forcing APs and market makers to rebalance aggressively. Cointelegraph reported significant weekly ETF outflows that correlated with the deterioration in price.

Two mechanisms matter here:

- Direct liquidity transmission: large ETF redemptions require selling spot BTC (or borrowing it), adding to order-book pressure at a time when derivatives were already stretched.

- Perception and leverage: outflows can flip market sentiment, raising funding costs and encouraging deleveraging in margin books even before spot selling completes.

More important for the crash dynamic was the presence of a large paper layer of BTC — synthetic positions that exist in futures, perpetual swaps, options and structured products. That layer means price can move violently without a proportional change in spot supply, because leverage and derivative exposures create amplifiers that translate relatively modest spot flows into outsized price moves.

Derivatives and synthetic BTC: how market mechanics have changed

Derivatives no longer feel like an overlay to spot markets — they are the plumbing that often controls them. Analysts have argued that layered financial products and derivatives now exert dominant influence over price action, and the crash confirmed that claim: funding rates, futures basis, options gamma and dealer net delta all combined to create a fragile state.

Mechanically, the danger is straightforward but potent:

- Perpetual swap funding and concentrated long positions mean that a single directional shock can create runaway funding spikes, incentivizing shorts to add pressure.

- Futures and options desks can synthetically create exposure (long or short) via index-linked products and delta-hedged option books; if demand for those products reverses, dealers hedge by transacting in spot or other derivatives, producing feedback loops.

- Structured products and institutional desks that sell yield or overlay leverage can be forced to rebalance into thin liquidity windows, magnifying moves.

A useful way to think about it: when synthetic supply (open interest) is large relative to available depth in spot order books, the market becomes leverage-sensitive. Blockonomi summarized this shift in market mechanics, arguing that derivatives increasingly control price moves rather than pure spot supply-and-demand.

Liquidations: scale, concentration, and who paid the price

The cascade produced an outsized wave of liquidations. Market reports and exchanges documented massive forced exits across futures, perpetuals and margin accounts. DailyCoin reported that mass liquidations and the leverage unwind played a central role in the crash, with long positions bearing the brunt.

Distributional pattern observed:

- Leveraged retail longs: a large share of liquidated positions were retail and small institutional longs on perpetual and futures venues. These accounts typically have little margin cushion and are the most mechanically vulnerable to quick price moves.

- Institutional desks and market-makers: while many institutional participants had risk controls, desk-level hedges and options protections, the speed of the move forced some to cover or to accelerate hedging, which added liquidity pressure.

- Whales and spot sellers: on-chain analysis suggested big spot holders (whales) were reducing exposure during the slide while smaller wallets accumulated dips. Coinpaper’s on-chain work noted whales selling into weakness even as retail wallets picked up discounted coins.

Net result: a one-two punch where concentrated leveraged shorts/longs and spot selling combined to compress price. Liquidations are not evenly distributed; structurally, the most leveraged and most levered-to-funding-rate participants were hit hardest.

Knock-on effects on corporate treasuries, miners and balance sheets

Large price shocks matter beyond trader P&L. Companies with public Bitcoin treasuries and miners with high operating cost structures face real balance-sheet and cash-flow implications. MicroStrategy (ticker MSTR) and other corporates that hold BTC on their balance sheets saw headline volatility translate to mark-to-market swings and increased scrutiny from boards and creditors.

For miners, the economics depend on hashprice, operating costs and treasury policy. In an extreme market drop, miners that lack conservative treasury management (e.g., limited fiat liquidity, high debt, or aggressive monetization schedules) may be forced into opportunistic selling to cover payroll, capital expenditures or debt. That selling pressure can feed into the wider event if it coincides with other forced sellers.

Corporate treasury implications include:

- Volatility in reported equity and leverage ratios when treasury BTC is marked to market.

- Potential covenant risks for firms that used BTC as collateral or that issued debt referencing treasury value.

- Reputational and governance questions about the prudence of large, concentrated BTC positions without sufficient hedges.

