Why Ethereum Whales, Liquid Staking and Post‑Quantum Security Make ETH an Institutional Bet

Summary

Thesis: ETH as a nuanced institutional exposure

In the past 24 months ETH has stopped behaving like a pure risk asset that institutions punt on for short windows and started to look like a layered institutional exposure. On‑chain signals show large accounts accumulating again even as others take profits; a sizable portion of those inflows is being redirected into liquid staking solutions; and the Ethereum Foundation has just announced a dedicated Post‑Quantum security team to tackle a long‑term existential risk vector. For CTOs and institutional researchers, those three developments—whale behavior, liquid staking flows, and post‑quantum readiness—combine to create a different custody and capital‑allocation problem than a plain spot BTC or equity bet. This article unpacks the evidence, mechanics and practical implications.

How to read the current whale tug‑of‑war

On‑chain analytics over the last few weeks show two visible behaviors among large ETH holders: renewed accumulation at perceived dip levels, and active reshuffling into staking vehicles rather than into centralized exchanges. Multiple outlets observing chain transfers reported that large wallets are buying the dip and moving tokens into staking and liquid staking pipelines rather than letting them sit on exchanges where they could be sold quickly (Coinspeaker; Cryptopolitan). Tokenpost also flagged that institutional desks and long‑only allocators are showing renewed interest in building ETH positions, not just trading them intraday (Tokenpost).

That creates a tug‑of‑war: accumulation pressure from long‑term holders vs distribution from active trading or profit‑taking accounts. The important nuance is destination. When whales route ETH to staking contracts or liquid staking providers, the immediate sell pressure is removed from the order books—even though liquid staking derivatives (LSDs/LSTs) can recreate tradable exposure synthetically. The net effect: a smaller pool of free, easily withdrawable ETH on exchanges and a larger share of ETH that is economically committed to securing the network.

Liquid staking: flows, circulating supply and yield math

Liquid staking is the mechanism that converts illiquid staked ETH into tradable claim tokens. That product design reconciles two institutional objectives: earn staking yields while retaining market exposure.

What the flows look like and why they matter

Recent coverage and on‑chain traces indicate a material uptick in transfers from large wallets into staking routes and liquid staking providers (Coinspeaker; Cryptopolitan). For institutions, liquid staking is attractive because it allows treasury teams to maintain dollar‑value exposure while accruing protocol yields and avoiding some operational burdens of running validators.

From a macro liquidity perspective, staking reduces the immediately withdrawable supply of ETH. But because LSTs mint a derivative token representing a claim on staked ETH plus rewards, effective tradable liquidity depends on LST issuance, market depth for those derivatives, and how custodial/wrapping providers manage redemption mechanics. Practically, that means: on‑chain circulating supply denominated as "free ETH" falls, while synthetic liquidity via LSTs increases.

Implications for staking yields and market dynamics

- Staked ETH reduces available spot liquidity, which can amplify price moves in thinner markets. Institutional accumulation into staking routes can therefore create asymmetric tightness: less sell pressure but more concentrated holder base.

- Liquid staking keeps price exposure accessible, but it introduces counterparty and composition risk—LST tokens trade in secondary markets and their price can diverge in stressed scenarios.

- Yield calculations for institutions must account for fee splits, protocol‑level staking APRs, and provider fees or slashing exposure. Staking yields are attractive relative to cash returns, but they are not pure alpha: they come with operational, counterparty and systemic liquidity risks.

Institutional signals and capital rotation toward ETH

Tokenpost and other observers have documented renewed institutional interest in ETH beyond retail momentum (Tokenpost). Why now? A few structural reasons standing out:

- ETH’s economics: burn mechanics, fee dynamics and a growing share of ETH locked in staking make it a candidate for longer‑term holdings that can be modeled as yield‑bearing collateral.

- Liquid staking primitives: institutions can earn staking yields while maintaining tradable exposure—solving the classic liquidity vs yield tradeoff.

- Diversification and product innovation: asset managers are increasingly comfortable with integrated strategies that combine spot ETH, LST exposure and derivatives hedges.

For CTOs evaluating allocations, capital rotation into ETH means reassessing custody tiers. A typical institutional stack now may include:

- Cold custody for spot ETH (long term holdings)

- Managed validator custody (self‑run or delegated) for yield capture

- Custodial or non‑custodial exposure to LSTs for tradability and treasury management

Each layer carries a distinct risk surface: physical key security for cold wallets, operational risk and slashing for validators, and counterparty plus smart‑contract risk for LSTs. Platforms like Bitlet.app that offer institutional plumbing now have to demonstrate both operational security and integration with LST architectures as part of their value proposition.

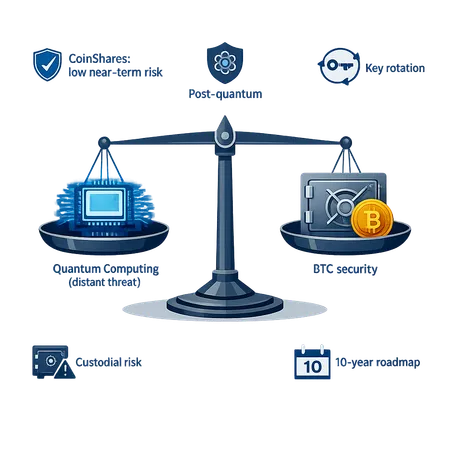

The Ethereum Foundation’s Post‑Quantum security team: what it changes

On January 26, 2026 the Ethereum Foundation announced a dedicated Post‑Quantum security team—funded and staffed to bring post‑quantum cryptography (PQC) readiness into the protocol and tooling layer (Cryptonomist). For institutions, that’s a watershed moment: the protocol is treating quantum resilience as an engineering priority rather than a theoretical footnote.

