AML

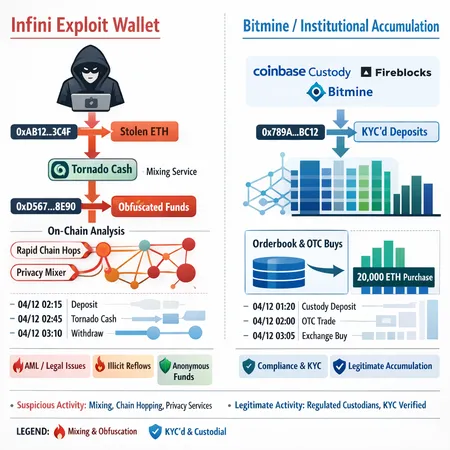

A forensic comparison of an exploit-linked wallet that reactivated to buy ETH (and routed funds through Tornado Cash) against institutional accumulation such as Bitmine’s 20k ETH purchase. This piece provides a practical on-chain provenance and AML framework for reporters and compliance teams to separate illicit reflows from legitimate buying.

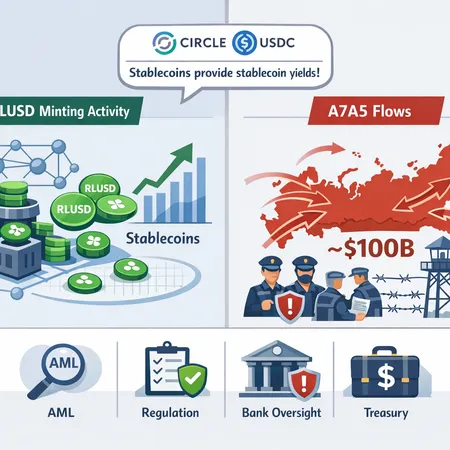

An investigative primer on recent stablecoin minting, cross‑border risk, and the debate over yield‑bearing stablecoins. Practical policy recommendations for compliance officers, stablecoin teams and regulators.

Dubai’s recent ban on privacy tokens and reworked stablecoin rules, combined with high-profile freezes like Tether’s $182M action on TRON, are forcing exchanges, custodians, and privacy projects to rethink listings, custody and compliance strategies.

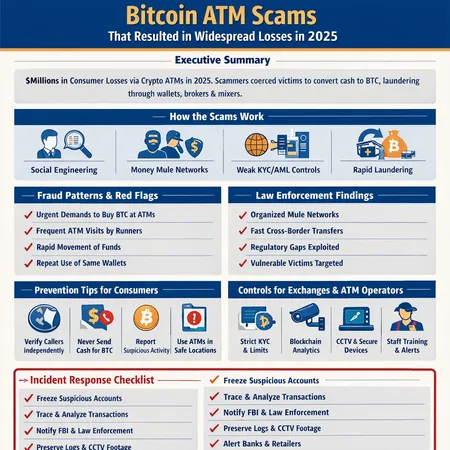

In 2025 scammers exploited Bitcoin ATMs to steal an estimated $333M from Americans. This investigative guide breaks down scam mechanics, FBI findings, and exact steps exchanges, ATM operators, compliance teams and consumers should adopt to stop repeat offenses.

Kenya’s Virtual Assets Service Providers Act has taken effect, yet Bitcoin ATMs are already appearing in malls and shopping centres — often without licensed operators. This investigation explores where these kiosks are, the enforcement and AML risks, and how regulators and entrepreneurs can bridge the compliance gap without choking access.

U.S. senators have asked DOJ and Treasury to probe World Liberty Financial (WLFI) token sales amid allegations of purchases linked to sanctioned actors. This explainer breaks down the legal, AML and operational implications for exchanges, custodians and compliance teams.

The new U.S. anti-money laundering (AML) legislation is set to significantly influence the cryptocurrency industry by enforcing stricter compliance measures and promoting transparency. This regulatory environment aims to reduce illicit activities while encouraging responsible adoption of crypto assets. Platforms like Bitlet.app are adapting by enhancing compliance features and continuing to offer innovative services like Crypto Installments, allowing users to buy cryptocurrencies now and pay monthly.

Turkey has introduced new Anti-Money Laundering (AML) regulations targeting the cryptocurrency sector. This article explores these regulations and offers compliance tips for crypto investors and businesses, highlighting how platforms like Bitlet.app can assist users in adhering to these legal frameworks while enjoying crypto investments.

Turkey has introduced new Anti-Money Laundering (AML) regulations for cryptocurrencies, affecting how users and businesses handle digital assets. This article explores the impact of these regulations and offers compliance strategies to stay ahead.

Turkey has introduced new Anti-Money Laundering (AML) regulations for cryptocurrencies, aiming to increase transparency and security in the crypto market. Bitlet.app supports these regulations by providing a compliant platform that ensures safe and legal trading, including innovative services like Crypto Installment for flexible payments.