These downstream effects underscore the systemic risk when large holders operate without explicit stress testing and layered hedges.

Practical, tradeable risk-management lessons

This episode should change how both institutions and sophisticated retail investors think about allocation, leverage and liquidity. Below are actionable lessons that can be implemented immediately.

For institutions and corporate treasuries:

- Stress-test for extreme intraday moves, not just weekly VAR: simulate >10% intraday declines and ensure liquidity buffers cover operational needs without forced asset sales.

- Use options for convex hedges: long-dated puts or collars can cap downside without full liquidation of strategic holdings; dynamic hedging must be tested under tail events.

- Diversify custody and counterparty exposure: ensure multiple settlement channels and reduce dependence on any single AP or prime broker for redemption/creation flows.

- Explicitly model funding-rate and basis risk: if your business writes products tied to perpetuals or funding, include those line items in treasury stress scenarios.

For institutional traders and funds:

- Limit gross leverage and monitor concentrated directional exposures across venues — cross-exchange netting matters.

- Pre-position liquidity: hold spot fiat or stablecoin liquidity equal to likely margin calls under stressed scenarios.

- Prefer transparent, exchange-settled derivatives with clear default waterfalls for large notional hedges; avoid opaque structured credit that can produce surprise gamma.

For retail and advanced individual investors:

- Avoid high leverage on perpetuals; funding-rate dynamics can turn profitable positions painful quickly.

- Apply position sizing rules tied to portfolio risk, not just conviction: limit any single crypto position to a fraction of net worth and cap downside exposure.

- Dollar-cost average into long-term allocations and use installment/earn products thoughtfully. Platforms like Bitlet.app that support installment buying and yield products can help smooth entry, but understand counterparty risk and redemption mechanics.

Cross-cutting tactics (both groups):

- Monitor on-chain indicators and open interest: rising open interest with thin spot liquidity is a red flag.

- Keep a schedule of rebalancing and automated stop-loss frameworks that consider slippage and funding costs, not just nominal price levels.

- Plan communications and governance for corporate holdings: boards and stakeholders should understand the liquidity policy and hedging strategy before volatility hits.

Looking forward: market structure and regulation implications

The crash highlighted that modern crypto markets are hybridized — a spot market with derivatives plumbing that often dictates short-term price dynamics. That hybridization raises questions for market stability: should exchanges and regulators require higher margin on highly-leveraged venues, better transparency on structured products, or clearer reporting from ETF providers about flows and redemption mechanics?

None of these changes are straightforward, but market participants should accept that price discovery has migrated into derivatives-capable venues and OTC desks. As a result, systemic risk can emerge without large spot flows if synthetic positions are large and concentrated.

Final takeaways

- The >$10k single-day plunge was not a single-cause event; it was the product of ETF outflows, concentrated derivative exposures, leverage, and the interaction between spot sellers and synthetic positions.

- 'Paper Bitcoin' — the large layer of synthetic BTC created by derivatives — can make market moves larger and faster than spot liquidity alone would suggest.

- Liquidations disproportionately hit leveraged retail and short-margin institutional positions, while whales often managed exposure by selling spot, and small wallets opportunistically accumulated.

- Institutions and retail investors alike must adopt stress-tested liquidity plans, hedging programs, and conservative leverage policies to survive the next tail event.

This post-mortem is part of an evolving conversation about market structure in crypto; expect more debate as participants, exchanges and regulators digest what happened and what changes would reduce the likelihood of repeat events.

Sources

- Reports on Bitcoin ETFs registering heavy weekly outflows as BTC hit $60K

- Coverage of the unprecedented >$10k single-day drop and bear-market analysis

- On-the-ground reporting of mass liquidations, ETF outflows and leverage unwind during the crash

- On-chain analysis showing whales selling while small wallets purchased dips and $42,000 support flagged

- Argument that derivatives and layered financial products have fundamentally altered Bitcoin price action