ASTER Crash Explained: Whales, Buyback Fund, and Recovery Scenarios

Summary

Quick framing: why ASTER’s crash matters

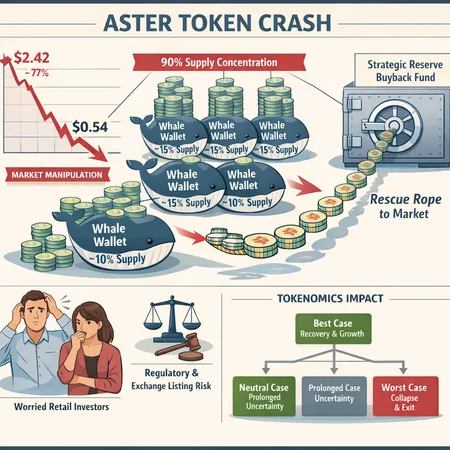

Small‑cap altcoins routinely swing hard, but ASTER’s recent move was notable for who moved the supply. When a handful of wallets can push a token from $2.42 down to $0.54, tokenomics — not just sentiment — becomes the story. For traders and retail holders trying to parse whether the drop is a buying opportunity or an unrecoverable collapse, the answer turns on concentration, incentives, and the credibility of remedial tools like a buyback fund.

What the on‑chain evidence shows: six wallets, ~90% control

Blockonomi’s analysis found that roughly six wallets control nearly 90% of ASTER’s supply, a concentration level that changes the risk profile drastically (Blockonomi analysis). That level of concentration means supply is effectively centralized in the hands of a few actors who can coordinate dumps, with outsized market impact on low‑liquidity orderbooks.

Why this matters in practice:

- With concentrated ownership, even moderate sell pressure from those wallets will overwhelm bids and cascade stop‑losses. The price path from $2.42 to $0.54 is consistent with sequential or block selling into thin liquidity.

- Concentration distorts tokenomics: circulating supply metrics become misleading if most tokens sit inert in a handful of addresses that can become active at any time.

- Markets price in counterparty risk: exchanges, custodians, and OTC desks may widen spreads or delist tokens that appear susceptible to manipulation.

If you track concentration visually, you’ll see supply cliffs — long stretches of potential sell pressure clustered at a few addresses — and that’s precisely what on‑chain dashboards and Blockonomi highlighted.

Timeline recap: from $2.42 to $0.54

The price collapse unfolded over a compressed period: a peak around $2.42 followed by heavy dumps and a sharp fall to about $0.54. AmbCrypto documented the low and the project’s subsequent activation of the Strategic Reserve Buyback Fund to arrest the slide (AmbCrypto coverage). The sequence — sharp drop, liquidity vacuum, buyback announcement — is familiar in small‑cap episodes but the prior concentration makes outcomes less predictable.

The Strategic Reserve Buyback Fund: mechanics and credibility

A buyback fund can help in theory: using reserves to purchase tokens supports price, reduces circulating supply temporarily, and signals commitment from the protocol or treasury. But its effectiveness depends on several concrete variables:

- Funding source and size: Is the fund financed with protocol revenue, external fiat, vested tokens, or a one‑time allocation? A fund made of the same token or small reserves is a weak backstop.

- Execution rules and transparency: Will buybacks be programmatic at defined price levels, or discretionary? Transparent smart contracts and on‑chain execution reduce moral hazard.

- Governance control: Can governance actors, including those large wallets, alter buyback rules or withdraw funds? If whales effectively control governance, a buyback can be announced and then neutered.

- Market liquidity: Buying into thin orderbooks quickly raises prices but doesn’t build sustainable liquidity. Without market‑making, prices can fall again once purchases stop.

AmbCrypto’s report notes that the Strategic Reserve Buyback Fund was activated after the five‑month low, which can restore some confidence if the fund is credible and separately funded. But a buyback is not a cure‑all: it can blunt panic, but it does not repair structural issues like centralized ownership or harmful vesting schedules.

Can a buyback restore market confidence? The realistic view

Short term: yes, a sufficiently large and transparent buyback often stabilizes markets by removing immediate selling pressure and creating bid support. Traders who trade news will step back in.

Medium to long term: only if the buyback comes with governance reforms and demonstrable diversification of supply (e.g., redistribution, vesting rebalancing, lockups, or incentives to add decentralised liquidity). If the same six wallets retain control, confidence will likely relapse once buys end.

