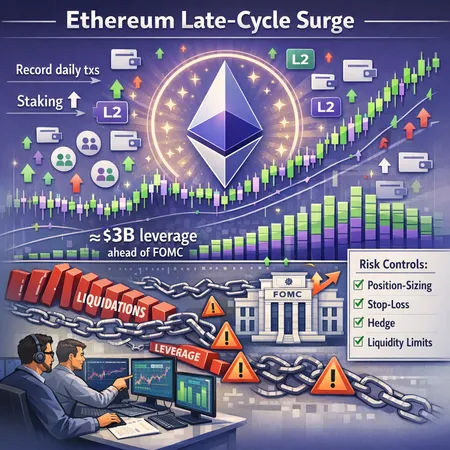

Ethereum's Late‑Cycle Surge: Activity, Staking, and $3B of Leverage Ahead of the FOMC

Summary

Executive snapshot

Ethereum’s on‑chain picture looks bullish: wallet creation and daily transactions have jumped, driven in part by Layer‑2 networks and stablecoin flows. At the same time, staking rates and ETH locked in the beacon chain are rising, supporting a supply‑side bullish case. Yet macro timing matters: analysts report roughly $3 billion of leverage in ETH markets ahead of the FOMC, which creates a plausible path to violent, short‑term drawdowns via forced liquidations and margin calls. This piece walks through the data, explains how L2 adoption changes user economics and risk transmission, and ends with a practical checklist for position sizing and hedges for traders and portfolio managers.

The surge in network activity: new wallets, L2 adoption and record daily transactions

Multiple reporting outlets have documented a clear uptick in Ethereum network activity. One analysis showed daily transactions moving toward record highs as L2 traffic and stablecoin movements increased; user retention metrics have reportedly doubled, a signal that this spike is not just bot noise but returning or sticky users driving throughput. Coinpaper also highlighted a surge in new wallets and wallet‑level activity, framing the rally as broad‑based onboarding rather than a narrow, speculative loop. For many market participants, Ethereum is again behaving like a platform: more wallets, more transactions, more use cases.

This matters for traders because higher activity usually means deeper spot liquidity on‑chain, but it also changes market microstructure. L2 adoption reduces user costs and increases transaction frequency; however, it can fragment liquidity across multiple rollups, which raises slippage and routing risk for large orders. Higher on‑chain throughput also feeds more on‑chain derivatives flows, as automated strategies and liquidity providers react to smaller spreads and faster fills.

Staking highs and the bullish supply story

Staking momentum on Ethereum has accelerated: ETH staked in the beacon chain continues to climb, and staking inflows tighten circulating supply available to spot and futures markets. Some analysts point to staking trends and supply reduction as part of a narrative that could support higher ETH price targets — the narrative that a growing locked supply and persistent demand from applications should be bullish for ETH over the medium term. Coverage that tracks staking highs ties this supply denominator to price targets in the near‑to‑medium term, with some price commentary setting lofty zones like the $4k area if demand remains intact.

From a risk perspective, rising staking does two things at once. On one hand, greater staking reduces immediate sell pressure from long‑term holders and strengthens the case for ETH as a yield‑bearing asset. On the other, staking increases liquidity rigidity: ETH that is time‑locked or subject to unstaking windows cannot be rapidly redeployed to meet margin calls, which matters if leverage squeezes markets around macro events.

Leverage has built in ahead of the FOMC — why $3B matters

Shortly before key macro events, derivative markets commonly accumulate leverage: open interest in futures, concentrated perps positions, and structured options exposure. Reporting suggests roughly $3 billion of leverage had stacked into ETH markets ahead of the FOMC. That figure is not a cliff by itself, but it increases the likelihood of cascade dynamics: if a macro surprise causes a directional move, stop hunts and funding‑rate spikes can trigger automatic liquidations that feed back into price.

A leveraged market is a brittle market. When margin calls cascade, execution worsens, funding rates surge and sellers compete for liquidity. For intermediate traders and risk managers, the question is not whether leverage exists but about concentration (are positions clustered on a handful of venues?), collateral quality (are loans concentrated in volatile assets?), and cross‑margin linkages (do margin calls on one asset force sales in others?). Those structural details determine how that $3 billion could amplify volatility.

Contagion vectors to watch

- Liquidations and forced selling: Perpetual and futures liquidations can create immediate downward pressure; clustered liquidation levels across exchanges are particularly dangerous.

- Margin calls and deleveraging loops: Cross‑margin systems can force sales in ostensibly uncorrelated positions to cover ETH exposure.

- Funding rate shocks: Rapid flips in funding can make short or long positions expensive, prompting position unwinds.

- Liquidity fragmentation from L2s: Deep liquidity on one rollup and thin liquidity on another can cause localized slippage and arbitrage cascades when orders route between layers.

- Stablecoin or bridge stress: If stablecoins see redemption stress or bridges experience delays, liquidity to settle margin calls may be impaired, worsening price moves.

