When the Buy‑BTC‑for‑Treasury Trade Is Tested: Risks for Corporates and Sovereigns

Summary

Executive snapshot

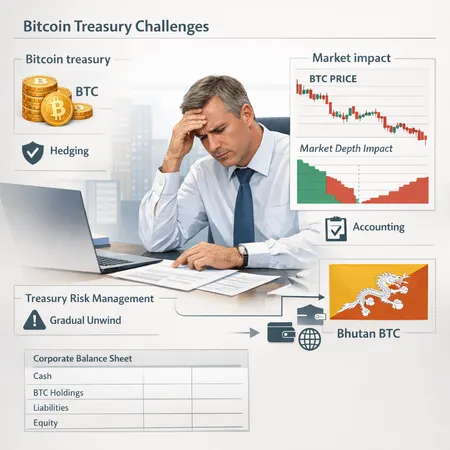

As BTC falls from recent highs, the strategic decision by companies and some sovereigns to allocate reserves to Bitcoin is being stress‑tested. What once looked like a relatively straightforward reserve diversification—“buy BTC for treasury”—is now revealing operational, accounting and liquidity tradeoffs. This article unpacks how on‑chain events and balance‑sheet dynamics turn modest price moves into material treasury risks, and gives a practical playbook CFOs and corporate treasurers can adapt.

Why the "buy‑BTC‑for‑treasury" trade is under pressure

The thesis behind corporate treasuries holding BTC was simple: limited supply, potential inflation hedge and corporate narrative benefits. But that trade assumes two things that don’t always hold during sell‑offs: market liquidity is deep, and volatility is a one‑way path up. Recent price action and analytics firms are flagging the downside. Market commentators argue that the Bitcoin treasury trade is being put through a critical stress test as prices slide and liquidity thins (CryptoSlate analysis).

A sharper, shorter drawdown can inflict outsized pain on treasuries that lack active liquidity planning. That pain shows up as realized losses if assets are sold, impairment and disclosure headaches, and potentially higher funding costs if investors or lenders reassess risk.

Sovereign transfers and single‑event liquidity shocks — the Bhutan example

Sovereign holders introduce a new layer of narrative and execution risk. Large on‑chain transfers tied to governmental wallets can trigger both market moves and reputational headlines. A recent example: wallets associated with the Royal Government of Bhutan moved 184 BTC to exchanges, creating questions about the timing and market impact of sovereign sales or reallocations (Coincu report).

Even if no immediate sale occurs, moving assets to exchange‑accessible custody can change market perception and increase selling pressure from other market participants. For companies, the lesson is clear: predictable, transparent custody and communication protocols matter. For markets, sovereign flows are a reminder that liquidity is not only a function of order books but also of narrative and attention.

Corporate balance‑sheet dynamics that increase treasury risk

Several structural issues magnify risk for corporate treasuries:

- Concentration and mark‑to‑market volatility: Large BTC positions relative to free cash can produce headline losses even when balance sheets remain solvent.

- Maturity mismatch and liquidity windows: Crypto markets have thin periods (overnight, weekends, regional holidays) where slippage rises and block execution becomes costly.

- Disclosure and accounting frameworks: Different reporting standards and disclosure expectations (and evolving regulator attention) can force realized losses or impairments on paper, influencing investor behavior.

Analysts and on‑chain data firms highlight that if sellers become forced or clustered, price moves can cascade; one report warns that bears are in control and downside to $50k is not out of the question under current structure and flows (Coinpedia summary of Glassnode signals). CFOs must plan for both gradual and shock scenarios.

Market‑impact mechanics: why selling more than you think costs more

Market impact is non‑linear. Executing a block sale across thin order books or during news events can move the price against you, making each additional coin sold costlier than the last. Key mechanics:

- Slippage: The immediate difference between quoted price and execution price grows with order size.

- Information leakage: Even announcing intent or moving assets to exchange custody transmits information and can invite front‑running.

- Liquidity windows: Depth varies by time of day and venue; OTC desks and block trading desks often provide better execution but at a negotiated cost.