What post‑quantum readiness practically entails

- Algorithm selection and standardization: migrating or adopting quantum‑resistant signature schemes (or hybrid schemes) that are vetted and interoperable across clients and wallets.

- Key management and rotation tooling: automated, auditable processes for migrating existing keys to PQ‑resistant formats without exposing private material.

- Client and infrastructure upgrades: validator software, light clients, custody firmware and HSM integrations must support PQ keys and verification logic.

- Backward compatibility and migration plans: a coordinated upgrade path that balances urgency with the need to avoid chain splits or operational failures.

The EF’s new team increases the probability that these pieces will be engineered and standardized within a time horizon that matters for institutional planning. That removes a major question mark for CIOs and CTOs who otherwise would have to model a speculative quantum event into their custody decisions.

Why post‑quantum readiness matters for custody and risk models

Quantum threats change the assumed hardness of the digital signature primitives that secure custody solutions. For large ETH exposures, the relevant implications are:

- Key compromise risk enlarges: a practical quantum computer would materially shorten the time horizon in which private keys remain safe. Institutions must plan both for proactive migration and for defensive containment.

- Migration complexity: migrating cold‑storage keys at scale is non‑trivial; it requires secure key generation, secure signing support in HSMs, and backward compatibility for multisig and threshold schemes.

- Contract and protocol compatibility: smart contracts and LST mechanisms that assume classical ECDSA/secp256k1 semantics may require updates or wrappers to accommodate PQ signatures.

- Insurance and regulatory posture: insurers and regulators will increasingly expect documented PQ migration roadmaps as part of operational resiliency.

The EF’s commitment signals that the protocol will increasingly support the primitives institutions need—hybrid signals, test nets for PQ schemes, and interfaces for HSM vendors.

Practical checklist for CTOs and custody teams

Below are actionable items to translate the analysis into architectural decisions.

Short term (0–6 months)

- Map exposures: classify ETH holdings into cold spot, validator (self‑run), staked via third parties, and LSTs.

- Reassess liquidity needs: set minimum tradable reserves separate from staked reserves to avoid forced unwind in stress.

- Counterparty due diligence: review LST providers’ custody models, slashing history, and redemption mechanics.

- Insurance engagement: ensure policies explicitly cover staking, LST exposures and evolving crypto‑security threats.

Medium term (6–18 months)

- Integrate PQ monitoring: follow EF workstreams and test nets; identify HSM and wallet vendors with PQ migration roadmaps.

- Validator strategy: decide between self‑hosting validators with in‑house security or delegating to vetted providers with robust SLAs and transparency (proofs of stake contribution).

- Hedging architecture: build or buy derivative hedges that can be applied to LST positions if basis risk widens.

Long term (18+ months)

- Implement a PQ migration playbook: key generation standards, hybrid signature deployment, audit frameworks, and a timeline aligned with EF and ecosystem upgrade signaling.

- Scenario drills: simulate mass redemption, LST depeg, and coordinated key rotation to test operational resiliency.

- Governance engagement: participate in protocol discussions to ensure institutional needs (e.g., predictable migration windows, client compatibility) are reflected.

Tradeoffs and open questions

- Liquidity vs yield: liquid staking reduces sale pressure but increases exposure to provider and smart‑contract risk. Institutions must price that into expected returns.

- Concentration risk: if whales and institutions concentrate ETH in a small set of validators or providers, systemic risk to staking infrastructure increases.

- Timing PQ migration: moving too early can lock institutions into immature algorithms; moving too late risks exposure to breakthroughs. The EF’s team reduces this coordination problem but does not eliminate implementation risk.

Conclusion: a layered institutional product, not just a token

Recent on‑chain behavior shows whales accumulating ETH and routing meaningful portions into staking and liquid staking channels. Those flows, combined with renewed institutional interest and a formalized push toward post‑quantum resilience, mean ETH is being treated as a layered institutional product: part yield instrument, part governance asset, part protocol‑level risk exposure. For CTOs assessing large ETH allocations, the required maturity is multi‑disciplinary—on‑chain analytics, custody architecture, counterparty diligence, hedging strategies and cryptographic migration planning.

The good news is the ecosystem is responding: on‑chain capital is aligning with engineering resources (notably the EF’s post‑quantum initiative) and products that let institutions capture yield while managing liquidity. But that alignment obliges institutions to be explicit about where they accept counterparty risk, how they will migrate keys in a PQ world, and what their liquidity buffers look like under stress. If you manage large ETH exposure, start by mapping positions to the custody layers outlined here, engage with your custodian and HSM vendors about PQ plans, and rehearse worst‑case liquidity scenarios.

For more on protocol economics and market mechanics relevant to institutional strategies, see our coverage of Ethereum and how staking primitives interact with broader DeFi liquidity.

Sources