Zcash at the Crossroads: Whales, Governance Rift, and Whether ZEC’s Dip Is a Buy

Summary

Snapshot: Weak Price, Active Chain

Zcash (ZEC) is sitting in an uneasy place: short-term price action shows a clear downtrend, yet several on-chain signals point to selective accumulation by large holders. The discrepancy matters because it creates a set of asymmetric trade possibilities — a bounce on concentrated buying or an accelerated slide if retail capitulation and governance noise undermine confidence. For many traders, understanding which narrative wins requires reading liquidity bands, support clusters, and the evolving governance story around development funding.

For broader context on the protocol and privacy coin dynamics, see Zcash. This article focuses on actionable levels, on-chain evidence, the governance rift around development funding, and trade rules that work across scenarios.

Technical setup and key support levels

ZEC’s immediate technical picture is best read in two timeframes: short-term (7–30 days) and trend (monthly/200-day). Recent market reads show ZEC testing near-term support after a string of down days, aligning with a contraction in 7- and 30-day performance that technical traders watch as a warning sign.The market read reporting the short-term weakness and support test

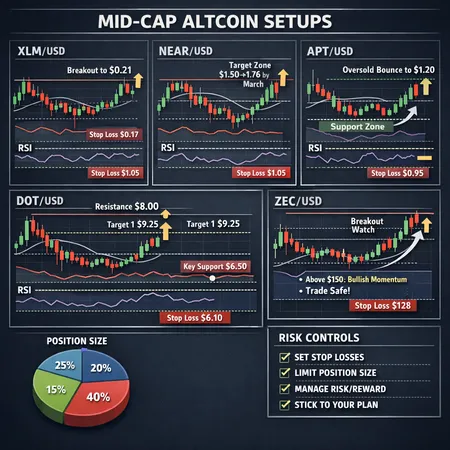

Key levels and reference points (use percentages if you trade multiple positions):

- Immediate support: the recent 7-day low and nearest intraday demand zone — tradeable for short swing buys if volume shows absorption.

- Secondary support: the 50–200 day moving average band (your platform will show exact MA values); a daily close below the 200-day MA would be a material bearish signal and suggests a shift to structural risk.

- Stronger structural support: long-term on-chain accumulation zones and prior multi-month lows — if these break, expect a tougher path back up.

Actionable rule of thumb: if you buy a dip, size position for a stop-loss 6–12% below entry for short swings; for position trades that assume protocol recovery, stop 20–30% below entry or beneath the 200-day MA. Those bands let you respect both local liquidity and larger trend risk without overleveraging.

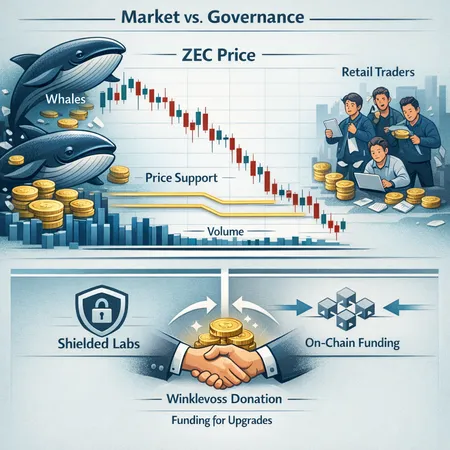

On-chain picture: whales are buying while markets fade

One of the more interesting divergences is that whale activity has not uniformly mirrored price weakness. On-chain flow analysis over the past weeks shows net inflows to large, cold-storage addresses and fewer big outflows compared with earlier distribution events. Exchanges are not seeing the same concentrated selling pressure; instead, some large wallets are accumulating or consolidating balances.

This split — retail sellers hitting spot markets and whales accumulating off-exchange or into custody — creates a liquidity mismatch. Short-term price drops can persist if marketable liquidity dries up, even when large holders are quietly increasing exposure. That’s why observing on-chain wallet changes alongside exchange order book depth matters: accumulation by wallets only translates to price support when those holders either bid into the market or refuse to sell, tightening available supply.

The latest market read emphasized this divergence: ZEC is testing support while whale accumulation counters some of the retail-led weakness (invezz analysis). Traders should weigh whether whales are accumulating to hold through upgrades and governance turbulence, or whether they’re selectively buying liquidity for a later distribution.

Governance rift and the Shielded Labs funding move

Zcash’s governance environment has grown more contested. Internal rifts — disputes over roadmap priorities, funding mechanisms, and the split between community steerage and developer teams — have sown uncertainty. The most concrete development in recent weeks was the donation of 3,221 ZEC to Shielded Labs by the Winklevoss founders, which has both practical and symbolic implications (Coingape report).

