Case Study: Pi Network Mainnet Migration — Early Market Impact and Communication Lessons

Summary

Introduction: why Pi Network's mainnet migration matters

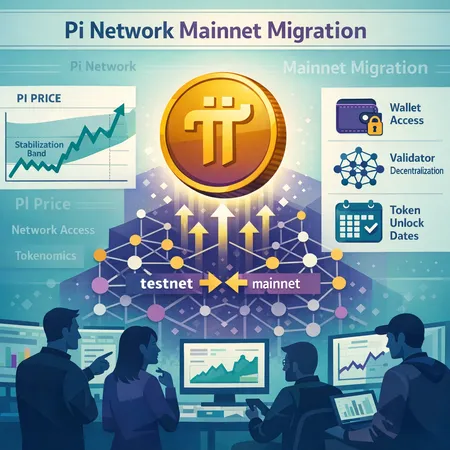

Mainnet migrations are inflection points. They move a project from promise to production: on-chain balances become native, validators run consensus, wallets begin to hold and transfer tokens, and tokenomics mechanics (staking, locks, unlocks) start to matter in real time. Pi Network’s recent mainnet migration update — coupled with positive market conditions — produced a visible PI price rebound, signaling that traders and holders interpreted the news as a step toward broad network access and utility rather than just another marketing milestone. As crypto participants watch macro cues like Bitcoin and sector flows into DeFi, this migration provides a concrete case to study how technical progress and communication interact with token price behavior.

What changed in the recent mainnet migration update

The most recent updates around Pi’s mainnet focused on easing access and clarifying technical steps toward broader participation. Coverage of the move noted an uptick in market interest precisely when Bitcoin settled higher and market attention returned to fundamentals; CryptoPotato framed the rebound in the context of BTC’s weekend stability and renewed focus on project-level catalysts. CoinPedia’s coverage emphasized the update itself — a major migration milestone — and how the announcement helped drive a recovery attempt in PI price after earlier volatility.

From a product standpoint, migrations typically bundle a few concrete changes: finalizing a token contract on mainnet, enabling wallet-to-wallet transfers, publishing a validator roadmap, and laying out token unlock mechanics or vesting schedules. For market participants, each of those items reduces a layer of uncertainty. That reduction in uncertainty is often what moves prices in the short term, especially when macro conditions are supportive.

Why the upgrade sparked a PI price rebound and early signs of stabilization

Three dynamics explain the rebound and early stabilization:

Reduced technical uncertainty: Announcing concrete steps toward broader network access signals that tokens will soon be usable, tradeable, and potentially consumable within the ecosystem. That realization converts a speculative promise into a more tangible asset in investors’ minds.

Market context: News events live inside broader market narratives. As reported, Bitcoin’s stabilization helped refocus capital on idiosyncratic stories. When the crypto market is calm, project-specific upgrades get more attention and liquidity, magnifying their price impact.

Positive feedback from early adopters: As wallets and limited validators start to process mainnet activity, social proof emerges. Traders react to on-chain signals (explorer activity, transfer volume, listing interest) and short-term momentum traders can push the price higher. The coverage from CryptoPotato and CoinPedia captured these supply-and-demand dynamics — the announcement catalyzed interest and the market’s technical picture allowed a rebound to stick, at least temporarily.

That said, early stabilization is not the same as long-term price discovery. Short squeezes, concentrated holder behavior, and limited liquidity can create temporary calm before fresh volatility. Projects need to recognize the difference and avoid conflating a momentary recovery with durable network health.

Fundamental milestones that still matter (and how to measure them)

Even after a successful migration announcement, several on-chain and governance milestones determine how sustainable a migration’s positive effects will be. Focus on three categories: wallet access, validator decentralization, and the token unlock schedule.

Wallet access and ecosystem onboarding

Why it matters: Wallet access converts ledger entries into tradable units and user-facing utility. When users can custody PI in widely supported wallets, integrate with custodial services, or use it in dApps, the token becomes an economic instrument rather than an aspirational badge.

What to watch: availability in major custodial and noncustodial wallets, the presence of a public block explorer showing transactions, the number of unique addresses transacting, and gas/fee UX that indicates whether transfers are practical for small-value users. A fast-growing number of active wallets with meaningful balances implies organic demand rather than purely speculative flows.

Validator decentralization and governance

Why it matters: Decentralization reduces single points of failure and the perception that a small group controls supply or consensus. Markets discount tokens that feel centralized because centralization risk translates to regulatory and technical tail risk.

