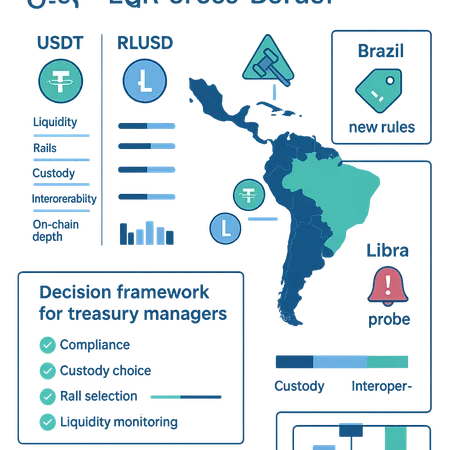

Stablecoins in LatAm: USDT vs RLUSD — Regulatory Risks, Liquidity, and a Treasury Decision Framework

Summary

Why stablecoin choice matters for LatAm treasuries

Latin America is a fragmented payments landscape: dozens of fiat rails, varying exchange controls, and wildly different regulatory appetites across jurisdictions. For treasurers and payments architects looking to use stablecoins as settlement rails, the choice between major issuers like USDT and newer entrants such as RLUSD is not only technical — it is regulatory and operational. The wrong decision can create settlement friction, exposure to on-chain liquidity gaps, or compliance headaches in countries like Brazil that are actively tightening stablecoin oversight.

Selecting a stablecoin rail affects FX execution, custody models, reconciliation workflows, and the speed/cost of cross-border corridors. It also influences counterparty exposure: does your firm accept custodial wallets and a centralized issuer, or prefer an interoperable, regulated-backed coin with narrower corridor support? These trade-offs matter more in LatAm because liquidity depth and regulatory clarity vary by corridor.

Regulatory backdrop in LatAm: Brazil’s rules and the Libra probe

Regulation is the single biggest exogenous risk for treasury teams operating in LatAm. Brazil recently implemented a stringent stablecoin ruleset that raises licensing, reserve disclosure, and AML requirements for issuers and intermediaries — a material change for any entity using crypto rails to move value into or out of Brazilian reais. The new framework also accelerates supervisory scrutiny of non-compliant activity, making onshore partners and licensed gateways more attractive. For readers, see a concise roundup of the policy shifts and enforcement posture in Brazil and the broader region in this LatAm regulatory coverage.

Meanwhile, the high-profile probe into LIBRA-era projects underscores how political narratives can drive enforcement even when technical risk is limited. Authorities are often concerned about monetary sovereignty, systemic risk, and AML exposure — all issues that directly affect stablecoin-based cross-border settlement. Treasury teams should treat regulatory momentum as a variable in rail selection, not a static background assumption. (For background on these developments, consult this LatAm regulatory roundup.)

Quick profiles: USDT vs RLUSD — what treasuries need to know

USDT (Tether)

USDT is the largest on-chain fiat peg by market cap and by far the deepest source of on-chain liquidity in many LatAm corridors. Native on Ethereum, Tron, Solana and several other chains, USDT provides broad exchange and OTC market access, tight spreads, and multiple custodial providers. That liquidity makes USDT attractive for FX execution, intraday hedging, and fast settlement. Downsides include issuer centralization, recurring questions about reserve accounting in some jurisdictions, and regulatory sensitivity in countries that treat custodial pools and stablecoin issuance as banking-like activity.

RLUSD (Ripple USD)

RLUSD is positioned as a regulated-backed stablecoin designed for payments rails and cross-border liquidity — it emphasizes compliance, audited reserves, and integration with Ripple’s payment stack. RLUSD aims to be more interoperable with legacy banking partners through compliance features and vetted gateway relationships, which could simplify on-ramps in jurisdictions enforcing tight controls. However, RLUSD’s on-chain liquidity is currently smaller and more concentrated than USDT’s, which can mean wider spreads and larger slippage in high-volume corridors until adoption scales. A practical comparison of USDT and RLUSD’s strengths and chain support is useful for treasurers weighing these trade-offs.

Custody and interoperability trade-offs

Choosing a stablecoin involves custody decisions that cascade into compliance and ops. Custodial models — using trusted custodians, banks, or exchanges — simplify AML/KYC and make regulatory reporting easier, but they reintroduce counterparty risk and potential withdrawal limits in stressed markets. Non-custodial or self-custody approaches reduce counterparty dependency but raise operational burdens: secure key management, liquidity sourcing, and the need for on-chain monitoring.

Interoperability matters too. USDT’s presence across many chains makes it easy to route liquidity through the cheapest or fastest chains (e.g., Tron vs Ethereum). RLUSD’s design and partner integrations may offer smoother fiat on/off ramps for regulated markets but might lock you into a narrower set of rails. For treasurers, a hybrid model—primary custodial liquidity for day-to-day flow and a self-custody buffer for settlement assurance—often balances these trade-offs well.

On-chain liquidity depth and corridor strategy

Liquidity depth is corridor-specific. In pairs that route to major exchanges (USD/BRL, USD/MXN), USDT typically offers tighter spreads and better order book depth. That makes USDT the pragmatic choice for high-frequency FX execution and large-value settlements. In corridors where regulated on-ramps and partner banks are the binding constraint, RLUSD’s compliance-first posture and partner integrations could shorten settlement ladders even with less on-chain liquidity.

