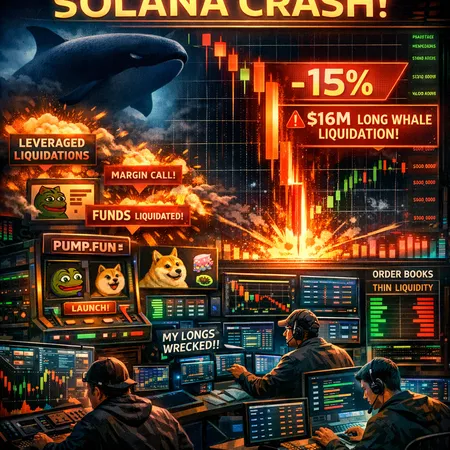

After the Shock: Lessons from Solana’s 15% Drop and a $16M Whale Liquidation

Summary

Executive snapshot

Solana suffered a sharp ~15% drop that hit a two-year low after a large long position was reportedly liquidated for about $16 million. That sequence — big position, rapid price move, automated liquidations and slippage — is a common pattern in leveraged markets, but it plays out differently on high-throughput L1s where liquidity is often concentrated in a few AMMs, market makers and launchpads. This note explains the mechanics and timeline of the move, why fast chains can still be fragile, how memecoin infrastructure like Pump.fun can amplify contagion, and practical mitigations for traders and protocol risk teams.

What happened: timeline and mechanics of the SOL drop

The headline: Solana's token, SOL, fell roughly 15% during the episode and reached a two-year low, driven in part by a large long-whale liquidation that real-time reporting pegged at about a $16M realized loss. Reporting on the liquidation is summarized in AmbCrypto's coverage of the move here.

How the cascade typically unfolds: a large leveraged long exists on perp markets (on-chain or off-chain). When spot liquidity is thin, an aggressive sell pressure — whether from the liquidated position itself being force-sold on DEXs/CEXs or from stop-loss cascades triggered elsewhere — pushes the on-chain price lower. Lower prices trigger more margin calls and algorithmic liquidations; those liquidations execute into shallow AMMs or orderbooks, generating heavy slippage and further pushes. In short: price -> liquidation -> execution into shallow market -> more price -> repeat.

On Solana specifically, the speed of settlement and the prevalence of permissionless launchpads and DEXs makes the feedback loop fast. The liquidation can show up as a spike in perp funding, aggressive taker fills on AMMs, and abrupt shifts in oracle prices — all feeding automated liquidation engines.

Why a high-throughput chain like Solana can still see large, sudden moves

Throughput (transactions per second) and low latency matter for execution but do not guarantee deep liquidity. Three structural amplifiers are worth spelling out:

Concentrated liquidity profiles: many Solana tokens — especially memecoins — gather liquidity in a small set of pools or launchpads. That concentration means even modest notional sales can cause severe slippage.

Leverage and cross-margin exposure: perps and margin desks aggregate risk. A single large leveraged position on Solana markets can be hedged imperfectly across venues; if liquidators must unwind into illiquid DEX pools, price impact grows nonlinearly.

Centralized execution & tooling: a small set of execution terminals, bots and launchpads can concentrate flow. When those systems are the execution point for many leveraged strategies or token sales, they become contagion vectors instead of neutral plumbing.

These issues illustrate that throughput is orthogonal to depth. You can process millions of tiny trades per second but still have low aggregate liquidity behind large market moves.

Did Solana’s technical stack materially contribute?

Short answer: mostly no — at least not directly. Solana's architecture (parallelized runtime, fast block times) enables rapid execution, but the flash move looks driven primarily by market microstructure (liquidity concentration and margin dynamics) rather than a consensus failure or fundamental outage.

That said, technical characteristics influence how events unfold:

- Speed lowers friction for automated liquidators and arbitrageurs, so a feedback loop can be executed faster than on slower chains. A fast loop is not the root problem, but it makes cascades sharper.

- Native tooling and concentrated order routing (some prominent launchpads and execution terminals route the majority of memecoin flow) means a failure or mass exit in one execution stack can have outsized market impact.

In other words, Solana’s stack made the cascade fast, not inevitable. The proximate cause was large concentrated positions and shallow liquidity, not a protocol-level bug.

Memecoin launchpads, execution terminals and contagion — the Pump.fun example

Memecoin ecosystems can act like accelerants. Launchpads, liquidity lockers, and execution terminals often bundle token discovery, market making and distribution in ways that concentrate both inventory and demand. Consolidation in that tooling increases systemic coupling.

Recent industry moves illustrate this risk. Pump.fun — a memecoin launchpad and trading ecosystem — announced an acquisition of execution infrastructure Vyper, signaling consolidation in the memecoin trading stack (coverage: TheNewsCrypto announcement and Cointelegraph's independent reporting). See the acquisition announcement here and broader coverage here.

Why that matters: when one execution provider or launchpad becomes a dominant funnel for listings and order flow, it also becomes a shared point of failure. A large liquidation or token dump routed through that provider hits many counterparties simultaneously, increasing the chance of cross-product margin stress. In other words, consolidation reduces redundancy and increases correlated risk.

