Why Miner Economics in Early 2026 Could Precede a Bitcoin Recovery

Summary

Executive summary

In early 2026 the Bitcoin mining patch is sending mixed but meaningful signals. A sharp difficulty increase combined with a softer hashrate has compressed miner revenue into what market participants call a stress zone near ~$30. That environment forces choices: continue selling to cover operating costs, shutter machines, or conserve balance sheets and hoard BTC in the hope of a rebound. Bitdeer’s recent liquidation of 943 BTC and reduction of treasury holdings to zero is a clear, high‑profile example of the selling response, while macro cross‑asset deleveraging (e.g., a yen carry unwind) can turn modest selling into outsized price moves.

This article dissects those dynamics, explains why miner economics can both precipitate and presage a recovery, and lays out pragmatic scenarios for traders and institutional allocators assessing supply‑side risk.

Mining landscape: difficulty up, hashrate down — why it matters

A jump in mining difficulty normally follows a period of rising hashrate, but the current pattern is unusual: difficulty has increased even as measured hashrate softened. That mismatch creates an immediate profitability headwind because miners face higher network requirements while earning less work share. Analysis of these mining stress signals highlights how a difficulty jump, paired with declining effective hashrate, reduces miner revenue and squeezes margins, especially for higher‑cost operators.

Why this combination is economically potent: difficulty determines how many hashes are needed to find a block; hashrate is how much computational power is hunting those blocks. When difficulty leaps and hashrate lags, revenue per unit of hashrate falls until the network rebalances. The short‑term result is tangible: incremental cost of mining rises while daily BTC inflows to miners decline. That dynamic is central to understanding the current Bitcoin mining stress picture and the behavioral choices miners make.

(For a focused technical read on these recent mining stress indicators, see this analysis.)(https://cryptoslate.com/bitcoin-mining-stress-signals-possible-bullish-trend-ahead/)

The ~$30 mining revenue "stress zone": what it implies

Market participants reference a roughly ~$30 revenue threshold as a practical stress marker — a level where many older rigs, or operations with high energy or capital costs, find margins thin or negative. The exact break‑even varies by region, electricity price, and equipment efficiency, but the psychological and operational effect is consistent: when per‑unit miner revenue compresses toward this band, selling pressure typically increases.

There are three behavioral archetypes triggered by that zone:

- Capitulation sellers: operators under distress liquidate BTC holdings and may power down rigs. This accelerates short‑term supply to exchanges or OTC desks.

- Tactical sellers: miners sell incrementally to cover OPEX while hoping to maintain production capacity, a pattern that creates steady but non‑panic supply.

- Hoarders / strategic survivors: low‑cost or well‑capitalized miners choose to weather shortfalls, accumulating or holding BTC rather than adding sell pressure.

Which archetype dominates determines whether the stress zone produces a temporary flush and recovery, or a deeper corrective phase driven by forced exits.

Bitdeer’s liquidation: a concrete signal of selling pressure

Bitdeer’s sale of 943 BTC and public decision to reduce corporate holdings to zero is an unambiguous real‑world example of miner selling. That move—reported by industry press—demonstrates two things simultaneously: first, that even sizable, established miners are willing to monetize reserves during stress; second, that headline sales can materially affect market psychology and available supply in the short run. You can read the report on Bitdeer's decision here.

While a single corporate sale doesn’t determine long‑term price direction, it raises the probability that other miner balance sheets under similar stress will follow suit. Large, coordinated or clustered sales tend to have outsized market impact, particularly if they happen at times of thin liquidity or coincide with negative macro flows.

Source: Bitdeer sells bitcoin treasury, cuts holdings to zero

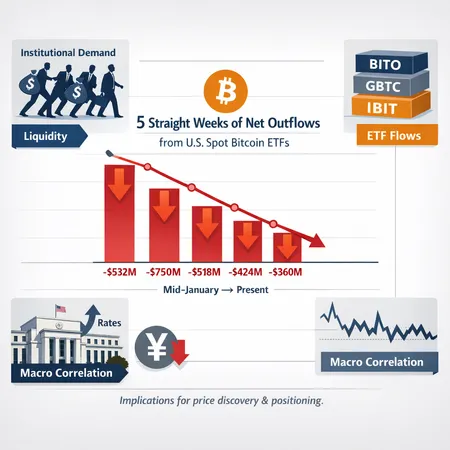

How miner selling interacts with ETF flows and on‑chain supply distribution

Two supply channels matter for price formation: miner outflows and institutional demand (including ETFs). Over the last few years, ETF inflows have absorbed a meaningful portion of newly issued or circulating BTC. However, ETF demand is not a perfect one‑to‑one sink for miner sales for several reasons:

- Timing mismatch: ETF subscription flows are periodic and sometimes lumpy; miners who need cash now may not find matching ETF demand at the same moment.

- Price sensitivity: ETFs are price‑sensitive buyers; prolonged downtrends reduce the appetite of incremental ETF investors, increasing the risk that miner sales depress prices before ETF demand steps in.

