Liquidations

A tactical framework for traders and risk managers to detect mounting liquidation cascade risk in BTC markets — combining on‑chain signals, derivatives metrics and ETF flow context. Practical checklist included.

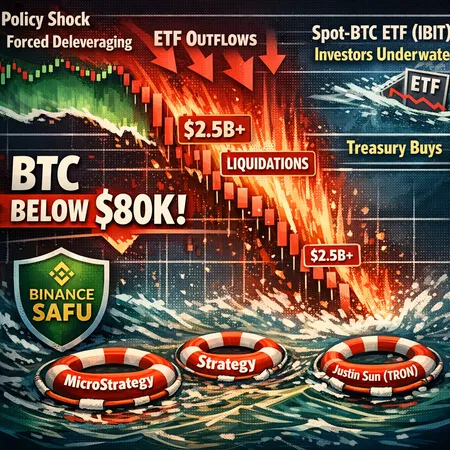

A macro pivot around the Fed and a wave of forced deleveraging pushed BTC under $80k; ETF flow dynamics and large treasury buys will determine whether this is a capitulation or buying opportunity.

A data-driven post‑mortem of the recent liquidation cascade that erased $2.5B+ in positions — including a single $220M Ether hit — and a practical playbook for traders and platforms to reduce tail-risk from high leverage.

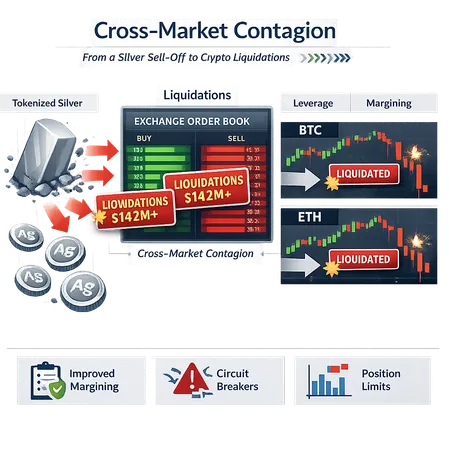

A sharp tokenized silver sell‑off triggered $142M+ in crypto liquidations and spilled into BTC and ETH; this investigative guide explains how tokenized commodities amplify systemic risk and lays out a mitigation playbook for exchanges and traders.

An investigative reconstruction of Bitcoin’s early-December flash crash, showing how a Japanese government bond yield shock met thin liquidity and algorithmic flows to spark a 180k+ trader liquidation cascade. Actionable risk-management and trade scenarios for traders and portfolio managers follow.

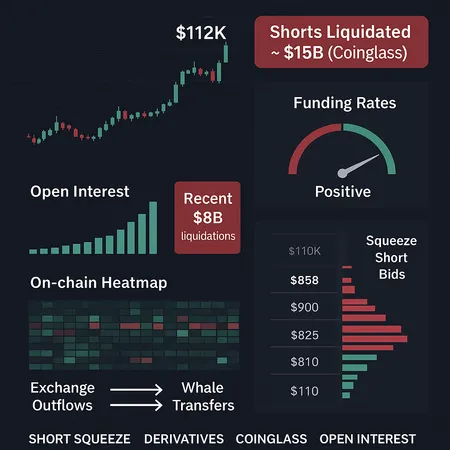

A tactical deep‑dive into how derivatives positioning can create a sudden BTC short squeeze and where liquidation risks are concentrated. Practical signals and scenario-based risk management for active traders and derivatives desks.

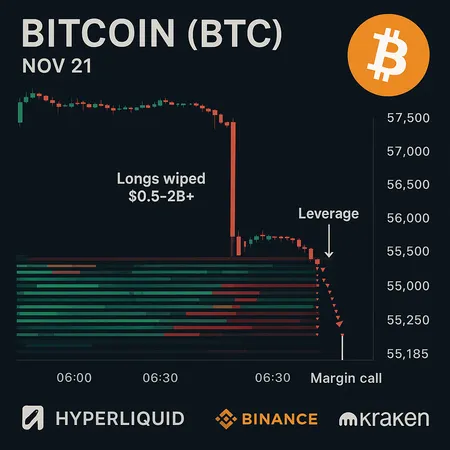

A minute-level forensic of the Nov. 21 Bitcoin flash crash that plunged BTC into the low $80ks on Hyperliquid and cascaded liquidations across venues. Actionable risk-management steps for traders and exchanges to prevent repeat disasters.

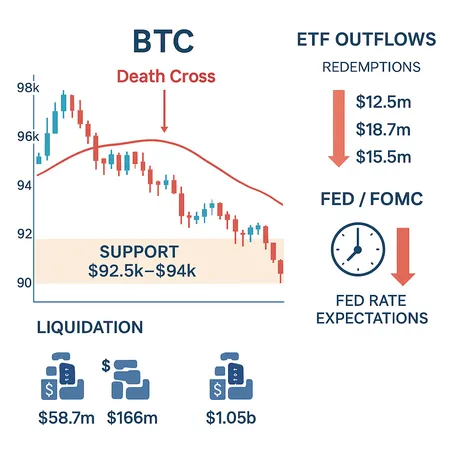

Bitcoin’s recent drop toward $93k–$95k reflects structural pressures — sustained US spot ETF outflows, concentrated forced liquidations, and changing Fed-rate expectations — not just noise. This piece unpacks the drivers, technical danger zones, and concrete risk-management steps for traders and allocators.

Bitcoin’s rapid fall under $100,000 in mid‑November stunned traders — a mix of ETF outflows, long‑term holder selling and a liquidation cascade amid a risk‑off macro pulse. This piece breaks the timeline, technical levels, and 2–6 week tradeable scenarios for intermediate traders and portfolio managers.

Explore key takeaways from qwatio's eight liquidations in high-leverage crypto trading and learn how to manage risks effectively. Discover how platforms like Bitlet.app can help you navigate crypto investments with safer strategies.