Contagion pathways to watch

- Margin engines and cross-margining: positions collateralized by on-chain assets can propagate stress across markets when oracles lag or fail.

- Token concentration on AMMs: single-pool domination by one liquidity provider magnifies slippage.

- Execution stack centralization: a dominant terminal that routes liquidations, swaps or limit fills can produce synchronized outflows.

- Correlated collateral: projects and launchpads holding the same tokens as their treasury or as staged liquidity can see balance-sheet erosion in a single crash.

Traders and risk teams should map these linkages: who routes execution, which vaults or treasuries hold concentrated positions, and which oracles feed margin engines.

Practical mitigation strategies — for traders

- Size and leverage discipline: cap leverage by notional and by percent of available on-chain liquidity, not just by collateral value.

- Prefer staggered exits: split large sells across time and venues and use TWAP/POV algorithms when liquidating large positions to reduce price impact.

- Multi-exchange hedging: hedge large directional exposure across venues (on-chain DEXs + CEXs) so a single venue’s illiquidity doesn't blow up the whole exposure.

- Watch funding and liquidation metrics: monitor perp funding, on-chain open interest, and oracle divergence as leading risk signals.

- Use institutional-grade liquidation monitoring: set tighter margin alerts and manual-override thresholds for sudden price moves.

Practical mitigation strategies — for protocol devs and risk teams

- Graduated liquidation mechanisms: avoid all-or-nothing stopouts. Implement partial liquidations or staged auctions that reduce slippage versus immediate full closeouts.

- Insurance and buffer funds: maintain insurance pools that absorb a fraction of liquidation shortfalls to slow contagion and provide time to arbitrate losses.

- Better oracle design and aggregation: reduce single-oracle single-point-of-failure risk by using aggregated feeds and sanity checks (circuit breakers for oracle divergence).

- Incentivize deeper and distributed liquidity: program liquidity incentives across multiple pools and venues to avoid single-pool depth risk.

- On-chain risk monitoring and alerts: instrument dashboards for real-time open interest, concentrated LP positions, and wallet-level exposure so teams can act before a cascade.

- Operational decoupling for launchpads: avoid routing all large token sales through the same execution runner; provide optionality and fallback routes for large order execution.

Practical mitigation strategies — for launchpads and execution terminals

- Listing hygiene: enforce token vetting, vesting schedules, and locked liquidity minimums to prevent immediate sell pressure.

- Treasury diversification: avoid holding large treasuries of a single memecoin; stagger unlocks and manage runway conservatively.

- Execution throttles and circuit breakers: build rate limits and emergency pause features into automated listing execution to prevent a single dump from being routed to all venues at once.

- Insurance and buyback commitments: maintain counter-cyclical liquidity commitments or backstops for market-making during severe dislocations.

A working checklist for post-mortem and prevention

- Map concentrated holders and their liquidity pools.

- Identify top execution routes and single points of failure (e.g., a dominant launchpad terminal).

- Calculate market depth vs. worst-case liquidator notional for the 1–5 minute window.

- Stress test oracle feeds and liquidation modules against sudden slippage scenarios.

- Implement partial liquidation and insurance buffers where feasible.

- Establish playbooks for coordinated pause and manual intervention.

Final takeaways for developers, risk teams and traders

The Solana crash and the reported $16M whale liquidation are a reminder that speed without depth is fragile. High throughput reduces latency and enables sophisticated market making, but it also enables faster contagion when liquidity is thin and positions are concentrated. Memecoin launchpads and unified execution terminals like those consolidating under Pump.fun can be powerful network effects — and they can also become correlated points of systemic risk.

For practitioners: map the plumbing, reduce concentrated single points of failure, and design liquidation and oracle systems that tolerate sudden slippage. Traders should respect notional vs. available depth and avoid letting leverage turn a single bad trade into a market event. For protocol teams, rebuilding resilience means combining engineering (circuit breakers, staged liquidations), economic design (insurance, incentives for depth) and operational readiness (alerts, manual overrides).

Bitlet.app users and product teams are already thinking about many of these trade-offs as they architect payment, earn and exchange features — resilience belongs in both product and protocol design.

Sources

- AmbCrypto — Solana drops 15% to 2-year low; whale fully liquidated for $16M loss: https://ambcrypto.com/solana-drops-15-to-2-year-low-can-sol-bulls-hold-70/

- TheNewsCrypto — Pump.fun acquires Vyper to enhance cross-chain and EVM trading capabilities: https://thenewscrypto.com/pump-fun-acquires-vyper-to-enhance-cross-chain-and-evm-trading-capabilities/?utm_source=snapi

- Cointelegraph — Coverage of Pump.fun and Vyper acquisition and trading infrastructure migration: https://cointelegraph.com/news/pump-fun-vyper-acquisition-trading-infrastructure?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound

For those who want to drill deeper, monitor on-chain metrics (DEX liquidity depth, concentrated LP share, on-chain open interest) and watch perp funding and liquidation analytics in real time — they are the best early-warning signals before leverage turns into a market event. And for broader context on protocol-level risk design, see discussions under Solana and operational risk coverage in DeFi.