BlackRock

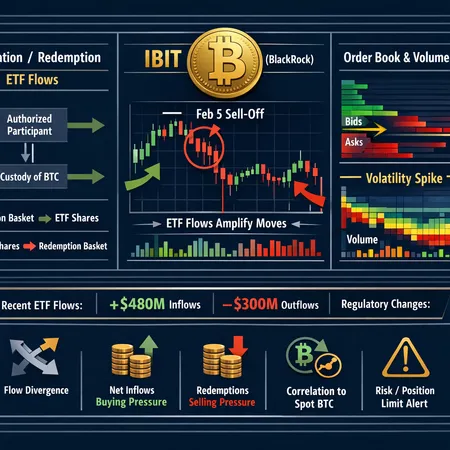

Spot Bitcoin ETFs, especially large products like BlackRock's IBIT, have become a dominant liquidity conduit that can amplify intraday moves through creation/redemption mechanics. This explainer gives intermediate traders and portfolio managers an actionable framework to read ETF-driven BTC price moves.

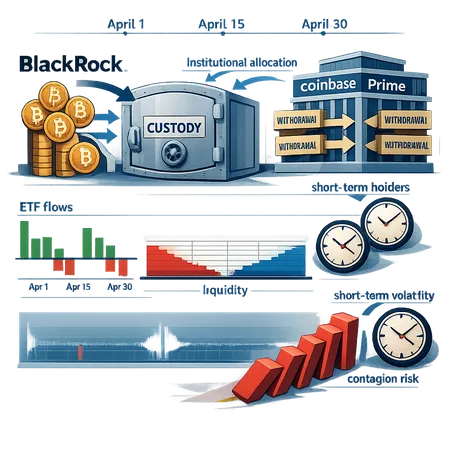

BlackRock’s recent withdrawals from Coinbase Prime during a short-term BTC dip exposed how large custodial moves, ETF flows and short-term holder behavior interact to shape liquidity and price risk. This piece unpacks the timeline, market-structure implications and actionable scenarios for asset managers and advanced traders.

Rumors of a Ripple IPO and renewed ETF speculation — especially around BlackRock — are reshaping how investors view XRP’s future. This piece investigates the evidence for an IPO, how institutional ETFs could alter market structure, technical price outlook into 2026, and the signals investors must monitor.

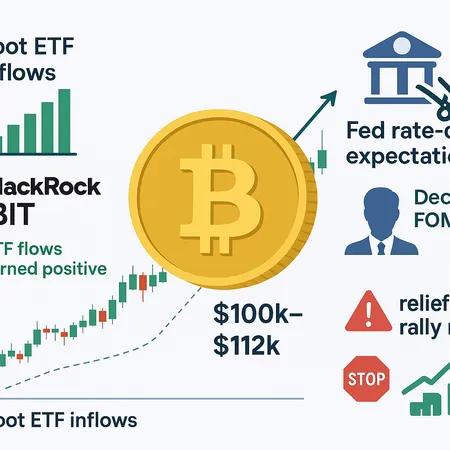

A mix of resumed spot ETF inflows and growing Fed rate‑cut expectations is powering Bitcoin’s recent bounce. This article explains the evidence, technical upside to $100k–$112k, and practical trade and portfolio steps for intermediate investors.

Securitize, a blockchain-based digital securities platform linked to BlackRock, has gone public. This milestone indicates growing institutional interest in crypto-assets and digital securities. For crypto investors, this means more trust, accessibility, and innovation in the digital asset space.

In 2025, major financial institutions like Morgan Stanley, BlackRock, and Vanguard are accelerating their adoption of cryptocurrency, signaling a transformative shift for investors. Learn how this impacts the crypto market and how Bitlet.app’s innovative Crypto Installment service can help you get involved.

Ethereum ETFs are experiencing unprecedented inflows, with BlackRock's ETHA fund reaching a $10 billion milestone. This surge reflects growing investor confidence and points to new opportunities in the crypto market. Platforms like Bitlet.app enable investors to capitalize on such trends by offering flexible crypto installment plans, making it easier to invest in Ethereum today and pay over time.

Institutional giants like BlackRock and platforms such as Truth Social are driving the next wave of cryptocurrency ETFs, signaling growing mainstream acceptance. Explore how these developments shape the future of crypto investments with insights from Bitlet.app's innovative crypto installment services.

BlackRock and Truth Social have announced the launch of new cryptocurrency ETFs, signaling a significant step towards mainstream adoption of digital assets. This move highlights growing institutional interest and opens new opportunities for investors.

BlackRock's launch of an Ethereum ETF marks a significant step toward mainstream adoption of crypto investments. This move offers investors a simpler and regulated avenue to access Ethereum's potential.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility