Whale Selling and Altcoin Microstructure: Lessons from Arthur Hayes’ FalconX Transfers

Summary

Introduction: why whale moves matter beyond the headline

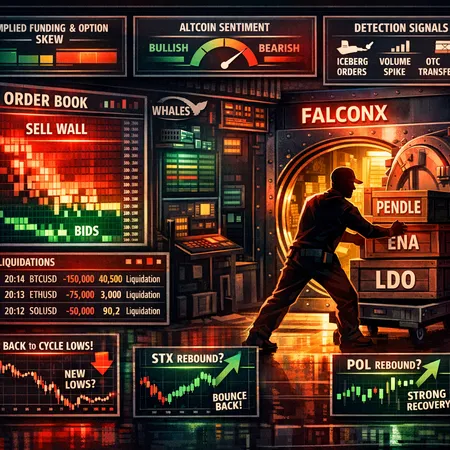

When a prominent trader moves millions in tokens into a custodian or OTC counterparty, the market doesn't just get a headline — it gets a structural event. Recent transfers reportedly involving PENDLE, ENA and LDO into FalconX below prior entry prices (reported by Coinspeaker) are exactly that kind of event: large, deliberate, and informative about forthcoming liquidity dynamics. Whales aren’t random sellers; they manage execution, counterparty risk, and information leakage — and those choices change how order books, funding rates, and options markets behave.

This article unpacks the mechanics behind these flows, shows how they propagate through microstructure channels, contrasts cases of alt weakness (LTC) with rebound episodes (STX, POL), and gives traders a checklist to detect and act on imminent large exits. The target reader is a trader or microstructure analyst tracking whale flows, order‑book risk, and altcoin sentiment. I’ll reference data and reporting where useful and mention Bitlet.app once in a practical context for execution and monitoring.

Why prominent traders route assets to custodial/OTC counterparties

Large market participants route assets to custodians and OTC desks for several interlocking reasons: privacy, execution quality, custody and settlement convenience, regulatory/tax handling, and liquidity aggregation.

- Privacy and information control: Routing through a custodian like FalconX reduces on‑chain visibility of a direct sale. A naked transfer to an exchange’s hot wallet is often an early signal of imminent market orders; routing via an OTC desk can obscure the timing and size of the final execution.

- Execution and block liquidity: OTC counterparties offer block liquidity and the ability to negotiate price or stagger fills — crucial for multi‑million token positions that would wipe out nearby order‑book liquidity.

- Settlement, custody and counterparty netting: Custodians handle settlements, prime financing, and cross‑asset netting that reduce funding costs and operational headaches.

The practical result: when whales move assets into custodial accounts, it’s often a precursor to a structured exit — whether via bilateral negotiation, a staged market sale, or using derivatives to hedge before the cash leg.

FalconX as an example

FalconX is a market participant frequently used for large transfers and OTC facilitation. The recent report that Arthur Hayes transferred large volumes of PENDLE, ENA and LDO to FalconX — at prices below his entry — is a textbook example of a well‑capitalized player choosing a counterparty to manage execution risk rather than immediately dumping into the lit order book (Coinspeaker report).

How these moves affect order books, funding and options

A whale routing coins into a custodian is not neutral — it changes multiple market observables that traders can monitor.

Order‑book microstructure and short‑term liquidity

Large sellers reduce the available resting buy liquidity across price levels. Even if the sale occurs OTC, the market anticipates future pressure and adjusts: limit buy orders often pull back, spread widens, and depth thins. In illiquid or mid‑cap altbooks, a single multi‑million sell can cascade into a 10‑20% move as algorithms and liquidity providers repriced risk.

- Visible effects include sudden imbalance metrics (bid density falls), iceberg print increases, and larger market‑sell fills sweeping multiple price levels.

- Hidden effects include market‑makers repricing quotes upward for inventory risk or pulling entirely from displayed books, increasing effective slippage for retail takers.

Funding, perp basis and option skew

Derivatives markets internalize expected future selling in different ways:

- Funding rates: As bearish risk rises, funding for shorts can turn positive (shorts pay longs) or, conversely, longs may pay shorts depending on who provides natural flow. A large anticipated sale often puts downward pressure on perp basis as liquidity providers demand compensation.

- Implied volatility and option skew: Option markets price in tail risk. Abrupt increases in put skew or rising implied vol for downside strikes indicate dealers buying downside protection — a leading indicator of market concern. This can make hedged, staged exits more expensive for whales and influence their execution choice (OTC vs lit market).

Liquidations and knock‑on effects

Large sales that move the spot can trigger margin calls and liquidations in levered positions elsewhere, amplifying price moves. Traders monitoring leverage metrics and open interest will see a compounding effect: a whale exit that nudges price down a few percent can induce forced sells and cascade liquidity out of the market.

Case study 1 — Hayes’ PENDLE, ENA and LDO transfers to FalconX

The Coinspeaker piece reported that Arthur Hayes moved significant holdings of PENDLE, ENA and LDO to FalconX at prices below his entry. The key takeaways:

- Timing and price context matter: The transfers were not just custody moves but occurred at a loss relative to entry — signaling intent to exit rather than short‑term reallocation.

- Order book ripples: Markets for PENDLE and similar mid‑cap tokens typically have shallow depth; news of a large offshore transfer often prompts immediate thinning of bids as passive participants lower exposure.

- Sentiment signalling: A known name moving coins at a loss changes altcoin sentiment — retail may interpret it as capitulation, and algos repricing risk can accentuate price drops.

