After the $2.5B Liquidation Wave: A Data‑Driven Guide to Leverage, Margin Calls and Systemic Risk

Summary

Executive summary

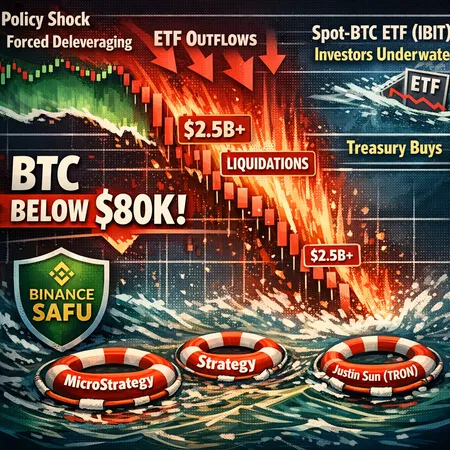

The last liquidation episode — an estimated $2.5B+ in wiped‑out positions across margin and derivatives markets — was not merely a headline. It exposed how concentrated leverage, brittle liquidation mechanics and cross‑asset correlation can turn routine price moves into systemic events. A single reported trade saw roughly $220M of Ether positions forcibly closed on a leveraged venue, and simultaneous drops across BTC, ETH and XRP amplified losses and triggered cascades. This post‑mortem combines data points from the field, a brief technical diagnosis of failure modes, and a practical mitigation playbook for traders and platform risk teams.

What happened: the numbers and immediate triggers

Between the large flash move and the ensuing cascade, public trackers and market reporters logged billions in liquidations. Crypto derivatives monitors reported more than $2.5 billion in liquidated positions in the immediate event window, a figure corroborated by market commentary and exchange printouts. For a sense of scale, some market roundups placed the weekend headline losses across major tokens at roughly $200 billion in market cap shift as prices gapped and stopped out long and short positions alike. The most dramatic single‑counterparty figure came from a Coindesk account showing a ~ $220 million ETH liquidation tied to concentrated leveraged exposure on a venue tied to Hyperliquid; that one trade alone materially worsened order‑book pressure and slippage for Ether.

Price moves were not isolated to Ether. Bitcoin (BTC) and XRP experienced synchronized selloffs that triggered additional margin calls and automated deleveraging across platforms. XRP price action even flashed a high‑volume hammer on the short timeframes as liquidations surged, a classic intraday overshoot and partial bounce pattern that underscores the market's violent short‑term dynamics.

Sources: a report documented the single $220M Ether loss and its linkage to leverage on a particular venue, while liquidation aggregators and market coverage tallied the broader $2.5B+ and weekend market cap declines (see Sources section for links).

How leverage and derivatives amplify price moves

Leverage concentrates risk: a 10x long position amplifies a 5% move to a 50% swing in the trader's equity. When many participants use similar multipliers, small directional moves cascade through margin calls and forced liquidations. Derivatives venues compound this in three ways: (1) they provide high effective exposure with small capital, (2) automated liquidation engines execute large market orders when maintenance margins breach, and (3) cross‑margin and portfolio margining designs can transmit stress between legs or tokens.

Take the typical liquidation mechanics: when a position hits maintenance margin, the platform either closes the position immediately or auctions it off to third‑party liquidators. In thin markets—or after a single large forced sale—the resulting market impact moves the index price lower, which in turn trips additional margin thresholds elsewhere. That positive feedback loop is precisely what multiplied initial losses into the $2.5B+ wave.

Hyperliquid and similar venues are often cited because they support large notional exposure and route liquidations through off‑chain counterparts or concentrated liquidity pools. The Coindesk account of the $220M ETH event shows how a concentrated levered position can be the proximate cause of an order book collapse that produces outsized slippage and knock‑on liquidations on other exchanges and venues.

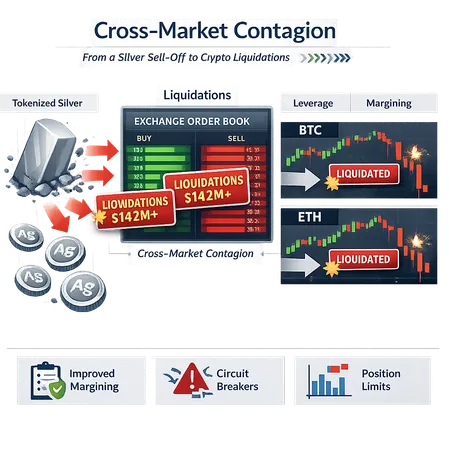

Correlation and contagion across BTC, ETH and XRP

In crypto, correlation is not constant; it spikes during stress. Historically uncorrelated assets begin to move together as portfolio repricing, margin calls, and risk‑parity adjustments accelerate cross‑market sell pressure. During this crisis window, BTC, ETH and XRP moved in high synchronicity: Bitcoin's stop runs pulled liquidity out of spot and derivative markets, Ether's forced deleveraging delivered outsized order‑book impact, and XRP—despite showing a short‑term bullish candle pattern later—participated in the liquidity vacuum that drove the cascade.

Why does contagion happen so quickly? Three mechanics matter:

- Shared leverage pools: automated market makers and funding‑rate arbitrageurs often hold cross‑asset positions that are unwound in tandem.

- Index pricing: many derivatives use composite indices. A move in one constituent (large ETH trade) shifts indices and margin requirements for others.

- Liquidity commonality: market makers retreat from multiple order books simultaneously when volatility spikes, widening spreads across assets and amplifying realized slippage.