What to watch: diversity of validators (geographical and organizational), the number of independent entities running nodes, the rate at which stake or voting power distributes away from founding parties, and published validator audits. Projects that publish clear validator onboarding criteria and timelines make it easier for markets to price decentralization progress.

Token unlock schedule, vesting, and tokenomics clarity

Why it matters: Even with perfect tech, poorly communicated or front-loaded unlocks can create sustained selling pressure. Precise tokenomics — who gets tokens, when, and under what lockups — determines supply-side dynamics for months.

What to watch: a transparent calendar of unlocks (dates and volumes), on-chain evidence of vesting contracts, pacing mechanisms (escrow, time-based linear releases), and policies for team/founder tokens. Markets react badly to ambiguity; a clear, auditable unlock schedule reduces the probability of surprise sell-the-news events.

How projects should communicate technical migrations to avoid sell-the-news

Sell-the-news episodes typically happen when expectations are inflated and communication fails to align reality with timelines. The goal of project communications should be to calibrate expectations, create measurable signals, and keep the community engaged during the months after a migration.

Recommended practices:

Lead with clarity and metrics: Announce what changed, why it matters, and provide measurable milestones (e.g., “mainnet token contract published; wallets A, B, and C integrated; 5 validators live; explorer showing transfers”). Numbers beat narratives.

Phase rollouts and publish a timeline: Instead of a single all-or-nothing announcement, use staged milestones (alpha wallets, beta validators, public explorer, full unlock). Phased rollouts generate a string of discrete, verifiable events rather than a single binary moment that invites selling.

Publish an auditable unlock schedule and snapshots: Share vesting smart contracts and make historic snapshots public so that claims about supply distribution can be verified. Projects that allow third-party observers (auditors, researchers) to validate the schedule reduce rumor-driven selling.

Use consistent, candid messaging: Avoid overhyping each milestone. If some features are delayed, say so early and explain the plan. Community trust is cumulative — honesty about minor setbacks prevents catastrophic reactions to surprises.

Provide tooling and liquidity guidance: If token transfers are enabled, provide recommended liquidity onboarding steps for exchanges and market makers, and suggest sensible price discovery practices (e.g., staged listings, initial LP incentives with vesting). Practical help reduces chaotic, uncontrolled flows.

Engage market makers and custodial partners early: Partnering with trusted liquidity providers and custodians before enabling full transfers can flatten extreme order-book moves and provide institutional-style confidence.

Coordinate with community leads and moderator teams: Equip moderators with FAQ packs, charts, and an expected timeline of actions so community channels stay informative rather than rumor-driven.

These tactics aim to convert a single news spike into a sequence of verifiable, manageable events that markets can price more rationally.

Actionable checklist for token project managers, community leads, and momentum traders

For project managers & community leads:

- Publish a clear, auditable unlock schedule and stake distribution table.

- Announce a staged migration roadmap with specific, measurable milestones and expected dates.

- Release tooling (wallet SDKs, block explorer) concurrently with migration updates and include integration guides for custodians/exchanges.

- Publish validator onboarding criteria and invite independent operators to participate.

- Coordinate a liquidity plan with market makers and exchanges that includes vesting for any tokens allocated to LP programs.

For momentum traders assessing migration risk:

- Evaluate on-chain signals: unique active addresses, transfer volume, and explorer activity after the migration.

- Monitor the unlock calendar and size of upcoming vesting cliffs that could supply the market.

- Watch validator concentration metrics; a sudden centralization signal increases tail risk.

- Size positions relative to liquidity; thin order books amplify downside on surprise news.

- Track project communications for increased specificity — more transparency usually reduces short-term tail risk.

Conclusion: interpreting early stabilization with healthy skepticism

Pi Network’s mainnet migration and the subsequent PI price rebound illustrate how technical progress plus favorable market conditions can quickly change investor sentiment. But early stabilization is only the first chapter. Real, durable progress depends on wallet accessibility, meaningful validator decentralization, and a transparent token unlock schedule. Projects that combine technical rigor with clear, metrics-driven communication reduce the chance of sell-the-news dynamics and help markets price migration risk more rationally.

For teams planning or executing migrations, the practical playbook is straightforward: break the migration into verifiable steps, publish auditable tokenomics, and coordinate with liquidity partners. For traders and community leads, the key is to distinguish between temporary momentum and structural change by watching the fundamental on-chain signals that follow a migration.

Bitlet.app users and other market participants evaluating migrations should treat this as both a technical and communications exercise — success requires both reliable infrastructure and disciplined messaging.