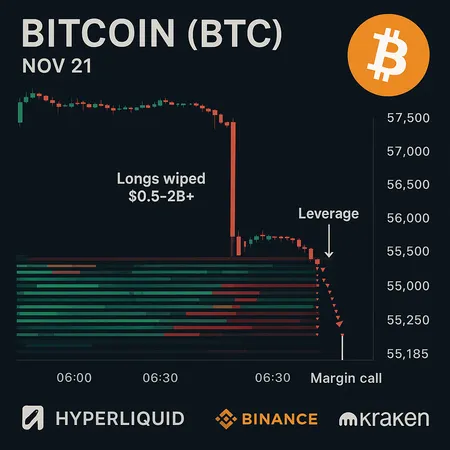

Anatomy of the Nov. 21 BTC Flash Crash: How Hyperliquid Triggered a Leverage Cascade

Summary

Executive snapshot

On Nov. 21 the market experienced a classic leverage-driven flash crash: a minute-length plunge that took Bitcoin from a stable range down into the low $80,000s on Hyperliquid before a rapid bounce. That single-venue price dislocation fed into mark-price models, automated liquidations and funding shocks on other platforms, producing a cascading unwind that professional trackers put somewhere between $0.5 billion and over $2 billion in wiped-long exposure depending on scope and counting methodology. CoinDesk captured the minute-level Hyperliquid plunge to about $80k, while Decrypt and U.Today quantified the broader liquidation pain in the subsequent hour.CoinDesk, Decrypt, U.Today

Why this event matters

This was not just "another dip." It’s a textbook example of how microstructure — concentrated order-book depth, stale liquidity and a price-print on a single venue — can interact with margining systems and leverage to create systemic liquidity stress. For intermediate-to-advanced traders and risk teams, the key lesson is that venue-level anomalies can rapidly become cross-exchange problems when leverage and automated liquidations are involved.

The venue-level trigger: Hyperliquid and concentrated order-book liquidity

Hyperliquid (ticker: HYPE) was the locus of the initial mispricing. According to minute-level reporting, the exchange experienced a cascade of sells that exhausted resting buy orders deep into the book, producing a sub-second or minute-level drop to approximately $80k before liquidity reappeared and the price recovered.

Two structural problems combined:

- Concentrated depth: a small number of limit bids provided most of the resting liquidity near the mid. When those bids were taken, the visible book collapsed.

- Aggressive execution: market-sweep orders — whether large single fills or algorithmic VWAP/TWAP slippage gone wrong — ate through those bids and printed the extreme low.

The combination produced a local best-trade that downstream mark-price oracles either used directly or weighted heavily when constructing索引-based mark prices, feeding automated margin calls elsewhere.

Timeline reconstruction (minute-by-minute, approximate)

Below is a pragmatic minute-by-minute reconstruction based on exchange prints, public reporting and liquidation tallies. Exact second timestamps differ by feed; this is a logical sequence rather than forensic server logs.

T-minus 5 to 0 minutes: BTC was trading in a relatively narrow range; market funding rates were not signaling extreme stress. Open interest was elevated, with many retail and institutional longs using 5x–20x leverage on various venues.

T0 (initial sweep): A large sell pressure — likely a combination of an aggregated algorithmic execution and a few manual liquidations or stop-runs — hit Hyperliquid’s bid stack. Visible liquidity was thin, and the market sweep consumed bids far below the mid, printing a rapid trade at roughly $80k. CoinDesk’s coverage highlights a minute-level flash crash to about $80k on Hyperliquid before a bounce.CoinDesk

T+1 to T+3 minutes: The sub-$82k prints on Hyperliquid were picked up by cross-venue index providers and mark-price algorithms that use a weighted or median-of-prices approach. Many derivatives platforms use a combination of a spot index and the exchange’s own last prints to compute a mark price for margin and liquidation triggers; the sudden drop tightened margin requirements and triggered auto-liquidations.

T+3 to T+10 minutes: As long positions started to liquidate en masse, aggressive sell pressure propagated into spot and perp markets on other venues, widening spreads and causing slippage. Decrypt reported nearly $1B liquidated in an hour as BTC plunged below $82k, while other outlets estimated up to $2B across broader crypto markets.Decrypt, U.Today

T+10 to T+60 minutes: Emergency liquidity providers and market makers stepped in, spreads normalized gradually, and the surviving order book rebuilt as positions closed and margin was restored. Coinpedia and others framed the overall wipeout and debated next technical support levels as the dust settled.Coinpedia

Note: public reports vary in aggregate liquidation totals because some count only derivatives liquidations while others include cross-asset margin calls, lending deleveraging and spot unwind impacts.

The mechanics of the leverage-driven cascade

To understand why a single venue's microstructure caused systemic pain, follow the capital flow:

- Local price shock: Hyperliquid prints a low due to thin bids and an execution sweep.

- Mark-price impact: Platforms that source price feeds or inputs from Hyperliquid (directly or via index providers) shift their internal mark prices lower. Some engines weight recent trades heavily, so an extreme last trade can materially lower the mark.

- Margin compression: Lower mark prices increase unrealized losses for leveraged longs; maintenance margin ratios are breached and auto-liquidation engines begin to close positions.

- Liquidation execution: Closed positions are often executed as market taker orders, which add aggressive sell pressure and hit remaining bids on other venues, producing real spot price moves.

