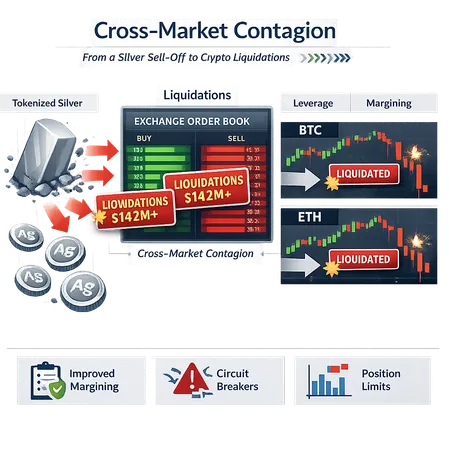

When Tokenized Silver Broke the Market: A Post-Mortem on Cross‑Market Contagion and How to Stop the Next One

Summary

Executive summary

In late January 2026 a sharp sell‑off in tokenized silver — driving an approximate 30–35% intraday drop in metal reference prices — produced a wave of margin shortfalls and forced liquidations that exceeded $142 million across crypto venues. Reporting from CoinPedia and CoinDesk highlights that tokenized silver futures unexpectedly became the single largest source of liquidations that day, eclipsing typical BTC and ETH events (CoinPedia report and Coindesk analysis). CoinTelegraph and CryptoPotato tie the shock to broader metals sentiment and ETF flows that exacerbated stress across markets.

This piece is a technical post‑mortem and mitigation playbook for risk managers and derivatives traders. It outlines how tokenized commodity products can amplify systemic risk on crypto venues, the mechanics by which leverage spilled into BTC and ETH, and practical safeguards exchanges and traders should adopt going forward. Bitlet.app risk teams and derivatives desks will find concrete controls and trader‑level tactics in the sections below.

Timeline and empirical facts (what happened)

A sudden and deep decline in the spot/reference price for silver — reported as roughly a 30–35% intraday fall — triggered a cascade of margin calls on tokenized silver futures positions across multiple venues. CryptoPotato documents the double‑digit metal dumps that erased billions in correlated markets in the same window (https://cryptopotato.com/bitcoin-too-volatile-heres-how-gold-and-silver-dumped-by-double-digits-in-1-day/).

As leveraged longs in tokenized silver were liquidated, exchanges and lending pools attempted to close positions into thinning order books. Funding spikes and market impact pushed related risk assets lower; BTC and ETH saw outsized volatility as capital and stop orders flowed into more liquid crypto markets.

Aggregated forced selling resulted in reported crypto liquidations north of $142M, with tokenized silver responsible for an outsized share of initial margin shortfalls that metastasized into broader spillover (CoinPedia, Coindesk).

Market participants and ETF flows simultaneously reduced metals allocations, per CoinTelegraph, creating a feedback loop between traditional and crypto trading desks (https://cointelegraph.com/news/crypto-etf-bitcoin-ether-outflows-metals-sentiment-down?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound).

Why tokenized commodity products can amplify systemic risk

Tokenized commodities (tokenized silver in this instance) are attractive because they provide synthetic exposure, 24/7 trading, and high capital efficiency. But those same traits increase systemic fragility when design, margining, and liquidity assumptions are weak.

Key amplification channels:

Concentrated collateral and leverage. Tokenized commodity desks often pledge a narrow set of collateral (stablecoins, ETH, BTC) that become correlated during stress. When the tokenized good re‑prices violently, margin shortfalls force liquidation of collateral that depresses other markets.

Thin liquidity and market impact. Tokenized commodity markets can be shallower than the spot metal futures they track. Large liquidations of tokenized positions execute into limited order book depth, causing outsized price slippage whose effects propagate into correlated assets.

Oracle and settlement mismatches. Tokenized products depend on price oracles and oftentimes reference off‑chain futures or ETFs. Latency, stale feeds, or differences between on‑chain settlement and off‑chain closing prices can create sudden basis moves and mispriced margin requirements.

Cross‑margining and netting blind spots. Cross‑margining reduces capital costs in calm markets but couples risk across products. A levered loss in tokenized silver can produce margin deficits that the platform remediates by liquidating BTC and ETH collateral, transmitting stress to large, otherwise unconnected markets.

Behavioral and hedging spillovers. Market makers and systematic funds use similar execution strategies across venues. Margin calls in one market can trigger correlated, programmatic behavior (tightening spreads, pulling liquidity) in others.

These factors combined to turn a commodity price shock into a crypto systemic event.

Mechanics of leverage spillover to BTC and ETH

The transmission from tokenized silver to BTC/ETH unfolded through several interacting mechanisms. Below is a layered, technical explanation.

1) Initial margin shortfalls and forced liquidations

Most leveraged positions require an initial margin buffer and a maintenance margin. When tokenized silver lost 30–35%, leveraged longs quickly breached maintenance thresholds. Exchanges' liquidation engines executed market orders to close these positions.

