Leverage

A tactical framework for traders and risk managers to detect mounting liquidation cascade risk in BTC markets — combining on‑chain signals, derivatives metrics and ETF flow context. Practical checklist included.

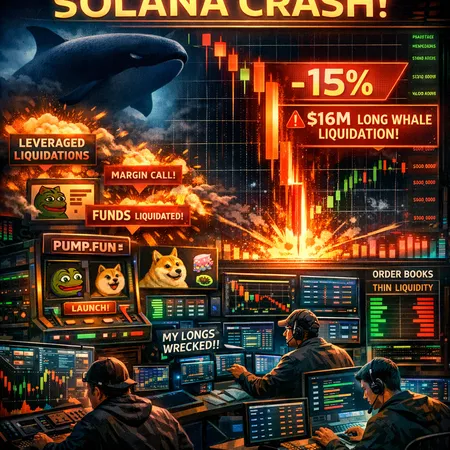

Solana’s sudden 15% slide—catalyzed by a reported $16M long-whale liquidation—exposes structural risk for high-throughput L1s that rely on concentrated liquidity and margin. This post unpacks the mechanics, contagion vectors (including memecoin launchpads and execution stacks like Pump.fun), and practical mitigation steps for developers, risk teams, and traders.

Strategy (formerly MicroStrategy) continued to add Bitcoin even as its corporate holdings moved underwater — a move that raises concrete balance-sheet, covenant and dilution questions for corporate treasuries. This article breaks down the disclosed buys, compares cost basis to the market, and offers a practical risk/return framework for CFOs and institutional allocators.

A data-driven post‑mortem of the recent liquidation cascade that erased $2.5B+ in positions — including a single $220M Ether hit — and a practical playbook for traders and platforms to reduce tail-risk from high leverage.

Ripple’s recurring escrow unlocks, XRPL’s 2026 upgrades and a pending US market‑structure bill create a dense set of near‑term catalysts for XRP. This guide breaks down supply mechanics, regulatory inflection points, leverage risks and an actionable watchlist for traders and long‑term holders.

A leverage-driven dump pushed XRP to a multi-month low, triggering roughly $72M in liquidations and nearly wiping a single whale. This piece quantifies the damage, maps likely support zones, and gives a trader-focused watchlist to spot accumulation vs. squeeze risk.

A trader-focused roadmap for Bitcoin heading into the FOMC: what the bearish weekly EMA crossover means, how ETF flows and on-chain supply-in-loss influence downside risk, and tactical 7–30 day plays with strict risk rules.

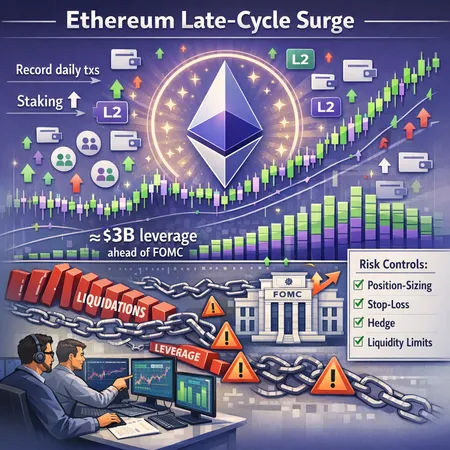

Ethereum is seeing a late‑cycle burst — new wallets, L2 adoption and record daily transactions — even as staking tops out and roughly $3B of leverage builds into the FOMC. Traders and risk managers should balance bullish fundamentals with clearly defined leverage controls and hedges.

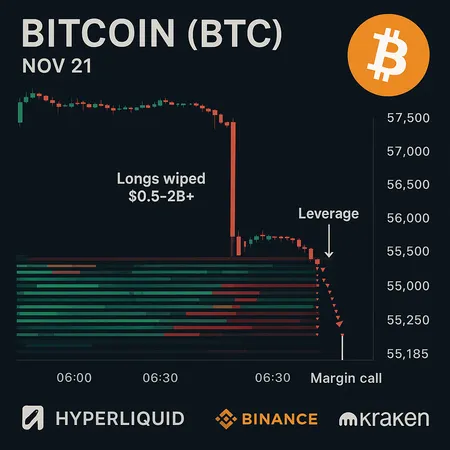

A minute-level forensic of the Nov. 21 Bitcoin flash crash that plunged BTC into the low $80ks on Hyperliquid and cascaded liquidations across venues. Actionable risk-management steps for traders and exchanges to prevent repeat disasters.