MicroStrategy

Strategy (formerly MicroStrategy) continued to add Bitcoin even as its corporate holdings moved underwater — a move that raises concrete balance-sheet, covenant and dilution questions for corporate treasuries. This article breaks down the disclosed buys, compares cost basis to the market, and offers a practical risk/return framework for CFOs and institutional allocators.

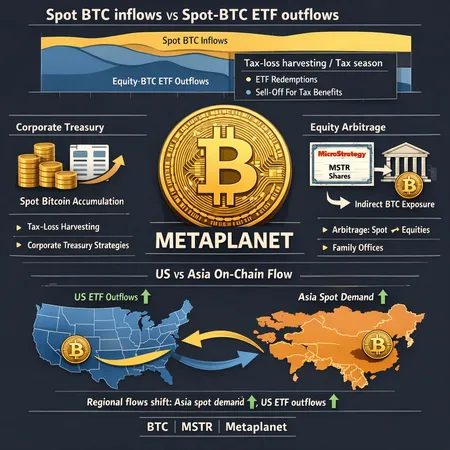

Institutional routes to BTC exposure are diverging: direct corporate accumulation plans like Metaplanet’s 210k BTC target sit alongside equity-based exposure via MicroStrategy, while tax-loss harvesting pushes seasonal ETF outflows that reshape on-chain and regional flows. This analysis unpacks mechanics, cross-asset arbitrage, and tactical takeaways for allocators and family offices.

Bitcoin's on-chain liveliness is signaling renewed activity even as technical charts and corporate treasury stress flash warning signs. This piece synthesizes the bullish on-chain case with the fallout from corporate adopters to outline realistic 2026 regimes.

A step‑by‑step investigation into recent claims that MicroStrategy sold large BTC holdings, the evidence refuting those stories, and a practical verification framework traders can use to avoid knee‑jerk moves. Learn how on‑chain checks, corporate disclosures, and market psychology interact when whale rumors surface.

MicroStrategy's recent Bitcoin purchase highlights a growing trend of corporate accumulation, driving Bitcoin's price surge. Discover how companies are strategically investing in crypto and how platforms like Bitlet.app can help you buy Bitcoin through easy installment plans.

Public companies such as MicroStrategy are playing a pivotal role in influencing institutional Bitcoin investment approaches in 2025. Their active participation demonstrates growing confidence in crypto assets, encouraging broader adoption among institutions. Platforms like Bitlet.app complement this trend by providing innovative ways to invest in Bitcoin, such as their Crypto Installment service which allows investors to buy Bitcoin now and pay monthly.

Public companies like MicroStrategy are transforming crypto investment strategies by accumulating significant Bitcoin holdings. This trend signals growing institutional confidence and influences how individual investors approach crypto portfolios. Platforms like Bitlet.app facilitate participation with flexible payment options, making crypto investment more accessible.

Public companies such as MicroStrategy are pioneering corporate Bitcoin accumulation, influencing how businesses approach crypto investments. This trend highlights new strategic ways to integrate Bitcoin into corporate finance. Platforms like Bitlet.app complement this movement by offering innovative services like Crypto Installment, allowing both individuals and corporations to buy cryptocurrencies now and pay over time.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility