XRP Goes Institutional: Evernorth’s $1B Treasury, RLUSD Listing, and the Sentiment Gap

Summary

Executive snapshot

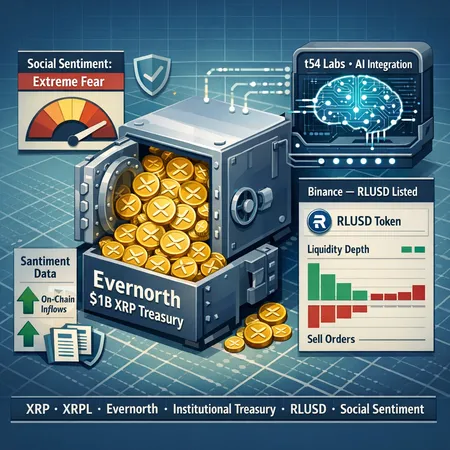

Evernorth’s plan to raise more than $1 billion and build a large institutional XRP treasury on the XRPL with t54 Labs and AI infrastructure is not just a press release — it’s an operational blueprint for institutionalizing XRP exposure. That move, paired with RLUSD’s Binance listing, improves native rails for settlement and liquidity. Yet retail social sentiment sits at unusually low levels, a divergence that can create asymmetric opportunities for long-term treasury managers who get the plumbing, custody, and compliance right.

For many allocators, XRP is shifting from an exotic exposure to an asset that can be operationalized at scale. Below I unpack what Evernorth actually announced, why RLUSD on Binance matters, how sentiment data diverges from on‑chain flows, and a practical investment framework for treasury teams.

What Evernorth’s $1B‑plus treasury plan means

Evernorth’s initiative to create a large institutional XRP treasury — developed alongside t54 Labs and with AI infrastructure on XRPL — is important for three practical reasons:

- Scale of demand: A >$1bn target signals a willingness to hold meaningful, long‑dated exposure, which in turn demands deeper liquidity and robust custody solutions. See Evernorth’s announcement for details. (Evernorth announcement)

- Operational integration: Building on XRPL and adding AI orchestration implies programmatic treasury management (automated rebalancing, execution routing across venues, liquidity forecasting) rather than ad hoc trade execution.

- Native rails: An institutional treasury on XRPL can use on‑ledger tokens for settlement and instant reconciliation, lowering counterparty and settlement risk compared with multi‑leg off‑chain arrangements.

This is not simply speculative capital; it’s a design for how an allocator might custody, monitor, and transact large XRP positions with professional tooling.

RLUSD on Binance: liquidity, pairing, and on‑ramp implications

The listing of RLUSD on Binance brings two clear implications for institutional treasuries:

- An on‑exchange settlement pair: RLUSD provides a new fiat‑like pair for traders and treasuries to hedge and exit positions without forcing on/off‑chain conversions. Coverage of RLUSD’s listing explains how it widens options for traders and treasuries. (AmbCrypto on RLUSD listing)

- Deeper liquidity and routing options: With a major venue like Binance listing RLUSD, execution algorithms can route across RLUSD, USDT, USDC, and native fiat corridors to find best pricing and minimize market impact.

However, new stablecoins introduce counterparty, reserve‑transparency, and regulatory dimensions. Treasuries should treat RLUSD as a settlement instrument to be validated on reserves, redemption mechanics, and jurisdictional compliance rather than assuming parity with established dollar stablecoins.

Social sentiment vs. institutional flows: a divergence to exploit

Public sentiment trackers have been flashing pessimism. Santiment’s analysis shows XRP slipping into an "Extreme Fear" band in social chatter even while institutional inflows and treasury builds suggest otherwise. (Santiment/Coinspeaker coverage)

Why this matters to allocators:

- Retail sentiment is a contrarian signal: When social chatter is overwhelmingly fearful yet large, verifiable institutional flows continue, the balance of marginal buyers/sellers shifts — institutions can build positions with lower execution cost and potentially higher asymmetry to the upside.

- Liquidity vs. noise: On‑chain metrics (exchange reserves, large wallet inflows, custody deposits) are often better signals of allocators’ intent than Tweets or Reddit. Still, social fear can compress spot liquidity temporarily, widening execution windows in favorable ways.

A practical rule: treat social sentiment as a short‑term volatility indicator, not as the primary thesis for multi‑year treasury allocations. Combine it with exchange reserve trends, spot depth, and custody inflows to time tranche entry.

Custody and regulatory considerations for large XRP treasuries

Holding large XRP balances introduces operational and legal obligations. Considerations for treasury managers include:

- Custody architecture: Multi‑custodian model vs single qualified custodian; hot/cold split; MPC (multi‑party computation) or HSM key management; insured custody options; certificate and bonding for delegated signers.

- Legal opinions and regulatory mapping: Obtain jurisdictional legal opinions on XRP’s treatment (security vs commodity vs utility) where you operate and where counterparties reside. Stablecoin arrangements (like RLUSD) need separate legal reviews around reserve proofs, redemption rights, and issuer jurisdiction.

- AML/KYC and sanctioned‑entity screening: Ensure custody providers and prime brokers apply chain‑aware AML controls for XRPL flows and token issuances; test reconciliation between on‑ledger activity and KYC records.

- Operational playbooks: Predefined actions for large redemptions, circuit breakers, emergency key rotation, and cyber‑incident response. These are as important as the allocation itself.

XRPL’s settlement finality and low fees are attractive, but they do not remove the need for strong custody governance and ongoing legal vetting — especially as institutional exposure scales.

An investment framework for institutional treasuries

Below is a practical framework that treasury teams can adapt. It separates governance, sizing, execution, and monitoring into repeatable processes.

Governance & policy

- Define a clear treasury mandate (e.g., strategic hedge, return-generating allocation, diversification).

- Approval thresholds: cap allocation per legal entity, required signoffs for >X% moves.

- Counterparty policy: approved exchanges, custodians, market‑making counterparties, and stablecoin issuers (including RLUSD due diligence).

Sizing and entry

- Use a risk budget approach: allocate a fixed percentage of total crypto exposure rather than percent of total corporate liquidity. Common starting bands for experimental allocations are 0.5–3% of liquid assets; heavy conviction treasuries may go higher after testing.

- Tranching: deploy capital in 3–6 tranches over time or algorithmically based on liquidity metrics (e.g., execute when spread/market impact < target).

- Use VWAP/TWAP execution windows and dark‑pool or OTC blocks for large fills to reduce market impact.

Liquidity & hedging

- Maintain liquidity buffers denominated in multiple rails (e.g., RLUSD, USDC, a major fiat) to facilitate rapid exits if required.

- Use options or futures where available as downside insurance; if derivatives are thin, prioritize on‑ledger hedges or cross‑asset protection.

Custody & settlement operations

- Dual custody model: primary insured custodian + backup MPC provider. Regular audits and public reserve checks for stablecoin counterparties.

- Reconciliation cadence: end‑of‑day on‑ledger reconciliation, weekly custody attestations, quarterly external audits for treasury holdings.

Monitoring & escalation

Track a compact dashboard of metrics:

- Exchange reserves and large deposit/withdrawal flows on XRPL

- RLUSD order book depth and 24‑hour turnover on major venues

- Social sentiment indices (Santiment or proprietary) as a short‑term volatility input

- On‑chain wallet concentration and active market maker liquidity

Have escalation thresholds tied to specific metrics (e.g., withdraw 10% of position if exchange reserves spike + market breadth collapses).

Scenario analysis: stress tests and what to watch for

- Bull case: Increased on‑chain adoption, rising RLUSD liquidity, continued institutional inflows. Outcome: tighter spreads, easier scaling, option to layer additional allocations.

- Neutral case: Choppy markets, regulatory headline risks, but operational execution remains intact. Outcome: manage via hedges and slow rebalancing.

- Regulatory shock: Hostile rulings in key jurisdictions or stablecoin clampdowns. Outcome: forced unwind risks, need for cross‑jurisdictional redemption pathways, and legal contingency plans.

Stress test treasury under each scenario: model liquidity draws, redemption velocity, and time‑to‑exit under adverse market impact.

Practical checklist before committing meaningful capital

- Confirm custody provider can support XRPL native settlement and prove insured coverage.

- Validate RLUSD reserves, redemption mechanics, and exchange market‑making commitments.

- Run OTC/venue connectivity tests for block execution; measure realized slippage vs quoted spread.

- Obtain legal opinions across operating jurisdictions and coordinate tax/treatment modeling.

- Set up monitoring for both on‑chain metrics and social signals; automate alerts for defined thresholds.

Platforms like Bitlet.app are emerging to help with operational flows for crypto treasuries, but institutional managers should still build independent verification and governance around any third‑party tooling.

Conclusion: asymmetric opportunity with operational discipline

Evernorth’s >$1bn XRPL treasury plan, paired with RLUSD’s growing venue footprint, materially improves the plumbing for institutional XRP exposure. At the same time, persistent retail fear—captured by sentiment trackers—creates potential windows to build positions with favorable risk/reward. But that upside is conditional: large allocations require rigorous custody architecture, legal clarity, liquidity testing, and a repeatable execution framework.

For treasury managers, the question is less if XRP can be held at scale, and more how to do it safely: structure the custody, validate stablecoin rails, stress test liquidity, and enter with disciplined tranches. If those boxes are checked, the current divergence between institutional flows and social sentiment could be the asymmetry long‑term allocators seek.

Sources

- Evernorth’s XRPL institutional treasury announcement: https://u.today/ai-on-xrp-ledger-evernorth-just-made-ultra-bullish-move?utm_source=snapi

- RLUSD Binance listing and implications: https://ambcrypto.com/assessing-ripples-growth-rlusds-binance-listing-and-xrps-long-term-prospects/

- Santiment / social sentiment coverage on XRP’s ‘Extreme Fear’: https://www.coinspeaker.com/xrp-dives-into-extreme-fear-but-its-good/