Meme Coins

DOGE fell ~10% in a one‑day selloff, testing the psychological $0.10 support even as social chatter spiked in mid‑February. This piece weighs technical stress against renewed narrative momentum and offers a practical trading framework for speculative retail positions.

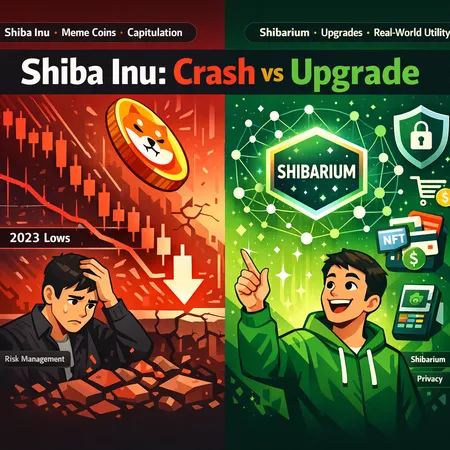

Shiba Inu sits between two narratives: a technical crash to 2023 lows and a bullish roadmap tied to Shibarium upgrades. This piece compares both views, examines market drivers, and gives practical risk-sizing frameworks for retail traders and community managers.

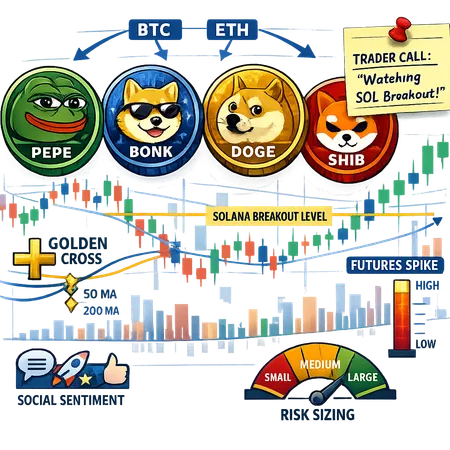

Early 2026 has seen a sharp revival in memecoins — PEPE, BONK, DOGE and SHIB — driven by a mix of social headlines and technical breakouts. This article breaks down what’s real, what’s noise, and practical frameworks for sizing risk without getting wiped out.

Dogecoin's early‑2026 low exposed cracks in the memecoin market: fading 'reserve-asset' narratives, thin order books and collapsing altcoin liquidity. This piece uses DOGE as a case study and delivers a checklist for disciplined exposure to speculative tokens like SHIB.

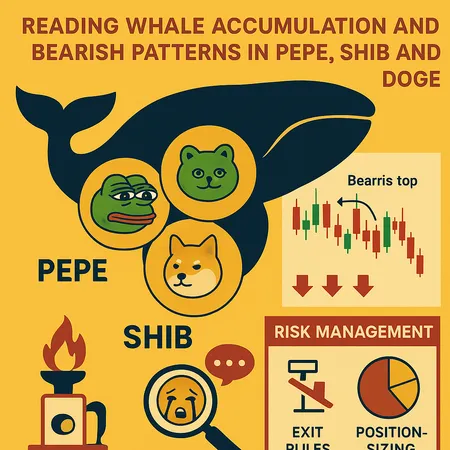

Meme coins trade on narrative and extremes — this guide decodes on-chain whale signals, PEPE’s bearish technicals, and the long-term supply risks in SHIB and DOGE, then gives practical position-sizing and exit rules for retail and quant traders.

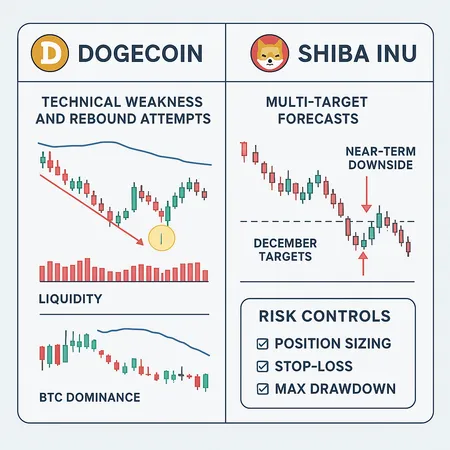

A tactical deep-dive into how Dogecoin’s technical frailty and Shiba Inu’s bifurcated forecasts play out during liquidity drains. Includes concrete entry/exit rules, position sizing formulas, and volatility controls for retail meme-coin traders.