If the exchange uses cross‑margining, the platform will seize collateral posted in other assets (often BTC, ETH, or stablecoins). Liquidation of BTC/ETH collateral into already stressed books pushed their prices down, widening mark‑to‑market losses for traders with cross‑exposures.

2) Market impact and funding shocks

Large liquidation flows into BTC and ETH order books caused price slippage; this impact widened bid/ask spreads and shifted funding rates. Traders holding perpetuals saw funding jumps and mark‑to‑market gaps, increasing the number of accounts hitting maintenance margins — a classic cascade.

3) Liquidity evaporation and dealer pullback

As market makers adjusted risk limits and reduced provision, depth contracted. A shallower BTC/ETH market absorbs liquidation volume worse, raising realized volatility and making liquidation engines less effective (they execute into thin books and produce worse fills, meaning larger residual shortfalls).

4) Fire sale of correlated collateral and feedback loops

Some platforms execute deleveraging by selling collateral from defaulted accounts. If that collateral is BTC/ETH, the selling pressure reinforces price declines, creating a feedback loop where new price drops cause fresh liquidations across many accounts.

5) Oracle and cross‑listing contagion

If tokenized silver uses price oracles that reference derivatives or ETF prices, a sudden divergence between oracle price and large exchange trades can temporarily misstate risk. Arbitrage and programmatic trading then try to exploit discrepancies, sometimes worsening volatility until settlement and oracle windows realign.

Where risk models and processes failed in this event

From the public reports and observable market dynamics, several weak points emerge:

Underestimated stressed volatility for tokenized silver. Margin models calibrated to normal volatility levels failed to anticipate double‑digit intraday moves.

Excessive reliance on cross‑margining without conservative inter‑product correlation buffers. Cross‑margin benefits became channels for contagion.

Inadequate insurance fund sizing and recovery rules. Insurance funds were insufficiently sized to absorb clustered losses without ad‑hoc interventions.

Liquidation engine design and throttling gaps. Engines that fully execute into thin order books produced high slippage. Absence of partial auctions or staggered deleveraging amplified market impact.

Weak pre‑trade and concentration limits. Large concentrated positions in tokenized silver were allowed without upper bounds or staged risk reduction requirements.

Insufficient oracle governance and settlement lags. Oracle refresh rates and reliance on off‑chain references allowed temporary basis shocks to trigger automatic liquidations.

Practical safeguards for exchanges (architecture and policy)

Below are actionable controls exchanges and custodial venues should adopt to reduce cross‑market contagion risk.

Strengthen margining frameworks

Implement dynamic initial and maintenance margins tied to realized and implied volatility. For tokenized commodities, use wider windows and stress multipliers that kick in during regime shifts.

Apply inter‑product correlation haircuts on cross‑margining. Cross‑margin should be discounted by a conservatively estimated correlation matrix; worst‑of or stress‑correlated segregation can prevent a single product from eating collateral across a trader's entire book.

Use staged margin increases rather than single large jumps to give participants time to respond and to avoid synchronized liquidations.

Rework liquidation and closeout mechanics

Introduce throttled liquidation algorithms: staggered auctions, time‑weighted deleveraging, or partial unwinds to reduce instantaneous market impact.

Employ temporary auction windows for large, illiquid products (similar to traditional exchange volatility auctions) to concentrate price discovery and reduce slippage.

Maintain an automatic priority queue for internalization to matching engines or designated liquidity providers before executing into the wider market.

Size and manage insurance funds with scenario analysis

Use stress scenarios that combine commodity shock with crypto volatility (e.g., a 35% commodity move plus a 10% BTC move) to size insurance funds.

Require dedicated reserves for tokenized commodity products so that losses are ring‑fenced and do not immediately deplete platform‑wide protections.

Position limits, pre‑trade risk checks, and monitoring

Set per‑product and per‑counterparty position limits calibrated to available liquidity and historical high‑water marks.

Enforce maximum leverage tiers based on asset class (e.g., much lower leverage for tokenized commodities than for BTC spot futures).

Real‑time risk dashboards with automated alerts for concentration, correlated exposures, and unusual funding rate moves.

Improve oracle governance and settlement design

Use multiple, well‑weighted price sources and shorten oracle refresh intervals during stress.

Add sane tolerance bands so that transient basis moves do not immediately trigger on‑chain liquidations; pair that with manual or automated intervention when divergence thresholds are passed.

Cross‑market coordination and external reporting

Coordinate with counterparties and other venues to manage extreme events (e.g., voluntary temporary trading halts for specific products).

Publish de‑identified stress metrics so market participants can price counterparty and platform risk properly.

Practical safeguards for traders and risk desks

Traders and institutional desks can also reduce their exposure to contagion with straightforward risk management practices.

Positioning and leverage

Reduce leverage on tokenized commodity products — use much lower leverage than for deep crypto perpetuals. Consider absolute leverage caps (for example, no more than 3–5x on illiquid tokenized commodities).

