Market Manipulation

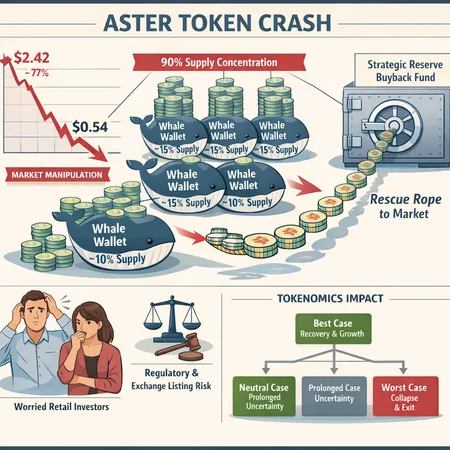

ASTER’s collapse from $2.42 to $0.54 exposed extreme supply concentration and prompted a Strategic Reserve Buyback Fund. This analysis breaks down the evidence, buyback mechanics, regulatory risks, and practical scenarios for retail holders.

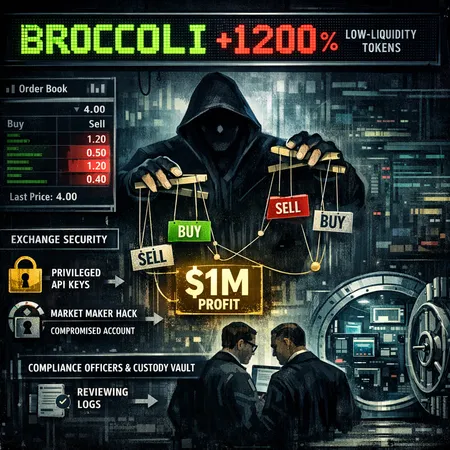

An alleged market-maker account compromise on Binance ignited a BROCCOLI rally that a trader converted into roughly $1M in profits. This article reconstructs the timeline, the technical weak points that enabled the exploit, and concrete controls exchanges, custodians, and counterparties should adopt.

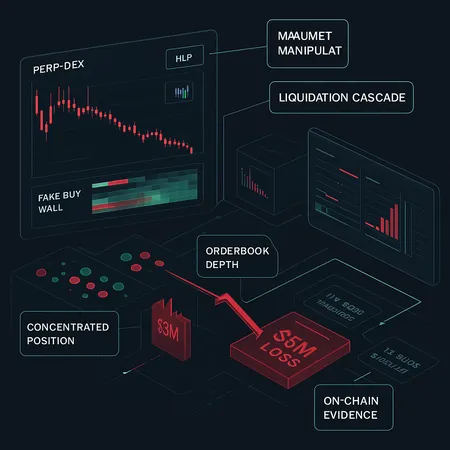

An investigative post-mortem of the coordinated attack on Hyperliquid that paid ~$3M to force a multi-million-dollar perpetuals loss and the related POPCAT crash. We reconstruct plausible on-chain signals, explain perp-DEX mechanics that amplify contagion, and give practical mitigations for traders and protocol designers.

DeFi

All DeFi postsBitcoin

All Bitcoin postsRisk Management

All Risk Management postsEthereum

All Ethereum posts- Two Compelling Reasons to Buy Ethereum Before July 2026 — With Risks, Sizing, and a Regulatory Checklist

- Investor Brief — Bit Digital’s Pivot From BTC Mining to ETH Staking & AI Infrastructure

- Reading the Signals: What the Ethereum Foundation’s Five‑Year Austerity and Vitalik’s 16,384 ETH Move Mean for Developers and Investors