- Feedback loop: Further drops push more accounts below maintenance, prompting additional liquidations — a positive feedback loop until liquidity or external intervention halts the motion.

This path explains how $0.5–2B+ of long exposure was removed: the variation comes from whether you measure purely exchange-perp liquidations (~$1B per Decrypt), include spot and margin-led spot sales, or include cross-asset funding and credit-line deleveraging (U.Today and Coinpedia count higher totals).

Why cross-venue contagion is so fast

A few systemic features accelerate contagion:

- Shared reference prices: Many platforms lean on similar index constructions; a bad print on one venue biases the industry-wide reference.

- Algorithmic similarity: Liquidation engines behave similarly — once a mark ticks, lots of bots and matching engines fire similar sell orders at the same time.

- Interconnected market making: Market makers quote across venues; when inventory becomes imbalanced, they withdraw quotes broadly, reducing liquidity industry-wide.

- Funding spikes: Rapid changes in perp funding and basis push arbitrageurs to rebalance, selling spot or buying perps, adding to directional flow.

All these channels mean a local microstructure failure can become a macro-market event in minutes.

How exchanges and protocols contributed

Exchanges differ in risk-management setups. Near-term drivers visible in this event included:

- Fragile order-book depth on Hyperliquid at key levels. Thin order-books are not necessarily a bug — they reflect real supply/demand — but they are risk when leveraged positions are large.

- Mark/Index sensitivity. If an exchange’s mark price is overly sensitive to a single venue print, it will create outsized margin shocks.

- Insufficient circuit-breakers and staggered liquidation auctions. If liquidation engines submit market orders directly into a shrinking book without throttling, they themselves exacerbate price moves.

Practical risk-management lessons for traders (intermediate–advanced)

- Position sizing and leverage discipline: Use conservative leverage, especially when order-book liquidity is thin. The marginal cost of smaller leverage is low; the risk of 20x on a narrow book is high.

- Monitor venue microstructure: Watch depth, spread, and hidden liquidity on the venues where you carry positions. Don’t assume uniform liquidity across exchanges.

- Use limit exits and time-weighted execution: When reducing big positions, prefer TWAP/VWAP with slippage limits rather than sweeping markets.

- Cross-check mark vs. index: Keep an eye on the mark price your counterparty uses and compare to multi-venue indices. If a margin call looks driven by a single-venue print, contact support before forced liquidation if possible.

- Diversify where you hold risk: Spread large positions across custody and trading venues to avoid single-point-of-failure margin shocks.

- Stress-test scenarios: Run liquidation-spiral stress tests on your positions (what happens if index goes -8% in one minute?) and set stop-losses accordingly.

Traders using services such as Bitlet.app should be especially mindful of leverage and cross-venue exposure when using installment, earn or P2P features that might re-concentrate risk.

Practical safeguards for exchanges and platform risk teams

- Improve mark-price construction: Use robust, median-weighted indices with outlier rejection and time-weighting to avoid overreacting to single-venue prints.

- Enforce dynamic liquidation throttles: Stagger and cap market-impact of liquidation orders; consider using auction mechanisms rather than pure market-sweeps for large forced closures.

- Depth provisioning and maker incentives: Encourage genuine depth near the top-of-book through incentives and viable market-making programs.

- Circuit breakers and pause logic: Short-circuit aggressive deleveraging when moves exceed a calibrated threshold; allow time for liquidity to be provided.

- Transparent risk metrics: Publish anonymized aggregate metrics (open interest, concentrated book risk) so advanced clients can monitor systemic exposure.

- Insurance funds and cross-margin limits: Maintain sufficient insurance funds and dynamic margin multipliers correlated to market liquidity.

Readable checklist: Immediate trader actions after a flash event

- Check mark-price vs. index and review open-interest and funding announcements.

- Avoid panic topping up into rebound; reassess true exposure and liquidity across venues.

- If forced liquidation is imminent, attempt negotiated close-outs or partial limit exits where possible.

- Recompute stress scenarios and reduce leverage ahead of risky macro events.

Closing thoughts

The Nov. 21 flash crash is a reminder that price discovery is a fragile, venue-dependent process when leverage is large. A single mispriced print on Hyperliquid — amplified by thin order-book liquidity, sensitive mark-price mechanisms and a high open interest in longs — cascaded quickly into a multi-venue liquidation storm. As crypto markets mature, both traders and platforms must bake microstructure-aware risk rules into their playbooks to prevent local failures from becoming systemic collapses.

For traders and risk managers seeking deeper operational safeguards, this incident is a useful case study: its anatomy is clear, and the remedies are concrete. Integrating multi-source pricing, throttled liquidation execution and conservative leverage policies will reduce the odds of repeating Nov. 21.

Sources

- CoinDesk: Bitcoin suffers flash crash to USD80k on Hyperliquid amid market volatility

- Decrypt: Nearly $1B liquidated in an hour as Bitcoin plunges below $82k

- U.Today: Morning crypto report — Bitcoin crashes precisely to $82,000; $2 billion liquidation?

- Coinpedia: Bitcoin crashes to $81,000 as $2 billion gets wiped out — is $74k next?

Related reading: for many traders, Bitcoin remains the primary market bellwether; for liquidity and protocol implications see discussions on DeFi.