Open Interest

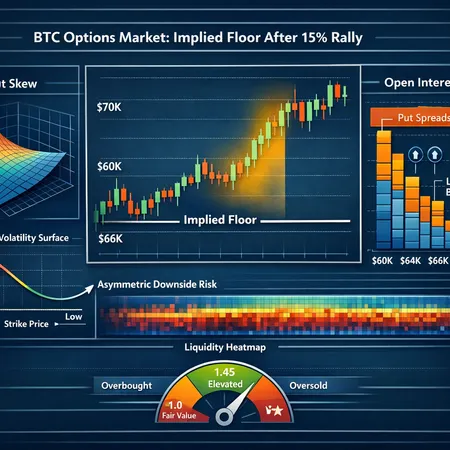

After BTC’s sudden 15% jump to ~70k, options markets are carving out an implied ‘floor’ via put skew, concentrated open interest and dealer hedging flows. This piece explains how to read that signal, combine it with Mayer Multiple and liquidity heatmaps, and translate it into actionable hedges for desks and advanced retail traders.

HYPE's sudden outperformance ties to HIP‑3-driven product changes, a surge in open interest and concentrated whale flows that reshaped DEX derivatives liquidity. This piece breaks down the on‑chain metrics, market structure, and practical sizing strategies for traders and LPs.

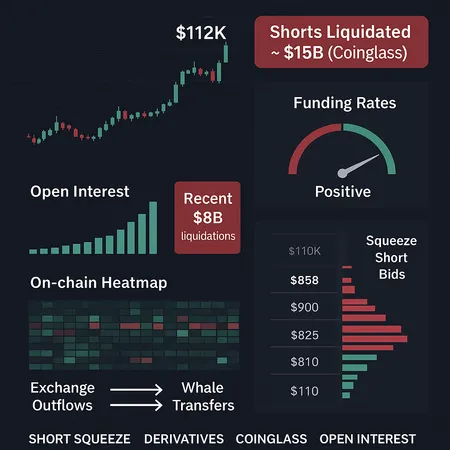

A tactical deep‑dive into how derivatives positioning can create a sudden BTC short squeeze and where liquidation risks are concentrated. Practical signals and scenario-based risk management for active traders and derivatives desks.

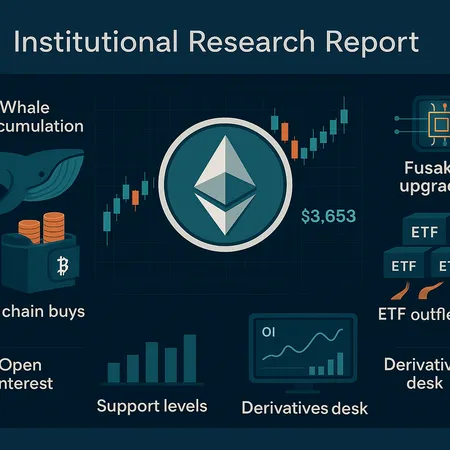

November’s price action in ETH exposed a liquidity paradox: institutional whales piled in while ETF products showed heavy outflows. This piece reconciles on-chain accumulation with ETF-driven selling, technical thresholds (notably $3,653), Fusaka’s role in positioning, and concrete trade scenarios for funds and derivatives desks.

Ethereum's futures market is witnessing a surge in open interest, signaling increased investor confidence and potential market volatility. Discover what this means for your crypto investments and how platforms like Bitlet.app can help you navigate these trends.

Ethereum's futures market has reached a record open interest, signaling increased investor confidence and market momentum. This surge reflects growing demand and optimism around Ethereum's future, impacting the broader crypto market dynamics.