Avoid concentrated cross‑margin across a broad basket of exposures. If you must cross‑margin, keep a designated collateral buffer above maintenance requirements.

Hedging and liquidity buffers

Maintain liquid hedges (e.g., options or futures on BTC/ETH or correlated instruments) to absorb margin volatility without forced selling.

Keep a cash/stablecoin buffer to meet margin calls intraday rather than relying on selling volatile collateral under stress.

Execution discipline

Use limit orders and staged exits in stressed markets to reduce slippage rather than aggressive market orders that worsen fills.

Pre‑set stop‑loss levels and maintain quick access to manage margin calls; do not rely on exchange auto‑liquidation as a preferred exit path.

Counterparty and venue selection

Prefer venues with transparent margining rules, robust insurance funds, and conservative liquidation mechanics.

Monitor funding rates, order book depth, and the exchange's governance around tokenized products. If an exchange cross‑margins aggressively without correlation haircuts, adjust exposure accordingly.

Example hypothetical: how a 35% silver move can propagate

Consider a simplified path: a trader holds a 10x leveraged long on tokenized silver with BTC collateral. Silver drops 35% intraday; the trader’s equity is wiped and the exchange liquidates the silver position and sells BTC collateral to cover the shortfall. Selling pressure pushes BTC down 6–8% in a short window, which causes other traders with BTC‑denominated cross‑margin to breach maintenance margins and be liquidated — amplifying the initial shock. The result: a single commodity move cascades into multi‑asset forced selling. This simplified chain mirrors the mechanisms observed in the late January event reported by CoinDesk and CoinPedia.

Governance, disclosure, and regulatory considerations

The event highlights public‑policy questions: should tokenized commodity products face exchange listing standards similar to regulated commodity futures? Should exchanges be required to maintain minimum insurance fund ratios or to publish stress test results? CoinTelegraph’s coverage tying ETF flows and metals sentiment to crypto outflows underscores the interconnectedness of traditional and crypto venues and strengthens the argument for coordinated reporting requirements.

Prudential standards for margining, position limits, and transparent oracle governance would materially reduce the chance of similar cross‑market contagion.

Quick checklist: immediate actions for operations and trading teams

For exchanges / CEX risk teams:

- Run an immediate stress test combining 30–40% commodity shock + 10% BTC/ETH move.

- Increase initial/maintenance margins for tokenized commodities until volatility stabilizes.

- Temporarily cap leverage and enforce per‑product position limits.

- Review and, if needed, replenish insurance funds.

For trading desks:

- Reduce exposure to tokenized commodities and post additional collateral in stable assets.

- Pre‑position hedges or reduce net directional bets in BTC/ETH until markets settle.

- Review execution algorithms to avoid cascading market orders during closeouts.

Conclusion

The tokenized silver incident is an important wake‑up call: tokenized commodities can be useful tools, but if listed and margined without conservative, cross‑product stress controls they become vectors for systemic crypto contagion. Exchanges must adopt more robust margining, liquidation, and insurance mechanics, and traders should de‑risk exposures, use hedges, and maintain liquidity buffers. Many of the fixes are straightforward — better stress testing, staggered liquidations, position limits, and stronger oracle governance — but they require discipline and coordination across venues.

For risk managers and derivatives traders, the path forward is twofold: harden the plumbing (margining engines, liquidation logic, oracles) and change behavior (lower leverage, better hedges, clearer concentration limits). If implemented, these measures will markedly reduce the chance that a single commodity shock becomes a cross‑market crypto crisis.

For ongoing monitoring and platform selection, consider venues like Bitlet.app that prioritize transparent margining and risk controls as part of their product design.

Sources

- CoinPedia — Silver crash triggers $142M in crypto liquidations, overtaking Bitcoin and Ether: https://coinpedia.org/news/silver-crash-triggers-142m-in-crypto-liquidations-overtaking-bitcoin-and-ether/

- Coindesk — Silver’s 35% plunge ends up beating Bitcoin in a rare crypto liquidation shock: https://www.coindesk.com/markets/2026/01/31/silver-s-35-plunge-ends-up-beating-bitcoin-in-a-rare-crypto-liquidation-shock

- CryptoPotato — Bitcoin too volatile: how gold and silver dumped by double digits in 1 day: https://cryptopotato.com/bitcoin-too-volatile-heres-how-gold-and-silver-dumped-by-double-digits-in-1-day/

- CoinTelegraph — ETF flows, Bitcoin and Ether outflows and metals sentiment down: https://cointelegraph.com/news/crypto-etf-bitcoin-ether-outflows-metals-sentiment-down?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound

Note: For established readers, some of the mechanics mirror long‑standing prudential strategies in traditional futures markets; adapting those proven controls to tokenized, 24/7 crypto venues should be a priority for every risk team and derivatives desk.

Internal references: for traders watching price spillovers, recall how BTC behaves as a bellwether in stress and keep an eye on Bitcoin. For teams building cross‑product strategies or integrating lending, governance practices from DeFi markets are relevant to oracle and insurance‑fund design.