Rumble Wallet with Tether: Noncustodial USDT Payments for Creator Monetization

Summary

Why Rumble’s wallet matters for creators and platforms

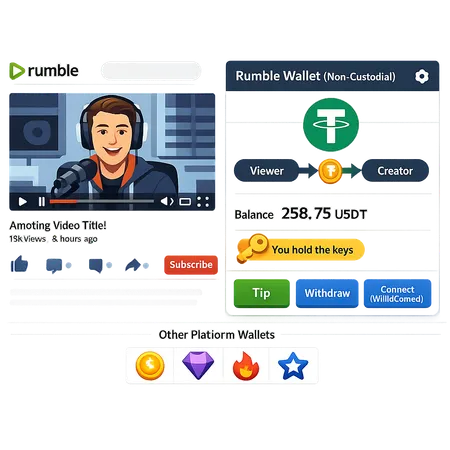

Rumble’s announcement of a wallet built into its video platform, in partnership with Tether, is more than a novelty — it’s a practical experiment in shifting payments and tips from fiat rails to stablecoin rails. By using USDT for settlement and a noncustodial model for token custody, Rumble tries to preserve user control while making in‑app value transfer immediate and programmable. The move sits squarely at the intersection of the creator economy, blockchain payments and product UX work that platform teams are currently wrestling with.

This matters for creators because it changes the latency and cost of receiving money, and for product teams because it changes identity, KYC and revenue mechanics. For many readers who follow crypto market developments, this is an iteration on earlier platform wallets — but with a heavier emphasis on stablecoin-native settlement and embedded custody UX.

What the Rumble Wallet is and how it works

According to the launch coverage, the Rumble Wallet is embedded into the Rumble platform and leverages Tether’s USDT for settlement. The integration aims to enable tipping, creator payouts and creator‑fan transfers without forcing off‑platform conversions every time a user wants to tip or pay for content. The announcement positions the wallet as a native payment rail for creators, not a separate product that lives outside the app (Rumble Wallet built with Tether).

High‑level architecture looks like this:

- A user creates or links a wallet inside Rumble’s app UI.

- Custody is noncustodial: private keys are held by the user (or derived locally) rather than by Rumble. That means Rumble cannot unilaterally move funds.

- Tipping, paid access, and payouts are denominated and settled in USDT.

- Off‑ramps (fiat conversion) and merchant rails are optional, handled via partnered providers.

This design reduces settlement volatility (USDT is a dollar‑pegged stablecoin) and leans on token rails to make value flows near‑instant and programmatic.

Noncustodial design and token custody UX

Noncustodial custody is a double‑edged sword for product leads. On one hand, it aligns with user sovereignty — creators and fans truly own tokens and private keys. On the other hand, it introduces friction: key management, device loss, seed phrase backup, and recovery are annoying for mainstream users.

Rumble’s challenge is to offer a custody UX that hides much of the complexity while preserving the security benefits of noncustody. Typical approaches in market experiments include:

- Key‑backup abstractions (encrypted backups to user email or cloud that still let users retain ultimate control).

- Social recovery (trusted friends or custodial fallback in emergencies).

- Account‑bound devices: private keys stored in secure enclaves and recoverable through multi‑factor flows.

If Rumble applies any of these, the tradeoff is between cognitive overhead and attack surface. Product teams should log test metrics around recovery rates, help‑desk tickets, and conversion lift from wallet‑enabled tipping.

How USDT settlement changes creator monetization flows

USDT eliminates the immediate FX and volatility risk that comes with native token tips. Practically, that means creators see amounts closer to what fans intend to send (a $5 tip is a $5 tip), and platforms can more easily model revenue and payouts.

Common monetization flows enabled by USDT settlement:

- Instant tips during live or recorded content with minimal settlement lag.

- Micropayments for pay‑per‑view clips or premium comments where fees would otherwise kill economics.

- Creator subscriptions denominated in USDT, with programmatic prorations and refunds.

- Cross‑border payouts without multi‑currency bank rails.

Operationally, platforms can either hold accumulated USDT in hot/cold wallets (and convert to fiat on cadence) or execute liquidity routing with partners. That’s similar to other on‑chain payment plays — see how merchant rails are evolving in the market with projects connecting wallets to point‑of‑sale experiences (Wirex and Tron example).

UX for creators: custody, payouts and cashing out

Creators care about predictability and simplicity. Practical expectations include:

- Immediate balance updates in USDT after a tip.

- Payout scheduling (daily/weekly) with clear fiat conversion fees and timelines.

