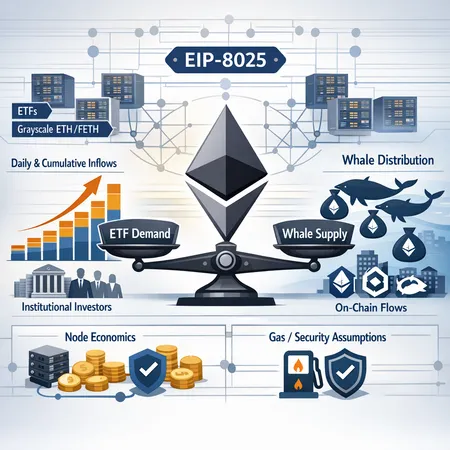

Ethereum ETFs vs. Whale Distribution: How EIP-8025 Could Rewire Node Economics and Risk

Summary

The apparent paradox: rising ETF demand and shrinking whale balances

Over the past year, institutional appetite for spot Ethereum ETFs has registered steady inflows even as on-chain data shows many large addresses trimming holdings. That split—demand emerging through regulated institutional channels while private whales reduce reserves—matters because it forces investors to judge which side has the greater and more persistent economic weight.

For many traders, Ethereum is now both an asset backed by regulated product demand and a live, on-chain economy where supply can move quickly. ETF purchases are concentrated in a few products—Grayscale ETH and FETH among them—and Blockonomi reported daily inflows as high as $13.82M in recent coverage, underscoring a steady institutional bid that acts like a recurring buyer for spot ETH (Blockonomi).

ETF mechanics and cumulative impact

Spot ETFs buy ETH to back shares, which mechanically reduces available spot supply when flows are positive. Two points investors should keep in mind:

Daily vs. cumulative effect: a daily inflow headline (for example, $13.82M) looks modest in isolation, but persistent daily buys accumulate into meaningful custody demand over months—raising the marginal cost of acquiring ETH for other market participants. The cumulative trajectory is therefore more important than single-day figures.

Product concentration: when flows concentrate into a handful of custodial products (Grayscale ETH/FETH are dominant), market impact is not only price-based but also custody-and-liquidity based: large blocks go into institutional vaults rather than circulating in trader-accessible venues.

ETF demand is a structural bid; it doesn’t need the same seller-versus-buyer choreography as retail markets. But it also can be fragile: redemptions, changes to fee economics, or regulatory shifts can change the cadence of buys quickly.

On-chain evidence: whales are shedding since late 2025

On the other side of the ledger, on-chain analytics providers and reporting indicate that many large addresses have been reducing ETH reserves since late 2025. Cryptopolitan’s analysis highlights a pattern of whale wallet distribution and elevated exchange flows that point to supply being funneled back toward liquidity venues (Cryptopolitan).

Why does that matter? Whales selling into an ETF-driven bid are effectively reallocating who holds ETH—moving supply from private cold storage into exchange-inventory or fiat conversions—creating potential short-term pressure even as the ETF narrative suggests scarcity. The final price effect depends on the balance between the ETF absorptive capacity and the velocity of distributed supply.

Institutional accumulation vs. fractured whale selling: the BitMine example

Not all large actors are sellers. BitMine’s aggressive accumulation—reported at 140,400 ETH (≈ $282M)—is evidence that some institutions are using market dislocations to build positions (Cryptopolitan BitMine). That purchase shows two important points:

- Institutional flows are not monolithic. While some large private wallets distribute, other institutions are actively aggregating exposure at scale.

- Size and intent matter. A coordinated accumulation by an entity like BitMine removes meaningful supply from the market for a sustained period if that ETH is held in custody or staked.

Put differently: ETFs create recurring, predictable demand; entities like BitMine create episodic but large demand that can offset transient whale selling. The net price effect depends on timing, custody, and whether accumulated ETH is made available for trading or locked via staking/custody agreements.

EIP-8025 and the new economics of validation

Beyond flows, a second order factor is the protocol-level shift toward proof-based validation—EIP-8025 is one of the updates pushing node and validation economics into new territory. The technical coverage of this transition explains why node operators and validators face different incentives going forward (AmbCrypto EIP-8025).