In plain terms: a buyback can create a reprieve; it rarely converts a fundamentally concentrated token into a healthy, decentralized market without deeper tokenomic fixes.

Regulatory and exchange listing risks from supply concentration

Extreme supply concentration triggers multiple operational and regulatory headaches:

- Delisting risk: Exchanges scrutinize market integrity. Tokens where a few addresses can manipulate price are candidates for heightened listing reviews or removal.

- AML/KYC and custody concerns: Custodians and institutional gateways avoid assets that present outsized counterparty/market‑abuse risk. That reduces avenues for liquidity expansion.

- Securities and control arguments: Regulators may treat tokens with centralized control as more like securities or centralized projects—this can bring additional compliance burdens.

Real world consequence: even if a buyback stabilizes price, an exchange or large custodian could still restrict trading or listing status if they conclude the token’s structure presents unacceptable risk. This happened with other small caps where token control implied market manipulation risk.

Scenario analysis for retail holders

Below are plausible scenarios and what they mean for retail investors. Think in probabilities, not certainties.

Scenario A — Stabilize and reform (low probability without concrete governance changes)

- What happens: Buyback stabilizes price; governance votes pass to decentralize holdings or impose new vesting/lockups; liquidity providers add depth.

- Outcome for retail: Partial recovery over months; new entrants more willing to buy; risk declines but remains above typical blue‑chip levels.

- Retail action: Hold or accumulate cautiously if you can verify on‑chain changes and independent audits of the buyback mechanism.

Scenario B — Pump and fade (moderate probability)

- What happens: Buyback creates temporary pump; whales or insiders sell into the rally; price drifts back down once purchasing ceases.

- Outcome for retail: Short‑term traders can profit but long holders risk losses. Volatility remains high.

- Retail action: Consider taking profits on rallies; set strict stop limits; avoid averaging down without clear on‑chain commitments.

Scenario C — Control persists, liquidity evaporates (high risk)

- What happens: The same wallets retain effective control; buyback is small or misused; exchanges delist or restrict trading; token becomes illiquid.

- Outcome for retail: Long recovery times, potential permanent impairment; secondary markets may dry up.

- Retail action: Exit if possible; prioritize tokens with better decentralization and clearer utility. If holding, hedge exposure and limit allocation size.

Scenario D — Legal or custodial intervention (tail risk)

- What happens: Regulators or custodians intervene because of manipulation concerns or illicit activity linked to controlling wallets.

- Outcome for retail: Frozen or restricted access to trading; forced settlement or reorganization of token terms.

- Retail action: Keep documentation of trades; prepare for prolonged illiquidity risk. Treat exposure as speculative capital only.

Practical checklist for retail investors and analysts

- Verify on‑chain: Confirm the six‑wallet concentration yourself using scanner tools. If the top N addresses control the bulk, treat it as a red flag.

- Read the buyback terms: Are funds locked in a multisig or a smart contract? Who controls them? Transparency matters more than headlines.

- Watch vesting and unlock schedules: Many crashes follow scheduled unlocks that coincide with dumps.

- Monitor exchange notices: Listing reviews or liquidity provider withdrawals often precede longer troughs.

- Size positions: Limit allocation to speculative buckets; don’t treat concentrated small caps as core holdings.

- Use Bitlet.app or comparable platforms to compare earn and liquidity options, but beware platform exposure to delisted tokens.

A final word on tokenomics and market manipulation narratives

ASTER’s episode is a textbook reminder that tokenomics isn’t just a whitepaper section — it’s the market mechanics that determine survivability. A Strategic Reserve Buyback Fund can be a responsible tool, but only when executed transparently and paired with structural decentralization. Otherwise, it risks becoming a short‑term PR bandage that fails to change the incentives of the whales who control supply.

For many analysts, the key question is not whether the fund exists but who controls both the fund and the large wallets. Until those two levers no longer sit in the same hands, retail participants should treat ASTER as a high‑risk speculative play and size positions accordingly.

Sources

- Blockonomi: ASTER price crash analysis and whale concentration https://blockonomi.com/aster-price-crash-from-2-42-to-0-54-amid-whale-dumps-and-market-control/

- AmbCrypto: ASTER’s 5‑month low and Strategic Reserve Buyback Fund activation https://ambcrypto.com/analyzing-asters-5-month-low-can-the-0-5-support-hold/