The XRP intraday hammer that followed the outsized liquidations demonstrates a typical dynamic: forced selling creates an overshoot, then short covering or opportunistic buyers create a rapid bounce — but the systemic damage (lost collateral, exhausted margin) is already done.

Exchange and clearing vulnerabilities revealed

This liquidation wave highlighted several architectural weak points across exchanges and clearing setups:

Reliance on instantaneous market‑order liquidations. Filling aggressive market orders when books thin leads to cascading price impact. Better alternatives include TWAP (time‑weighted average price) or partial, staged liquidations.

Insufficient insurance fund sizing or slow replenishment rules. When funds are undercapitalized, the platform's residual risks hit users or the venue itself.

Index and oracle fragility. Platforms using stale or narrow price feeds can misprice margin thresholds, causing premature or delayed liquidations.

Cross‑platform dependencies and counterparty concentration. A single large counterparty failure (or liquidity provider) can propagate losses across venues that rely on the same entities for balancing exposure.

Margin model assumptions tuned to benign markets. Many models assume normal liquidity and linear price impact; they break when volatility jumps and nonlinear price response dominates.

These failure modes mean systemic risk is not just a macro concept; it's embedded in product engineering. Platforms like Bitlet.app and other venues emphasize risk controls for a reason — the architecture determines whether a shock is absorbed or amplified.

Practical steps for traders: reduce tail risk now

For active traders and desk risk managers, the simplest and highest‑ROI changes come from position management and operational discipline. Key tactics:

Tighten position sizing and set expected notional exposure consistent with worst‑case slippage. Size positions based on liquidity depth, not just account equity.

Use lower leverage limits for volatile pairs. If liquidity can evaporate in minutes, 3x or 5x is far safer than 10x+.

Stagger exits instead of all‑or‑nothing market orders. TWAP or iceberg style exits reduce immediate market impact.

Maintain diversified collateral and avoid concentration in a single venue or token. Cross‑margining benefits are real but be aware of cross‑asset contagion risk.

Implement and rehearse stress scenarios. Run historical shock replays and hypothetical large‑trade stress tests to see margin call timelines and liquidation sequencing.

Automate risk triggers but keep human oversight windows. Auto‑deleverage reduces reaction time but can also create reflexive selling; a small discretionary buffer can help avoid unnecessary forced liquidations.

Monitor funding rates and open interest flow. Sudden spikes can presage forced deleveraging events.

These are practical, immediate controls traders can adopt without infrastructure changes.

Platform and risk‑officer playbook: engineering resilience

Risk officers and platform architects must think beyond single‑trade hygiene. Practical, actionable steps include:

Redesign liquidation engines: adopt staged liquidation (TWAP buckets), allow auctions for large tickets, and implement partial fills to reduce index slippage.

Expand and dynamicize insurance funds. Use stress‑based sizing rules that scale with open interest, realized volatility and correlation metrics.

Improve oracle governance: diversify price feeds, shorten feed latencies, use robust median/twap logic and failover paths.

Perform cross‑venue stress tests and publish summaries. Transparency about stress capacity builds market confidence and reveals hidden centralization risks.

Implement circuit breakers and temporary margin increases instead of immediate forced sales. A short delay with raised margin requirements can allow liquidity providers to reenter the market and reduce systemic impact.

Limit single‑counterparty concentration and diversify liquidity providers. When a dominant counterparty is forced to liquidate, the whole ecosystem pays the price.

Consider centralized clearing features for large, institutional products. A well‑capitalized central counterparty with clear waterfall rules can reduce bilateral contagion.

Invest in real‑time risk analytics. Track cross‑asset correlation, open interest ratios, and liquidation queue depth so the platform can act pre‑emptively.

Combining these measures materially lowers the odds of a single forced sale turning into an industry‑wide cascade.

Checklist: quick mitigation playbook (for urgent adoption)

- Reduce allowable max leverage on high‑volatility pairs.

- Require larger maintenance margins when funding rates spike or open interest accelerates.

- Enforce position limits and concentration checks per counterparty.

- Adopt staged liquidation windows (TWAP / auction hybrids).

- Increase public transparency on insurance fund status and stress testing outcomes.

Each item is implementable within weeks for many platforms and can prevent the types of dominoes we observed.

Closing thoughts: policy, design and culture matters

The $2.5B+ liquidation episode and the single $220M ETH liquidation are wake‑up calls. They reveal that mechanical leverage and liquidity structures — not just speculative bets — create systemic exposures. For traders, the answer is disciplined sizing, smarter exit mechanics and stress rehearsal. For platforms and risk officers, the solution is robust engineering: dynamic margin frameworks, staged liquidations, larger insurance funds and diversified oracles and liquidity relationships.

Crypto remains a market of high optionality and asymmetric returns. But the infrastructure that enables those returns must acknowledge real physical constraints in liquidity and counterparty risk. When it does, the market can grow in a healthier, more sustainable way.

For further reading on market reactions and on‑the‑ground reporting about the wave, see the Sources below. Bitlet.app and other exchanges are increasingly publishing risk metrics and post‑stress analyses — a trend worth watching.

Sources

- Single trader just lost USD220 million as Ether plunged 10% — Coindesk

- Ethereum price prediction: $2.5B liquidated as ETH slides to $2,400; is $2,100 next? — CryptoNews

- 200 billion gone from crypto markets as BTC, ETH, XRP tanked on Saturday — CryptoPotato

- XRP price flags a bullish hammer candle as liquidations jump — crypto.news

(Internal tags referenced in the text where useful: Bitcoin, Ethereum, DeFi).