Key changes to track:

Cost of running a node: proof-based validation changes the computational and storage profile of full nodes and validators. Some tasks become cheaper, others require different resources—raising the bar for certain types of decentralized participation while lowering it for optimized proof services.

Validator economics: EIP-8025 adjusts how proofs factor into block proposals and light-client verification. This can compress or expand rewards for different classes of stakers (solo operators vs. large staking pools), shifting centralization pressures.

Assumptions about gas and security: if proof-based validation reduces some node costs, gas-market dynamics could change indirectly (e.g., fewer transaction failures, different prioritization incentives). Conversely, any increase in validator centralization could raise latent security concerns, especially under stress scenarios.

These are not purely theoretical. Changes in node economics will influence where institutions choose to custody or stake ETH, and what counterparty risk they accept—factors that feed back into the ETF-versus-on-chain supply equation.

What this means for investors and institutional allocators

Bringing the pieces together: ETF flows, whale distribution, institutional buys like BitMine’s, and EIP-8025’s protocol changes create multiple moving parts. Here are practical takeaways and scenario-driven positions:

Scenario A — ETF-dominant tightening: if ETF inflows remain steady or accelerate and large accumulators continue to lock ETH into custody/staking, available circulating supply shrinks and upward price pressure persists. Passive allocations and long-duration holdings benefit.

Scenario B — Exchange-led supply pressure: if whale distribution accelerates into exchanges faster than ETFs and institutions can absorb it, liquidity-driven volatility rises. Tactical traders and volatility-hedged strategies have the edge.

Scenario C — Node-economics shock: if EIP-8025 materially reconfigures validator rewards or increases centralization, staking yields and counterparty risk change—prompting reallocations between liquid ETF exposure and direct staking/custody.

Practical portfolio steps:

- Use layered exposure: combine ETF allocations (for regulated, liquid beta) with small direct staking or custody positions if you want to capture protocol yield—but beware operational and node concentration risks.

- Monitor exchange inflows and large transfer patterns weekly; a sudden uptick in exchange-bound whales can presage short-term price stress even if ETF flows are positive.

- Follow protocol upgrade adoption curves. EIP-8025 may not flip the market overnight, but its longer-term impact on node economics should influence how large allocators think about custody vs. staking.

Tools for monitoring: on-chain analytics, ETF flow trackers, and industry reporting are complementary. Bitlet.app’s institutional features and reporting dashboards can be a practical part of that toolkit when assessing custody and flow dynamics.

Bottom line

ETF demand for ETH establishes a steady institutional bid that—over time—can change the available float and investor base. But on-chain signals of whale distribution and large but uneven institutional accumulation (e.g., BitMine) mean supply dynamics are nuanced. Add a protocol-level pivot like EIP-8025 and you get shifting node economics that impact both operational and macro risk for ETH.

For allocators, the right stance is scenario-driven and operationally informed: respect ETF momentum, but don’t ignore on-chain flows or the incentives created by protocol upgrades. The intersection of custody dynamics, validator economics, and whale behavior will determine whether ETF demand meaningfully offsets on-chain supply shifts over the medium term.

Sources

- Blockonomi — Ethereum ETFs update: 13.82M in daily inflows as Grayscale ETH and FETH dominate: https://blockonomi.com/ethereum-etfs-update-13-82m-in-daily-inflows-as-grayscale-eth-and-feth-dominate/

- Cryptopolitan — Ethereum whale wallets shed reserves 2026: https://www.cryptopolitan.com/ethereum-whale-wallets-shed-reserves-2026/

- AmbCrypto — Ethereum’s 2026 shift: why proof-based validation matters for nodes: https://ambcrypto.com/ethereums-2026-shift-why-proof-based-validation-matters-for-nodes/

- Cryptopolitan — BitMine adds 140,400 ETH (≈ $282M) accumulation: https://www.cryptopolitan.com/bitmine-adds-140400-eth-282m-accumulation/