Effective treasury risk management requires quantifying expected slippage under stress and arranging execution channels (OTC partners, block trades, algorithmic execution) before they are needed.

A CFO playbook — accounting, disclosure and governance

- Clarify accounting treatment and model impacts

- Confirm the applicable accounting framework: many jurisdictions still treat BTC differently (e.g., intangible asset classification historically under US GAAP). Understand impairment rules, revaluation possibilities and how realized vs unrealized losses flow through financials.

- Model multiple scenarios (10%, 25%, 50% drawdowns) for both P&L and covenant impacts.

- Tighten disclosure and investor communication

- Proactively describe treasury policy, limits and contingency triggers in MD&A or footnotes.

- Time communications to avoid market surprises and ensure consistent messaging to investors, auditors and regulators.

- Strengthen governance

- Move crypto position limits, execution delegation and unwind triggers into board‑level or CFO‑approved policy.

- Require pre‑approved counterparties for OTC and block trades; document counterparty credit and settlement risk.

Good governance reduces reflex selling and preserves optionality when markets move.

A CFO playbook — hedging, liquidity and staged unwind tactics

- Hedging options

- Derivatives (futures, options) can hedge downside but introduce basis risk and counterparty exposure. Options (puts or collars) offer asymmetric protection but cost premium.

- Structured hedges via prime brokers or OTC desks can be tailored to cash needs, though pricing varies widely during stress.

- Liquidity channels and execution strategies

- Prioritize pre‑negotiated OTC lines, block trade facilities and principal trading brokers. These reduce market‑impact but require solid legal/credit arrangements.

- Use algorithmic execution to smooth releases across time, and consider regional routing to capture liquidity pockets.

- Staged unwind and contingency triggers

- Define trigger thresholds for staged reductions (e.g., reduce X% at Y% drawdown or when liquidity indicators cross thresholds).

- Prefer smaller, predictable reductions over large, headline‑creating one‑offs.

- Cash‑flow hedges and backup liquidity

- Maintain a percentage of treasury in high‑liquidity assets to cover short‑term obligations so you aren’t forced to liquidate BTC into a weak market.

- Explore stablecoin overlays or repo‑style financing against BTC with trusted counterparties to borrow liquidity without selling.

Platforms and desks that specialize in corporate crypto operations (including custody, OTC and execution) can be part of a blended solution; some firms in the ecosystem, like Bitlet.app, provide tools used by treasurers for execution and settlement in constrained scenarios.

Scenario testing and what to simulate now

Run tabletop exercises that simulate:

- A sudden on‑chain transfer by a sovereign or major holder coinciding with a geopolitical headline.

- A liquidity black hole where primary venues widen spreads by 300–500 bps.

- A forced margin call on a leveraged treasury vehicle or financing line.

For each scenario, map who executes, what counterparties are contacted, and how investor communications are coordinated. The friction in those first 24–72 hours often determines ultimate economic outcomes.

Practical red flags and indicators to monitor

- On‑chain flows into exchange wallets (large spikes in inbound movements).

- Exchange order‑book depth and realized spread across venues.

- Derivatives basis and open interest concentration (signaling leveraged positions that could cascade).

- Counterparty credit and margin terms on any financing or custodial arrangements.

Some of these signals are leading indicators: for example, large sovereign inflows to exchange custody can presage a liquidity event, as seen with Bhutan BTC related movements reported on‑chain.

Conclusion — treat BTC as a strategic but operationally active reserve

The buy‑BTC‑for‑treasury trade can still make strategic sense, but it must be managed like any other exotic reserve: with disciplined risk limits, explicit execution plans, accounting clarity and active liquidity management. Tail events — sovereign transfers, concentrated selling, or rapid market repricing — magnify losses if treasuries are passive.

CFOs and corporate treasurers should move from theoretical allocation decisions to operational readiness: pre‑negotiated execution, scenario testing, clear disclosure and considered hedging. That posture turns Bitcoin from an uncontrolled volatility source into a managed reserve with known stress behaviors.