L2

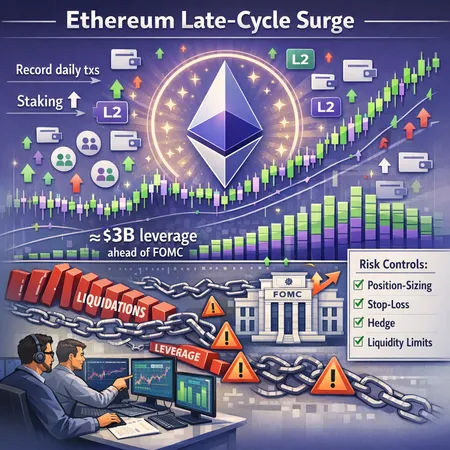

Ethereum is seeing a late‑cycle burst — new wallets, L2 adoption and record daily transactions — even as staking tops out and roughly $3B of leverage builds into the FOMC. Traders and risk managers should balance bullish fundamentals with clearly defined leverage controls and hedges.

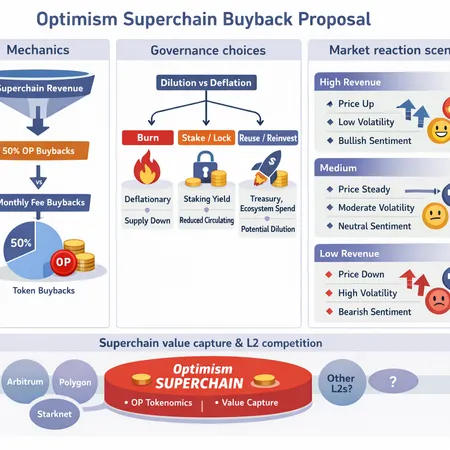

Optimism’s proposal to route Superchain revenue into OP buybacks forces a choice between steady supply-sink mechanics and flexible treasury policy. This deep-dive explains the buyback mechanics, compares a 50% revenue rule vs monthly fee-based buys, and outlines governance trade-offs — burn, stake or reuse — plus market scenarios and competitive implications for L2 value capture.

A technical explainer on Vitalik Buterin’s proposal for trustless on‑chain gas futures and what such a primitive would mean for Ethereum users, DeFi, and MEV. Covers architecture, L2/relayer integration, price discovery, and an MVP roadmap for teams building gas derivatives.