Stablecoin Trust During Market Stress: Lessons from the Hayes vs. Butterfill USDT Debate

Summary

Why stablecoin trust matters in market stress

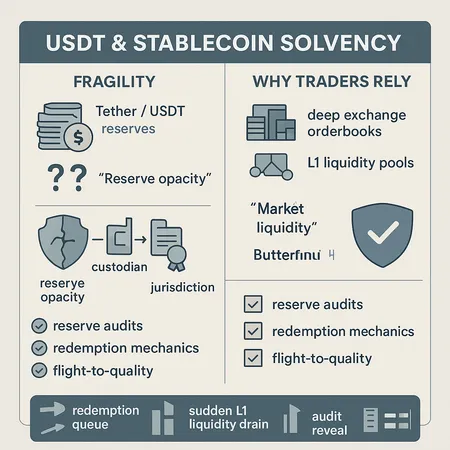

Stablecoins like USDT sit at the junction of crypto-native liquidity and traditional treasury practices. When markets tighten, counterparties stop behaving like willing market makers and start behaving like creditors; that’s when questions of stablecoin solvency, redemption mechanics and settlement finality become urgent. For treasury managers and compliance officers, the relevant question isn’t ideological — it’s operational: can my counterparty (or the token I hold) be converted to settlement currency quickly, predictably, and without large losses?

The Hayes vs. Butterfill debate over USDT brought these operational questions back into the spotlight. It’s not just academic: arguments about whether Tether is fragile or sufficiently backed shape market confidence and influence behaviour in the very moments when confidence is most needed.

The Hayes vs. Butterfill debate — a quick case study

At its core, the debate framed by commentators like Hayes and Butterfill revolves around whether Tether’s reserves and structure create a genuine redemption risk under stress. Critics point to periods of opacity, limited direct redemptions, and reserve composition as reasons to question USDT’s resilience; defenders emphasize liquidity in spot markets, wide on-chain circulation, and commercial reliance on USDT for trading pairs and settlement.

Context matters: commentators have leaned on historical examples and data points rather than a single definitive proof. Coverage summarizing these back-and-forths highlights two things: first, public trust is fragile; second, market participants often use USDT because it works for trading and rail connectivity even if it doesn't resemble a plain-vanilla bank deposit. For a more detailed framing of the debate see reporting that outlines both sides of the argument and what it implies for solvency concerns (AmbCrypto).

Why traders and institutions still rely on USDT

Despite high-profile criticisms, USDT remains deeply embedded in crypto markets. There are three practical reasons for that:

- Liquidity and market depth. USDT pairs exist across almost every exchange and on most L1s, which reduces execution risk and slippage during routine trades. For many traders, Bitcoin and altcoin exposures are hedged via USDT pairs because of the depth and narrow spreads.

- Cross-chain availability. Tether issues tokens across multiple chains (ERC-20, Tron, etc.), which supports rapid settlement across ecosystems — a form of operational liquidity that is hard to replace overnight.

- Network effects and rails. Market makers, OTC desks, and treasury stacks have built operational workflows around USDT. That creates inertia: switching to alternatives in a fast-moving market can increase execution risk and create reconciliation friction.

Those reasons are pragmatic. But pragmatic advantages are fragile when redemption mechanics or reserve composition fail to backstop a sudden run.

How legal and custody structures shape perceived safety

Perception of safety starts outside the blockchain: where the issuer is incorporated, the structure of custody, and the legal remedies available to token holders all matter. Legal structure determines your contractual claims (if any) against an issuer. Custodial structure — whether reserves are held in segregated accounts, with third‑party custodians or as intra-group assets — affects counterparty credit risk.

Tether publishes reserve breakdowns and attestations, but these are not the same as full annual financial audits by an independent Big Four firm. That difference is material for treasury teams used to bank counterparty assessments. “Attestation” provides a snapshot; it does not always offer the same depth of assurance as an audit with full access to counterparty contracts and third‑party confirmations.

Likewise, custody matters. If a meaningful portion of reported reserves lives in short-term commercial paper, repo, or related-party placements, the practical recovery path in stress may be slower and more contested than balances in segregated bank accounts. Compliance officers should map not only what a reserve contains but where it lives and under what legal framework — because that will drive recovery timing and legal remedies under stress.

Key stress-test scenarios to monitor

Below are concrete scenarios treasury and compliance teams should model, with the monitoring lens to use for each.

1) Reserve transparency and audit / attestation events

Scenario: An issuer changes frequency or scope of reserve disclosures, or an attestation highlights illiquid assets.

What to monitor: regularity of attestations, auditor identity, level of detail (cash vs. other instruments), and any sudden increase in non-cash reserve allocations. An absence of rigorous third-party audits increases uncertainty about stablecoin solvency and should shorten the assumed runway in your models.

Practical trigger: if attestations move from monthly to irregular, or commercial-paper allocations exceed a pre-set threshold, initiate escalation and reduce exposures.

2) Redemption mechanics and institutional exit

Scenario: A batch of counterparties seeks fiat redemptions or large peer-to-peer conversions in a compressed timeframe.