This is not to say every custodial transfer equals imminent dump, but when combined with on‑chain deposit patterns, option/funding signals and withdrawals from liquidity pools, the probability of a structured exit rises.

Case study 2 — broader alt weakness: Litecoin’s cycle low return

Not all whale flows originate from a single trader. In Litecoin’s case, BeinCrypto documented renewed selling pressure and LTC revisiting cycle lows. The mechanics are similar: reduced bid density, realizations of long liquidation and weaker altcoin sentiment that transfers across correlated alts (BeinCrypto analysis).

LTC’s move shows that macro/flow driven selling — not necessarily a single whale — can push a market back to structural lows when liquidity is thin and leverage is high. For traders, the lesson is to treat correlated liquidity exhaustion across pairs (LTC, LDO, PENDLE etc.) as a systemic sign, not isolated noise.

Case study 3 — contrasting rebounds: STX and POL

Not every alt follow‑through is bearish. Short‑term rebounds in STX and POL highlight how quick relief rallies can form when buyers opportunistically absorb flow or when developers/treasury moves create perceived support.

- STX (Stacks) saw a >20% jump in a day, which some analysts flagged as a trend‑reversal attempt rather than durable strength (Coinpedia STX piece). The microstructure behind such moves often includes concentrated buys from liquidity providers and reduced selling aggression.

- POL (Polygon) displayed strong bounce signals in its order book and on‑chain activity that made a fast double plausible in short windows (Coinpedia POL piece). These rebounds tend to be fragile: if underlying flows resume, the relief rally can be merely a liquidity vacuum being refilled before another leg down.

Contrasting these rebounds with the Hayes transfers demonstrates the nuance: a whale exit can produce a drawn‑out repricing, while opportunistic buying or treasury buys can cause transient recoveries. Traders should therefore differentiate between structural buy-side absorption and liquidity‑patch bounces.

Detection methods: spotting imminent large exits

Traders and microstructure analysts can combine on‑chain, off‑chain and order‑book signals to detect likely large exits. Below is a practical checklist with indicators and how to interpret them.

- Custodial/OTC deposits and wallet flows

- Watch sudden, large transfers to known custodial addresses or labels (FalconX, major exchanges). Multiple transfers clustered in time raise the odds of an upcoming exit. Pair this with token age and previous holding size to infer intent.

- Order‑book footprint and depth monitoring

- Track bid density, spread widening, and sudden pullbacks of passive limit orders. Heatmap tools that aggregate liquidity at price levels reveal when book depth is being adjusted pre‑emptively.

- Derivatives signals (funding & open interest)

- Rising put skew, abrupt implied vol increases for downside strikes, and changes in perp funding are early warnings that dealers expect downside flow. Monitor option skew and basis curves — shifts often precede spot moves.

- Dark pool/off‑exchange prints and OTC tape

- Watch for large off‑exchange prints recorded by reporting services. These often accompany custodial transfers when an OTC desk is finding counterparties.

- Correlation and cross‑market drain

- A coordinated sell across correlated alts or a one‑way flow out of liquidity pools can accelerate moves. If LTC or other liquid alts bleed, mid‑cap tokens can be pulled along via sentiment and funding dislocations.

- Social and narrative signals

- A known address or named trader changing their public stance or moving assets is higher‑conviction information than anonymous flows. Combine this with chain analytics to corroborate intent.

Execution and risk management for traders

If you detect a likely large exit, act defensively: tighten stops, reduce asymmetric exposure, avoid being the marginal liquidity taker, and consider layering entries rather than using market orders. For aggressive strategies, watch funding and option prices to structure hedges before entering or exiting a position.

Practical tools: stitch on‑chain transfer watchers with order‑book heatmaps, perp funding alerts and option skew monitors. Platforms like Bitlet.app can be useful when coordinating staggered buys/sells and analyzing P2P price impact across venues.

Conclusion — read the plumbing, not just the headlines

Whale flows routed through custodial/OTC counterparties — such as the reported Hayes transfers of PENDLE, ENA and LDO to FalconX — are signals about potential future liquidity stress, not just gossip. They change the microstructure calculus: order‑book depth, funding prices and options skew adapt before the ink dries on news wires.

Trading around these events requires a synthesis of chain analytics, order‑book signals and derivatives pricing. Different alts will behave differently — some (like LTC recently) may revisit structural lows, while others (STX, POL) can stage fragile rebounds. The edge for traders is in early detection and calibrated execution: know where the hidden liquidity sits, and plan exits and entries to avoid being the last marginal seller.

Sources

- Coinspeaker — Arthur Hayes transfers PENDLE, ENA, LDO to FalconX: https://www.coinspeaker.com/arthur-hayes-transfers-millions-in-pendle-ena-ldo-to-falconx-what-it-means-for-altcoins/

- BeinCrypto — LTC returns to cycle lows analysis: https://beincrypto.com/ltc-returns-to-cycle-lows-as-new-demand-emerges/

- Coinpedia — STX price rebound analysis: https://coinpedia.org/price-analysis/stacks-stx-price-up-20-today-is-a-trend-reversal-finally-forming/

- Coinpedia — POL/Polygon rebound analysis: https://coinpedia.org/price-analysis/polygon-pol-shows-strong-rebound-signals-can-the-price-double-from-here/

For readers tracking these dynamics, monitoring DeFi liquidity, Bitcoin correlation and exchange custody flows will improve your odds of anticipating large exits.