Treasure managers should map liquidity by corridor: test order-book depth, slippage at target ticket sizes, and time-to-settlement across chains. Track stablecoin flow on-chain over weeks to spot sudden liquidity withdrawals, a leading indicator of corridor stress. Use internal tooling or third-party analytics to quantify the effect of slippage on FX P&L and to set corridor-specific concentration limits.

A practical decision framework for corporates and payments companies

Use this five-step framework to pick a primary and secondary stablecoin rail for LatAm operations:

- Corridor mapping — list the fiat corridors you need (e.g., BRL, MXN, ARS) and rank them by volume and regulatory friction.

- Liquidity audit — measure on-chain order-book depth and average slippage at your ticket sizes for USDT and RLUSD on relevant chains.

- Compliance fit — evaluate issuer transparency, reserve attestations, and how each coin’s redemption/on-ramp partners align with local licensing (important under Brazil’s new framework).

- Custody model — choose between custodial, self-custody, or hybrid based on your operational capacity and counterparty exposure limits.

- Runbook and failover — define fallbacks (e.g., if USDT liquidity drops, swap to RLUSD via a pre-approved gateway) and test them quarterly.

A weighted scoring matrix combining volume, liquidity cost, compliance score, and operational complexity will make the choice defensible to auditors and senior management. For many payment companies, a dual-rail approach (USDT for depth, RLUSD for regulated on-ramps) is the most pragmatic path while monitoring legal developments.

Compliance, reporting, and Brazil-specific considerations

Brazil’s stricter rules change how treasury teams should think about issuer relationships and local partners. Under the new regime, intermediaries facilitating conversion between stablecoins and BRL may require explicit registration or licensing. That raises the importance of working with onshore partners who already understand local AML, CFT, and capital flows. In practice this means preferring stablecoin issuers or gateway partners with clear reserve policies, audited attestations, and a willingness to cooperate with local supervisors.

Treasurers must also prepare enhanced reporting: reconcile on-chain flows to bank statements, keep granular KYC/transaction records, and set thresholds for suspicious activity reporting. If using RLUSD because of its compliance features, confirm that its partner gateway(s) support Brazilian regulatory reporting, and document contractual commitments for redemptions in stressed scenarios.

Implementation checklist and operational playbook

- Counterparty due diligence: confirm issuer attestations, redemption terms, and sanctions screening policies.

- Corridor liquidity tests: run staged swaps at live volumes to measure slippage and settlement times.

- Custody policy: document key management, multi-sig requirements, and provider SLAs.

- Legal mapping: align with local counsel on licensing implications in each LatAm country where you operate, with priority on Brazil.

- Reconciliation flows: automate ledger reconciliation between on-chain receipts and ERP/treasury systems.

- Stress tests: simulate exchange delisting, issuer freeze, or reserve shortfall and validate failover to the secondary rail.

Bitlet.app’s architecture model—designed for installment and P2P use cases—illustrates how product teams can combine on-chain rails with fiat gateways while retaining compliance controls; treasury teams should learn from such integrations when designing their own stacks.

Example trade-offs in a real corridor: USD → BRL

Imagine a payments company settling USD receipts into BRL payrolls. Using USDT gives immediate liquidity and low slippage on major DEXs and CEXs, but converting USDT to BRL may require a licensed Brazilian gateway and exposes you to issuer counterparty risk. Using RLUSD may make the on-ramp to BRL smoother if the issuer’s partner bank has Brazil coverage and the coin meets local disclosure rules, but you may pay more in execution costs due to narrower liquidity.

A practical, low-friction approach is to hold a primary USDT pool for execution efficiency and a secondary RLUSD corridor with pre-approved gateway agreements for regulatory resilience and onshore settlement. Test and document the time-to-cash for both rails under ordinary and stressed conditions.

Mitigating legal and liquidity risk: best practices

- Keep diversified rails and avoid concentration in a single issuer or chain.

- Negotiate contractual liquidity commitments with gateway partners where possible.

- Require periodic reserve attestations and legal opinions from issuers.

- Maintain fiat buffer accounts in-region to absorb temporary on-chain liquidity swings.

- Work with local counsel in high-regulation jurisdictions (Brazil first) to ensure your flows don’t trigger unexpected licensing needs.

Conclusion: balanced rails for a dynamic region

There is no one-size-fits-all answer. For many LatAm corridors, USDT remains the pragmatic choice for day-to-day liquidity because of its depth and multi-chain footprint. RLUSD offers a compelling value proposition where regulatory alignment and bank partner integrations shorten the fiat on/off ramp and reduce supervisory friction, particularly as Brazil and other LatAm regulators clarify rules. Treasury teams should apply a corridor-by-corridor decision framework, pair liquidity audits with legal mapping, and implement hybrid custody and failover models to balance cost, speed, and compliance.

Stay pragmatic, monitor regulatory news, and run regular stress exercises. For treasuries in fast-changing LatAm markets, a dual-rail strategy—backed by clear operational runbooks and documented governance—will often be the safest route to scale cross-border payments without taking undue regulatory or liquidity risk.

For further reading on the issuer comparisons referenced here, see a practical market-by-market comparison of USDT and RLUSD, and for a deeper look at LatAm regulatory moves including Brazil’s rules and the Libra probe, consult the regional regulatory roundup.

For context: comparison of USDT vs RLUSD strengths and chain coverage is detailed in this market comparison (source). More on Brazil’s new rules and the LIBRA probe is available here.