Why the funding matters: Shielded Labs is a development vehicle focused on privacy and protocol improvements. A direct injection of ZEC into an active development fund does three things:

- Provides runway for specific engineering work and audits, reducing short-term funding uncertainty.

- Signals institutional or high-net-worth support for privacy-preserving upgrades, which can boost market sentiment.

- Raises governance questions: who controls spending, what conditions attach to grants, and whether this strengthens or fragments the formal governance process.

That donation is sizable in narrative terms but modest relative to total market cap. It changes momentum but does not automatically settle governance debates. The rift remains relevant because governance delays can stall upgrades that materially affect adoption and on-chain utility — a risk traders should not underweight.

How the Winklevoss donation alters the narrative

The 3,221 ZEC gift is meaningful in three ways for traders and investors:

- Runway extension: it buys time for development priorities that might otherwise be delayed; concrete progress on protocol upgrades reduces execution risk.

- Confidence signal: institutional-aligned actors putting skin in the game can lower perceived governance risk, likely supporting bids at key support zones.

- Not a panacea: single donations don’t equal decentralized funding frameworks. If the broader community perceives favoritism or opaque control, the governance rift can persist and reemerge as a selling catalyst.

In short, the donation nudges the narrative from “no runway” toward “targeted support,” which can help base-building if Shielded Labs converts funds into visible milestones (released code, audits, formal proposals). Traders should monitor on-chain treasury flows and public minutes or proposals from Shielded Labs as leading indicators.

Tradeable scenarios and risk management

Below are three clear scenarios and concise trade rules for each.

Bull (dip-buy to base):

- Thesis: Whale accumulation continues, Shielded Labs funding stabilizes roadmap, and ZEC holds secondary support.

- Trigger: A clear daily reversal candle showing absorption at immediate support and a pickup in stable inflow to non-exchange wallets.

- Trade rule: Buy up to 1–3 staggered entries. Stop 6–12% below recent low or beneath the confirmed intraday demand zone. Target near-term resistance at swing highs; trim into strength.

Neutral (wait for confirmation):

- Thesis: Governance noise persists and price action remains rangebound; no clean entry.

- Trigger: Price compression into a narrower range and a daily close above a meaningful resistance (e.g., the 50-day MA) with improving on-chain metrics.

- Trade rule: Avoid new large positions; use small option-based or long-dated exposure if you want asymmetry. Wait for a breakout or confirmed reclaim of trend.

Bear (structural decline):

- Thesis: Retail capitulation accelerates, 200-day MA fails, or governance disputes deepen and prompt developer flight or de-listing risk.

- Trigger: Daily close below the 200-day MA, rising exchange inflows, and public governance splintering.

- Trade rule: Reduce exposure, consider hedges (inverse ETFs, short structures where available, or options). Place stops 20–30% below entry for position trades; consider squared exposure if macro tail-risk appears.

Position sizing: scale into positions and diversify across timeframes. For capital preservation, cap single-position exposure to a percentage of portfolio aligned with your risk budget. If you’re using leverage, tighten stops; the ZEC setup rewards measured entries rather than large directional bets.

Macro tail risks and what flips the script

ZEC isn’t isolated. The major tail risks that can override on-chain nuance are:

- Bitcoin-led liquidity crunch: a deep BTC drawdown usually drags smaller-cap utility and privacy tokens lower.

- Regulatory pressure on privacy coins: stricter exchange delistings or compliance actions would materially reduce ZEC liquidity.

- Developer exodus or failed upgrades: governance breakpoints that fracture developer coordination can lead to lasting technical stagnation.

Monitor BTC market health, exchange flows for privacy-coin compliance signals, and public governance communications. Any rapid change in these areas can turn a tactical buy into a value trap.

Practical checklist before trading ZEC

- Confirm support holds with volume-based absorption and falling exchange balances.

- Watch Shielded Labs’ public outputs and treasury movement; announcements often precede sentiment shifts.

- Define stop levels by timeframe (swing vs position) and size positions to your conviction.

- Keep an eye on macro — BTC weakness or regulatory headlines wipe out localized narratives quickly.

Bitlet.app traders should log these checks into their trade routine: combining on-chain signals, governance updates, and strict risk rules will give the best chance of threading the needle.

Conclusion

ZEC’s current state is a classic crypto bifurcation: price pressure and retail weakness on one side, concentrated whales and targeted development funding on the other. The Winklevoss donation to Shielded Labs tilts the funding conversation toward stability, but it’s not a silver bullet. Traders who respect clear support bands, monitor on-chain accumulation versus exchange outflows, and apply disciplined stops can treat the present weakness as an opportunity — provided they remain alert to macro tail risks and governance developments. If key long-term averages break or governance fractures intensify, the trade flips from tactical buy to risk-minimization.