- On‑chain distribution: mining rewards accrued onto miner wallets are a mobile supply—miners can move coins to OTC desks, exchanges, or self‑custody. Large transfers to exchanges precede selling and are a reliable short‑term risk indicator.

When miner selling clusters during macro deleveraging events, price impact amplifies. For example, a rapid unwind of yen carry trades or other cross‑asset deleveraging can force margin calls and create synchronized selling pressure across liquid assets, making BTC liquidity more fragile. That macro channel has been documented as an amplifier for BTC downside during periods of stress and is worth monitoring alongside miner behavior.

For more on how macro unwind dynamics can amplify BTC moves, see this analysis on yen carry unwind and bitcoin risk.

Source: Yen carry trade unwind and its BTC implications

Scenarios: miner capitulation versus hoarding

Below are pragmatic scenario frameworks for traders and allocators. I assign qualitative probabilities based on current data but emphasize that probabilities should be updated with new hashrate, reserve and flow signals.

Scenario A — Miner capitulation (short‑term downside, medium‑term tightness):

- Trigger: sustained miner revenue below the stress zone, rising costs, and cluster liquidations (Bitdeer‑style sales) coincide with macro deleveraging.

- Mechanics: forced sales overwhelm ETF and spot demand, price drops accelerate as liquidity thins, weaker miners exit the market and power off equipment.

- Outcome: a sharper drawdown initially (potentially 20–40% from local highs depending on pre‑event liquidity), followed by structural supply tightening as miners retire inefficient rigs and on‑chain miner reserves fall. The medium‑term backdrop can then become bullish as issuance pressure contracts and long investors accumulate.

Scenario B — Miner hoarding (less sell pressure, faster rally):

- Trigger: revenue stress proves transitory (difficulty readjusts or hashrate recovers), or capital markets provide bridge financing to miners.

- Mechanics: well‑capitalized miners refrain from selling, ETF flows and spot demand outpace miner supply, tightening float and producing a supply squeeze.

- Outcome: a relatively quick price recovery and potential acceleration higher as on‑chain supply to exchanges decreases and realized supply concentration rises among holders who prefer custody to selling.

Scenario C — Mixed outcomes (choppy consolidation):

- Trigger: heterogeneous miner responses—some capitulate, others hoard—combined with uneven ETF demand and macro noise.

- Mechanics: episodic sell events create volatility without a decisive trend; miners’ exit and re‑entry cycles dominate price swings.

- Outcome: extended consolidation and range trading, with sharp intraday/liquidation moves that reward nimble traders and stress risk‑managed allocators.

Which scenario dominates will depend heavily on: (1) how many miners are truly underwater; (2) availability of credit or hedging to bridge stress; (3) the pace and size of ETF demand; and (4) macro tail‑risk events.

Practical signals and metrics for traders and institutional allocators

Monitor these on a near‑real‑time basis to gauge which scenario is unfolding:

- Hashrate and difficulty deltas: look for sustained divergence (difficulty up while hashrate down) or quick reversion.

- Miner reserve flows: net balance changes on miner clusters and large transfers to exchanges are high‑fidelity selling signals.

- Exchange inflows and outflows: sudden spikes in inflows often precede price weakness.

- ETF subscription/redemption data and custody flows: measure absorption capacity.

- Price action on low‑liquidity windows: overnight or holiday sales can produce outsized moves.

- Macro indicators: cross‑asset volatility spikes, carry trade reversals, and margin‑call events.

Platforms like Bitlet.app provide tools to track exchange flows and OTC liquidity; combine on‑chain metrics with derivatives market data (open interest, funding rates) to construct a multi‑angle view of supply pressure.

Trade and risk-management ideas

- If you believe capitulation is likely: favor short‑dated protection (puts or collars) and liquidity provision strategies around expected volatility spikes.

- If you lean toward hoarding / squeeze: accumulation on balance with option structures that finance long exposure (e.g., covered calls) can be effective.

- For allocators: size positions to reflect path dependency—miner exits reduce long‑term issuance but create short‑term drawdown risk. Use scenario weights rather than single‑point forecasts.

Conclusion

Miner economics in early 2026 are at an inflection point. A combination of rising difficulty, softer hashrate and compressed miner revenue around the ~$30 stress band has already produced observable selling (Bitdeer being a notable example). That selling increases short‑term downside risk, particularly if macro deleveraging events coincide. But the same dynamics can also produce a durable recovery: capitulation that removes higher‑cost supply or a shift toward hoarding by strong operators will both reduce available float and set the foundation for a bullish regime.

For analysts and institutional traders, the objective is not to guess a single outcome but to track the right signals—hashrate, miner reserves, exchange flows, and ETF absorption—and to size exposure around competing scenarios. The miner economic story is a supply‑side narrative that can abruptly change market regimes; staying alert to these metrics will separate reactive traders from those who anticipate the next phase.

Bitdeer’s liquidation is a wake‑up call, not a prophecy. Watch the miners: their choices — sell, hold, or exit — will materially shape BTC’s path. And remember to factor in macro cross‑asset dynamics; sometimes the leverage in other markets creates the push that moves crypto markets more than localized fundamentals.