Risk

ZeroLend’s wind-down exposes how fragile small, multi-chain lending protocols can be when TVL, token incentives and cross-chain complexity are misaligned. This article breaks down the failure modes and gives a practical stress-test checklist for projects, DAOs and LPs.

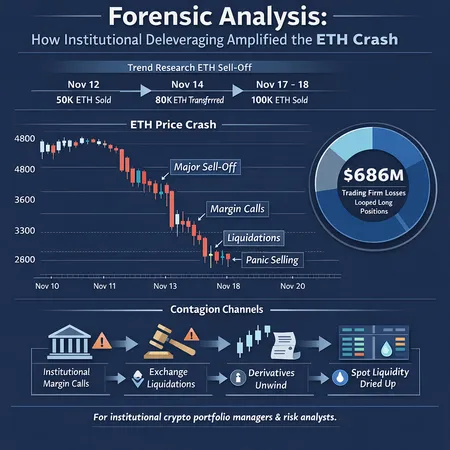

A forensic review of how institutional selling, margin calls, and looped long positions turned an ETH drawdown into a cascading market event. Using Trend Research and a related trading-firm collapse as a case study, this report maps the timeline, contagion channels, and practical lessons for risk teams.

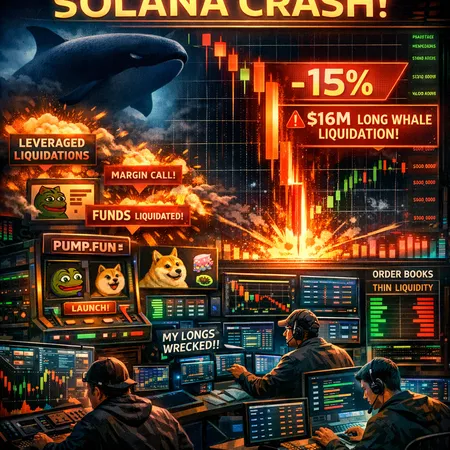

Solana’s sudden 15% slide—catalyzed by a reported $16M long-whale liquidation—exposes structural risk for high-throughput L1s that rely on concentrated liquidity and margin. This post unpacks the mechanics, contagion vectors (including memecoin launchpads and execution stacks like Pump.fun), and practical mitigation steps for developers, risk teams, and traders.

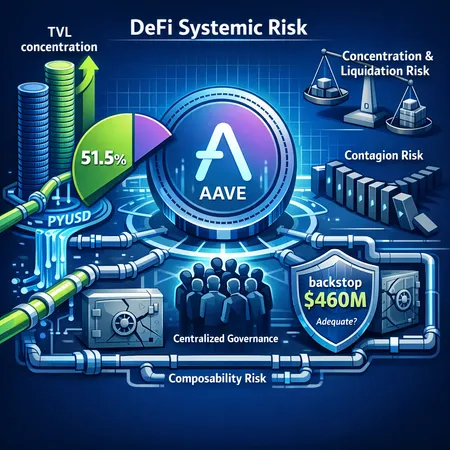

Aave now controls a majority of DeFi lending — an investigation into how it got there, what a $460m backstop really means, and protocol and policy fixes to decentralize lending markets.

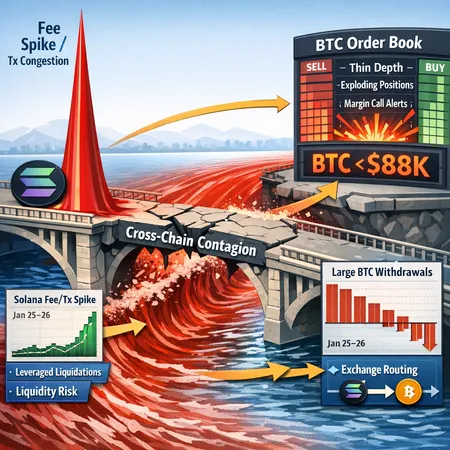

A Solana fee and transaction surge on Jan 25–26 catalyzed large rebalances and margin liquidations that pushed Bitcoin under $88K. This article reconstructs the on‑chain timeline, explains the mechanics of cross‑chain contagion, and offers a practical risk‑control playbook for traders, market makers and exchange ops.

Active traders face a clustered set of risks — technical, derivatives, security, and market-structure — that can compress BTC quickly. This piece breaks down seven immediate threats and gives concrete hedge strategies and a monitoring checklist to survive a volatile drawdown.

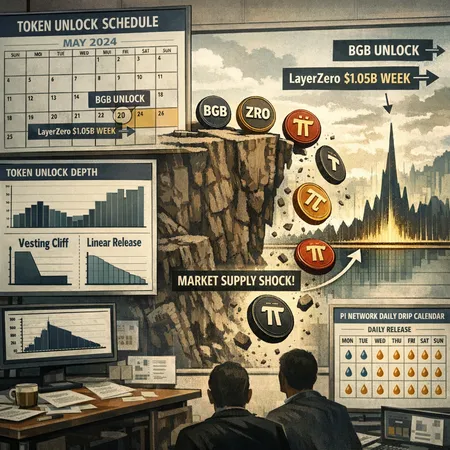

Large simultaneous token unlocks are a recurring systemic risk that can trigger sharp sell-offs and liquidity stress; understanding cliffs vs linear releases, pricing of expected supply, and mitigation strategies is essential for investors and venture teams. This investigation uses the BGB/LayerZero $1.05B unlock week and Pi Network’s daily cliffs as case studies.

A deep-dive into the ~$280M hardware-wallet theft that routed funds into Monero via THORChain, the attack vectors used, and actionable custody and policy steps security officers and family offices should adopt.

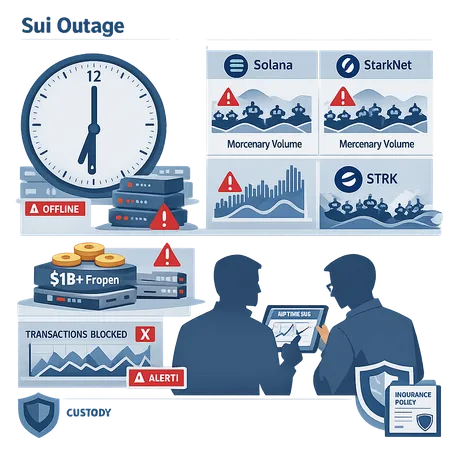

The nearly six-hour Sui halt that froze over $1B of on-chain value exposes how uptime risk is priced — and often underinsured — across so-called high-throughput chains. Engineers, product leads, and risk officers need practical operational changes to mitigate downtime and mercenary-volume distortions.

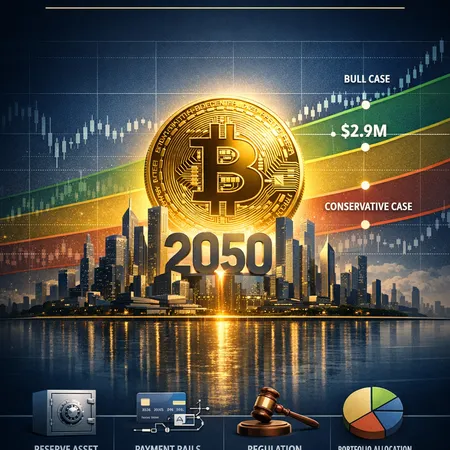

VanEck’s headline projection that one BTC could be worth $2.9M by 2050 rests on settlement and reserve assumptions that deserve close scrutiny. This piece breaks their model into components, stress-tests the core inputs, offers alternative scenarios, and gives practical allocation and custody guidance for institutional allocators.