Futures

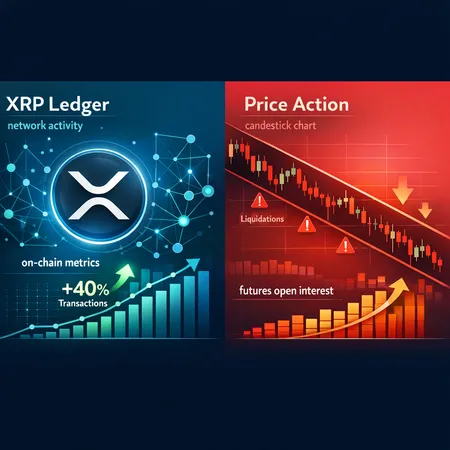

XRP Ledger activity has surged while price grinds lower inside a descending channel. This piece reconciles the 40% spike in daily transactions and rising futures open interest with liquidation-driven volatility, and gives a scenario playbook for traders and holders.

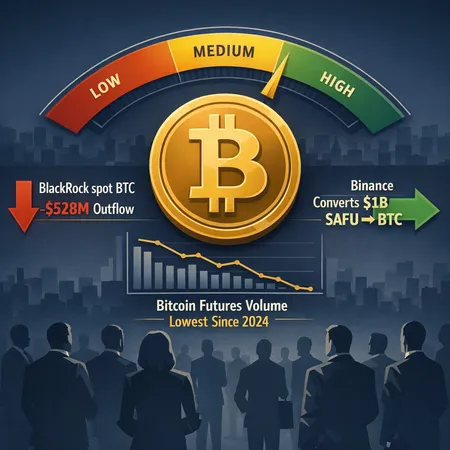

A tactical framework for traders and risk managers to detect mounting liquidation cascade risk in BTC markets — combining on‑chain signals, derivatives metrics and ETF flow context. Practical checklist included.

Recent data — a $528M outflow from BlackRock's spot BTC ETF, collapsing futures volumes and corporate BTC purchases — paint a mixed picture for institutional demand. This feature unpacks which metrics act as early-warning signals and outlines scenarios for BTC price dynamics under different institutional-return assumptions.

A data-driven look at how spot BTC ETF flows, corporate treasuries and exchange deposits pushed Bitcoin through $94.5–96k and what that means for a move toward $100k. Includes flow numbers, short-liquidation dynamics, futures positioning and macro risks for portfolio managers.

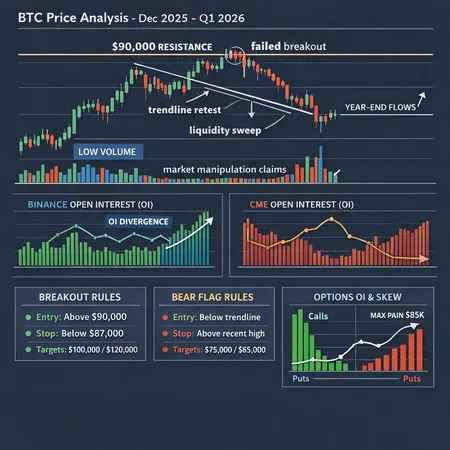

A technical-market-structure deep dive into Bitcoin's late‑December 2025 failed $90k breakout, unpacking resistance, trendline retests, futures/options open interest dynamics, manipulation claims, and actionable trade frameworks for Q1 2026.

ZEC’s recent 15% pop and a near‑record rise in futures open interest have reignited debate about structural demand for privacy coins. This note dissects drivers, technical odds of a 45% follow‑through, regulatory headwinds, and practical trading/holding rules for tactical allocations.

Ethereum Futures ETFs are reshaping the crypto investment landscape by offering new avenues for exposure and influencing market behavior. Discover how these instruments affect market dynamics and strategies, and how platforms like Bitlet.app can enhance your crypto journey.

Discover how disaggregated cryptocurrency trading reports can enhance your futures and options trading strategies. Learn how Bitlet.app's tools enable smarter decisions and optimized trades.

Understanding disaggregated cryptocurrency trading reports can boost your futures and options trading strategies. This guide explains key insights and how services like Bitlet.app can enhance your crypto trading experience.

Ethereum's futures market has reached a record open interest, signaling increased investor confidence and market momentum. This surge reflects growing demand and optimism around Ethereum's future, impacting the broader crypto market dynamics.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility