Why Bitcoin Fell Below $80K: Liquidations, ETF Outflows, and the Role of Treasury Buyers

Summary

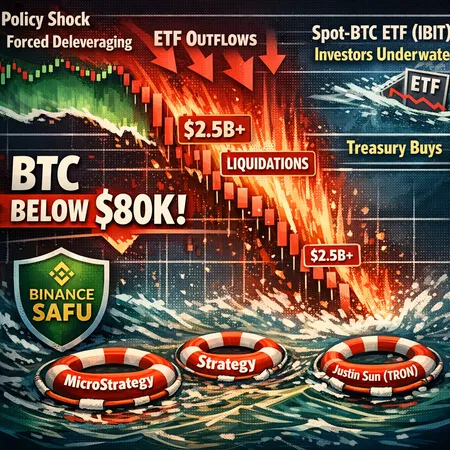

Quick read: the short chain reaction

When the Fed surprise landed (Warsh named chair), macro players repriced risk rates almost immediately. That repricing cascaded into a concentrated crypto deleveraging event — more than $2.5 billion in liquidations across futures and leveraged positions — and pushed Bitcoin below the $80,000 mark. This article unpacks the mechanics: how a policy shock turns into on-chain fire sales, why spot-BTC ETF investors are now sitting underwater, how exchange safety funds and big treasury buys can stabilize price floors, and a tactical checklist for institutional and retail allocators navigating the aftermath.

From Fed shock to forced deleveraging: the mechanics

The trigger is straightforward in macro terms: a Fed appointment that raises the odds of tighter policy or a changed rate path forces an immediate risk repricing across asset classes. Crypto, because of its leverage and concentrated exposures, amplifies that move.

Market makers and leveraged retail/institutional traders saw margin requirements rise and mark-to-market losses widen. Short-term funding costs jumped and liquid-stops were tripped. The result was a self-reinforcing wave of deleveraging as futures positions were forcibly closed.

Crypto-specific accelerants added fuel. As reported by CryptoNews, the initial cascade coincided with $2.5B+ in liquidations that concentrated selling pressure into thin tape windows, producing outsized price moves below $80k.

Why did liquidations matter so much? Because they convert paper losses into real sell orders at market. Large leverage pools (perpetuals with high funding) can move BTC far more quickly than spot flows alone, and the timing of liquidations often coincides with ETF and institutional flow patterns — a volatile mix.

Spot-BTC ETFs: the new plumbing — and its vulnerabilities

Spot-BTC ETFs were supposed to be the steady, institutional-friendly way to gain BTC exposure. They have helped bring huge amounts of capital into the market, but the plumbing matters: creations and redemptions, authorized participant (AP) behavior, and net flows determine where liquidity is sourced or sunk during stress.

Recent data shows a notable shift. CryptoNews analyzed ETF dynamics and found the average spot-BTC ETF investor is now underwater after heavy outflows. That matters for two reasons:

Behavioral: Retail and smaller institutional holders who bought at higher prices and now sit underwater have higher odds of redeeming or selling into weakness, especially if their allocation mandates or fund liquidity windows force them to close positions. Redemptions can create net sell pressure as APs deliver BTC to meet redemptions.

Mechanical: ETF spot redemptions require either delivery of BTC or cash settlement depending on fund structure and AP choices. Large outflows can therefore pull BTC into exchanges or AP custody, temporarily draining liquidity.

ETF flow dynamics are not binary. A modest, managed redemptions sequence can be absorbed. But when outflows accelerate and coincide with perpetual/futures liquidations, you have cross-market synergies that deepen price moves.

Exchange safety funds and treasury buys: stabilizers, not guarantees

A distinct but underappreciated layer of the response has been large corporate treasuries and exchange risk funds stepping in.

Binance reportedly moved 1,315 BTC into its SAFU fund as part of a broader plan to allocate up to $1 billion into BTC, an act that signals both balance-sheet scaling and an explicit risk buffer. The move is detailed in reporting by CoinDesk and is partly about demonstrating solvency and market support.

Justin Sun (TRON) publicly planned a $50M–$100M purchase for Tron’s treasury after the slide, another example of corporate treasuries stepping in with tactical buys to smooth balance-sheet valuations (reported by CoinDesk).

Longstanding institutional accumulators — MicroStrategy/Strategy and Michael Saylor — have historically used dips to add to holdings and publicly signaled interest in continued accumulation, which Coinspeaker covered when discussing how treasuries behaved during the crash.

Why these matter: such buyers are price-aware and typically buy with horizon and balance-sheet tolerance. Their purchases can absorb supply and create visible bids that restore confidence. Binance moving BTC to SAFU does two things: strengthens its custody safety posture and creates a publicly visible buyer narrative. Similarly, large treasury buys signal long-term commitment, which influences marginal risk-taking by other institutions.

But a critical caveat: these are stabilizers, not ironclad backstops. Balance-sheet buyers have limits and governance constraints. Exchange SAFU funds are principally insurance pools; they aren’t infinite liquidity taps. Treasuries buy strategically — they may buy to opportunistically average down, but they also must respect corporate governance and diversification rules.

Flow dynamics: why the next leg depends on net supply

Think of the market as a three-way flow equation: forced sellers (liquidations, derivatives), systematic sellers (ETF redemptions, margin deleveraging), and strategic accumulators (treasury buys, long-term institutional accumulation). The next major move depends on which side dominates over the coming weeks.

If forced and systematic selling persist, price action can cascade lower: ETFs deliver BTC to meet redemptions, exchanges see inflows of spot from APs, and liquidity evaporates, producing wider spreads and deeper slippage.

If strategic accumulators and opportunistic buyers (treasuries, whales, exchanges) step in with meaningful bids, they can dampen the volatility and create a base to rebuild inflows.

Key data points to watch: ETF net flows/creation-redemption stats, exchange net inflows/outflows, and derivatives open interest. Short-term market microstructure (order-book depth at key levels) will tell you whether treasuries' bids are being matched or merely clipped by momentum sellers.

Tactical checklist: how to assess risk and opportunity

Below is a practical framework for intermediate/advanced investors and crypto treasury managers to decide whether to accumulate, hedge, or wait.

1) Quantify liquidity and stress capacity

- Measure how much of your exposure is liquid vs. illiquid. For treasuries, compute dry powder and legal constraints for crypto purchases. For allocators, ensure sufficient NAV liquidity to withstand redemptions.

- Track exchange inflows (spot) and derivatives OI: a spike in derivatives OI with falling price suggests more forced sellers.

2) Monitor ETF creation/redemption metrics in near real-time

- If ETF outflows accelerate and APs are redeeming for spot BTC, expect increased spot sell pressure. Use daily ETF net flow dashboards and AP filings to detect regime shifts early.

3) Use hedges to protect downside; consider structured entry

- For institutions with mandates, collars (buy puts funded by writing calls) can limit downside while permitting upside capture. Options are preferable to crude stop-limits which can be whipsawed during flash liquidations.

- Retail DCA remains valid only if exposure is size-appropriate and within a broader risk budget.

4) Size buys to reflect liquidity absorption capacity

- Large treasury buys should be executed via TWAP/VWAP or OTC counterparties to avoid creating immediate slippage. Binance’s public moves illustrate signaling value, but private, staggered execution preserves price.

5) Keep scenarios and triggers explicit

- Define clear entry triggers (e.g., ETF flow reversal, stabilization of derivatives OI, sustained decline in exchange inflows). Equally define exit/hedge triggers (e.g., consecutive daily outflows above a threshold, or a spike in forced liquidations).

6) Governance and communication

- Treasuries must coordinate with boards and auditors. Public buys (like those of Tron or MicroStrategy) move markets — ensure messaging is consistent with compliance and investor expectations.

What success looks like: market stabilization vs. mean reversion

If strategic buyers continue adding size and ETF flows re-stabilize (net flows moving back to small inflows or neutral), this sell-off will likely mark a medium-term buying window. Conversely, if ETF outflows accelerate and derivatives deleveraging continues, we could see further downside and a prolonged period of range-bound volatility.

A practical midpoint: watch for sustained reductions in liquidation spikes and ETF outflows coupled with exchange reserves dropping — that combination historically indicates a durable bid.

Final thoughts for allocators

The Warsh appointment was a macro shock that exposed cross-market fragilities: leverage in derivatives, the plumbing of ETFs, and concentrated treasury exposure. Liquidations did the short-term damage; ETF flows determine whether that damage compounds; treasury buys and exchange safety reserves can cushion the fall.

This episode underscores a few perennial realities: manage leverage explicitly, monitor flow plumbing (ETF creations/redemptions), and execute large buy decisions with execution discipline. Bitlet.app users and treasury managers should consider integrating ETF flow monitoring and exchange reserve signals into their risk dashboards — these are now core inputs for tactical allocation decisions.

Sources

- Bitcoin slides below $80K after Warsh named Fed chair; $2.5B liquidated (CryptoNews)

- Average spot-BTC ETF investor turns underwater after heavy outflows (CryptoNews)

- Binance moves 1,315 Bitcoin into SAFU fund as it prepares to buy USD1 billion BTC (CoinDesk)

- Justin Sun plans up to USD100 million Bitcoin buy for Tron’s treasury after BTC slide (CoinDesk)

- Bitcoin crash hits strategy and spot ETFs — Saylor signals more buys (Coinspeaker)