Each contagion vector can interact. For example, a sudden rate surprise could push funding rates negative, forcing shorts to unwind; if that occurs while large holders are locked in staking or bridged across L2s with slow withdrawal rails, sellers and buyers may not meet, widening spreads and amplifying volatility.

How L2 adoption changes user economics and risk transmission

Layer‑2s materially lower transaction costs and latency for users, which is a net positive for retail and many DeFi strategies. Lower fees raise the frequency of on‑chain activity, improving user retention and enabling micro‑trading, recurring transfers, and higher‑frequency liquidity provision. That’s part of why the recent network activity jump has correlated strongly with L2 inflows.

But L2s also change the shape of risk. Liquidity fragments across rollups and sequencers, and bridging assets between layers introduces counterparty and smart‑contract risk. Large institutional flows routed through specific rollups may create pockets of concentrated liquidity: executing a large ETH hedge on an L2 with thin orderbooks can move price much more than the same trade executed on an integrated venue. Finally, L2 throughput can shift MEV dynamics and routing incentives, changing slippage profiles and the timing of order fills — all of which matter for execution risk and the timing of margin events.

Practical checklist: risk controls for traders and portfolio managers

Below are concrete controls and monitoring items to help size positions and plan hedges ahead of the FOMC or similar macro events. Use these as a decision framework, not a script.

- Position sizing and exposure caps

- Limit spot exposure to a share of risk capital (example: 1–3% of AUM per direction for active trades in high‑volatility windows).

- Scale down leverage as macro risk increases; consider halving typical leverage within 48 hours of the FOMC.

- Hedging and options

- Buy protective puts or structured collars to cap downside for large spot exposures; factor in implied volatility premium.

- Use short futures or inverse ETFs as temporary volatility hedges, but account for basis risk and funding decay.

- Liquidity and venue management

- Avoid concentrated execution on a single rollup when you need to move sizable size; pre‑split large trades across venues and layers.

- Ensure access to on‑chain and off‑chain liquidity in stablecoin pairs for margin posting; test withdrawal rails beforehand.

- Margin and collateral hygiene

- Maintain excess collateral buffers (e.g., 20–40% above maintenance margin) on margin accounts and cross‑margin systems.

- Prefer high‑quality collateral with stable peg mechanics; be cautious relying solely on algorithmic stablecoins during stress.

- Monitoring suite (real‑time indicators)

- Open interest and exchange flows: watch sudden spikes or concentration shifts.

- Funding rates: large, rapid swings often precede liquidations.

- Realized volatility and implied vol skew: rising realized vol with falling IV can point to short gamma positioning.

- L2 metrics: TVL per rollup, sequencing delays, and bridge queue sizes.

- Staking inflows and unstaking queues: measure liquidity rigidity in the supply base.

- Execution tactics

- Use limit orders and TWAP to avoid slippage and MEV extraction when possible.

- Stagger unwinds: set pre‑defined execution tranches tied to market moves rather than reacting to alerts alone.

- Scenario planning and stress tests

- Run a 5–10% adverse ETH move scenario and quantify margin calls across venues.

- Simulate a funding spike and estimate days‑to‑liquidate for concentrated positions.

- Communications and operational readiness

- Confirm withdrawal and settlement processes across custodians and L2s.

- Ensure trading desks and risk teams have escalations for rapid deleveraging and access to liquidity providers.

A short primer on sizing hedges: practical rules of thumb

If you are intermediate and prefer simple heuristics: cap downside risk per trade to a small fraction of equity (e.g., 0.5–2%). For directional exposures larger than that cap, buy puts sized to that loss tolerance rather than reducing spot outright — this preserves upside optionality. If using futures to hedge, size contracts to cover the expected dollar‑loss at your risk tolerance and monitor basis tightly; futures are cheap but can gap, so keep collateral buffers.

When in doubt, reduce leverage first. Volatility spikes erase time value and force slippage — you can always re‑enter on the other side but re‑entering after a liquidation is costly.

Conclusion: balanced view and tactical posture

Ethereum’s late‑cycle surge — tangible in new wallets, record transactions and robust L2 adoption — is a strong fundamental signal that demand and utility are expanding. Staking inflows add a supply‑side bullish case. Still, the presence of roughly $3 billion in leverage ahead of a major macro event like the FOMC materially raises short‑term tail risks. The path to a stable bullish outcome requires calm macro prints and orderly deleveraging; absent that, the market could see cascades amplified by funding rate shocks, fragmented L2 liquidity and constrained staking liquidity.

For traders and portfolio managers, the practical takeaway is straightforward: keep position sizes modest relative to AUM, increase collateral buffers, prefer paid hedges (options) for material exposures, and maintain operational access across chains and venues. These are pragmatic steps that protect upside optionality while managing liquidation risk. And remember: platforms like Bitlet.app make it easier to manage installment and settlement flows — but platform convenience is not a substitute for disciplined risk controls.