What to monitor: the issuer’s published redemption path (who can redeem, fees, minimums), historical redemption timelines, OTC desk behaviour, and whether exchanges accept institutional redemptions without wide spreads. Evidence that redemptions are operationally restricted or only possible through indirect channels is a red flag.

Practical trigger: widening of on‑exchange USDT/fiat spreads, increased queue times at OTC desks, or public statements restricting redemptions.

3) Flight-to-quality and L1 liquidity drains

Scenario: A macro or crypto-specific shock causes a flight to quality; liquidity migrates to perceived safer assets and away from USDT.

What to monitor: on-chain flows (big outflows to exchanges), order book depth across major L1s, and price dislocations (peers paying premiums for other stablecoins or fiat). L1 liquidity — the available liquidity on a given base layer — can dry up even for a deep asset if market makers withdraw; tracking L1 liquidity across chains is therefore essential.

Practical trigger: the emergence of persistent premiums/discounts for USDT in P2P markets, or a rapid increase in on‑chain transfer volumes to a few custodial addresses.

4) Cross‑chain and bridge stress

Scenario: Bridges and wrapped versions of USDT experience delays or insolvency of intermediary custodians, constraining usable liquidity.

What to monitor: bridge transaction confirmations, custody delays, and whether wrapped USDT on a chain can be redeemed back to the native token quickly. Cross‑chain fragmentation can create pockets of illiquidity even when overall supply is large.

Practical trigger: slowed finality on bridge transfers, or sudden withdrawal limits imposed by bridge operators.

Metrics and data sources to incorporate in dashboards

Operational risk requires instrumented monitoring. Useful metrics include:

- Frequency and detail level of reserve attestations and auditor identity.

- On-chain exchange inflows/outflows and concentration to a few wallets.

- Peer‑to‑peer premium/discounts for USDT vs. USD and alternative stablecoins.

- Order-book depth across major trading venues and on multiple L1s.

- OTC market quotes and time-to-settle for institutional redemptions.

- Public statements, regulatory actions, or litigation involving the issuer.

Automated alerts should map metric breaches to a predefined playbook: reduce exposure, trigger redemption, notify legal counsel, and execute hedges.

A practical playbook for treasury managers and compliance officers

Below is an operational checklist you can adapt to internal policy.

- Diversify counterparty stablecoin exposure: set concentration limits by issuer and by settlement chain. Consider alternative holdings such as short-dated government bills where regulatory mandate allows.

- Define redemption assumptions: model worst-case redemption latency and haircut scenarios; test the impact on liquidity ratios and settlement obligations.

- Maintain a stress buffer: hold a liquidity buffer (both crypto and fiat) sized to absorb a multiple of average daily outflows. Ensure buffer assets are quickly accessible across the same L1s you use operationally.

- Test redemptions and reconciliations: run quarterly redemption drills with custodians, exchanges and OTC desks; validate real-world timelines for converting USDT to fiat during a simulated stress event.

- Contractual and KYC hygiene: ensure master agreements cover force majeure, insolvency remedies and custody segregation; verify KYC and AML controls for large OTC counterparties.

- Monitoring and escalation: instrument dashboards for the metrics above and define clear escalation thresholds. Keep legal and compliance counsel looped in real time.

- Communication plan: prepare investor and counterparty messaging templates for various scenarios (delay, partial redemption, halt) to reduce rumor-driven runs.

Operational readiness means combining technical, legal and market intelligence into fast, decisive action.

Two short examples that illustrate why watching the plumbing matters

During episodes of extreme leverage liquidation, contagion can travel fast. Coverage of leveraged liquidations that depressed Bitcoin prices and created acute settlement stress shows how quickly a market can move from orderly to chaotic when counterparties are forced to unwind positions (see a case study of market stress in CoinPedia). Similarly, commentary and analysis around USDT solvency debates highlight how market confidence — not just underlying reserves — determines whether a stablecoin serves as a safe haven during a run (AmbCrypto).

These examples are reminders: operational access to your liquidity matters as much as headline reserve numbers.

Conclusion: be practical, not ideological

Stablecoin solvency debates are not purely academic. The Hayes vs. Butterfill exchange underscores that market trust is an operational asset that can evaporate. For treasury managers and crypto-native compliance officers, the right posture is pragmatic: instrument your exposures, run credible stress tests, tighten concentration limits, and rehearse redemption paths.

USDT will likely remain central to crypto markets for the foreseeable future because of liquidity and network effects. That reality doesn’t replace the need for active counterparty management. Tools and platforms like Bitlet.app can help operationalize some monitoring and execution tasks, but governance, documentation, and disciplined drills are what really reduce redemption risk.

Sources

- AmbCrypto — Is USDT safe? Inside the Hayes vs Butterfill battle over Tether’s solvency: https://ambcrypto.com/is-usdt-safe-inside-hayes-vs-butterfills-battle-over-tethers-solvency/

- CoinPedia — What caused Bitcoin price to crash below $90K today? (example of leveraged liquidation and market stress): https://coinpedia.org/news/what-caused-bitcoin-price-to-crash-below-90k-today/