Hyperliquid

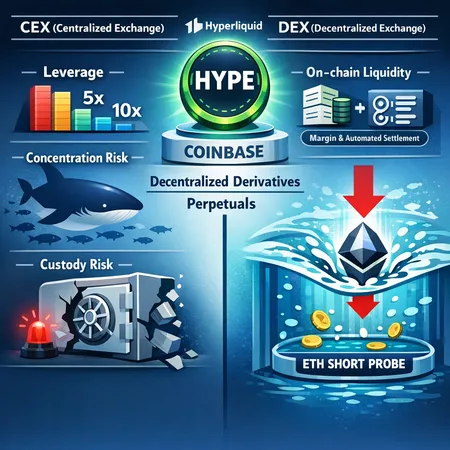

Hyperliquid recently overtook Coinbase in notional perpetual trading volume, marking a watershed moment for decentralized derivatives. This article explains the mechanics that enabled that shift, examines systemic risks through an ETH short probe, and outlines what traders and protocol designers should weigh when moving perp flow on‑chain.

HYPE's sudden outperformance ties to HIP‑3-driven product changes, a surge in open interest and concentrated whale flows that reshaped DEX derivatives liquidity. This piece breaks down the on‑chain metrics, market structure, and practical sizing strategies for traders and LPs.

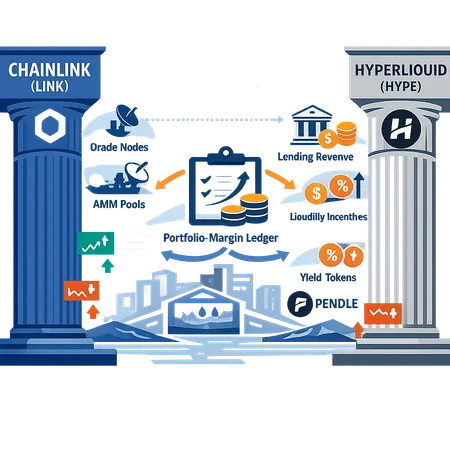

A comparative analysis of LINK and HYPE that focuses on product momentum, new revenue models like portfolio margin, and how yield-token subsidy designs such as PENDLE’s are reshaping liquidity economics. Practical metrics for product managers and traders to monitor protocol sustainability and competitive moat.

Hyperliquid’s rollout of on‑chain portfolio margin promises meaningful capital efficiency gains for unified spot and perpetual trading, but it also raises new contagion and smart‑contract risks. This article breaks down how portfolio margin differs from isolated margin, the technical implications of on‑chain implementation, expected efficiency gains, and practical defenses for traders and DeFi designers.

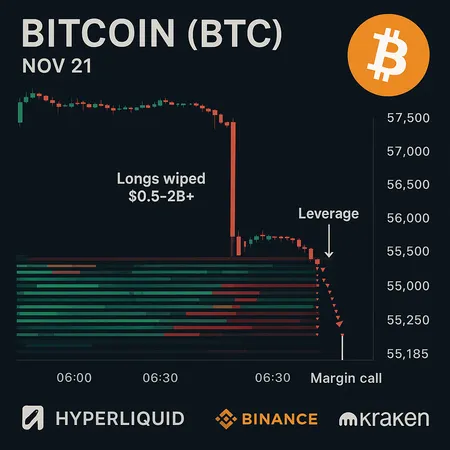

A minute-level forensic of the Nov. 21 Bitcoin flash crash that plunged BTC into the low $80ks on Hyperliquid and cascaded liquidations across venues. Actionable risk-management steps for traders and exchanges to prevent repeat disasters.

This report analyzes the rise of wallet-native perpetual DEXs using Safepal’s integration with Hyperliquid as a case study, covering UX, liquidity, custody tradeoffs, token dynamics, on‑chain expectations, and regulatory risks. It’s written for product managers, DeFi builders, and sophisticated retail traders evaluating on‑wallet trading.