- In‑app tools for invoicing, tax reporting, and revenue analytics.

Platforms should offer a simple ‘convert to fiat’ flow that shows fees and settlement time, plus the option to retain USDT for further on‑chain interactions (e.g., tipping other creators, participating in platform DAO votes, or DeFi yield). For creators interested in broader crypto activity, these flows lower the friction to experiment with NFTs, memecoins and other DeFi primitives.

Revenue models and practical math for product teams

Introducing an on‑platform creator wallet opens new monetization levers beyond a flat platform fee. Consider the following models and the key metrics to monitor:

- Fee on‑chain swaps and conversions

- Charge a small percentage on USDT→fiat conversions (e.g., 0.5–2%).

- Monitor churn sensitivity to conversion fees and the volume split between users who hold vs cash out.

- Convenience fees and instant payouts

- Offer instant fiat payouts at a premium. Charge for ‘instant cashout’ versus free scheduled payouts.

- Measure ARPU uplift from instantization.

- Value‑added services

- Analytics, tipping streak boosters, premium promo placements, or fan access that can be purchased in USDT.

- Track attachment rates and LTV uplift.

- Treasury and routing

- Platforms can earn yield on pooled USDT (with compliance controls) or manage FX spreads across liquidity partners. This is revenue, but also a regulatory exposure.

Example back‑of‑envelope model:

- Creator takes home 90% of tip. Platform fee 5%. Conversion fee 1%. Liquidity routing yield 0.1% captured.

- For $100k monthly tips volume, platform fee revenue = $5k; conversion revenue depends on how much is cashed out.

Run sensitivity analyses for cash‑out rates. If 70% of USDT is cashed out monthly, conversion revenue matters. If 70% is retained on‑platform, value‑added service revenue grows instead.

Onboarding, KYC and compliance tradeoffs

One of the biggest decisions for a platform wallet is how far to push KYC, and when. Noncustodial design helps reduce some compliance burdens — platforms that don’t custody funds have a different regulatory footprint than custodians — but they still face AML, sanctions screening and tax reporting complexities tied to fiats and off‑ramp partners.

Design patterns and tradeoffs:

- Light onboarding + partner KYC on cashout: let users create wallets with minimal friction, then require KYC only when they convert USDT to fiat via a third‑party. This maximizes growth but concentrates compliance at the fiat gateway.

- Strong KYC early: require identity verification to create a wallet. This reduces fraud and high‑risk activity but raises conversion friction and lowers conversion rates among privacy‑seeking users.

- Tiered limits: combine light onboarding with progressively stricter KYC thresholds for higher transaction volumes or faster payouts.

Practical recommendations:

- Align KYC policy with your legal advisers and the jurisdictions where you operate; stablecoin rails and fiat partners will each bring their compliance rules.

- Make compliance transparent in the UX: explain why KYC is needed and what data is used.

- Instrument identity flows carefully: measure drop‑off rates at each KYC prompt and A/B test fewer fields vs stronger verification methods.

Noncustodial wallets reduce certain operational liabilities, but any fiat‑on/off ramp will reintroduce KYC and AML requirements. Platforms such as Rumble appear to be leaning on partners (Tether and payouts partners) to provide the rails and compliance checks, a pattern mirrored in other merchant‑onboarding plays.

Competitive landscape: WalletConnect, in‑app wallets and merchant rails

Rumble’s approach competes both with pure wallet connectors and other in‑app wallet strategies. WalletConnect has been pushing merchant and wallet‑based payments as a way to bridge wallets and merchants without embedding custody in a single app — see WalletConnect Pay’s mainstreaming efforts (WalletConnect Pay context). That model preserves user custody while standardizing the UX across platforms.

Comparative notes:

- WalletConnect model: lightweight for platforms (no embedded wallet), standardized UX, relies on user wallets for custody. Good when you want interoperability across wallets.

- In‑app noncustodial wallet (Rumble): seamless, app‑native experience; better conversion because users don’t need an external wallet. But it requires the platform to solve key management UX and pair with liquidity/custodial partners for off‑ramp.

- Full custodial model (platform holds funds): lowest friction but highest regulatory and operational costs.

Wirex + Tron and similar merchant rails show another angle: fully on‑chain merchant infrastructure that focuses on payments at point‑of‑sale and routing. These examples illustrate that platforms have many architectural options; the right one depends on desired UX, regulatory appetite and monetization goals (Wirex & Tron rails).

Recommendations: onboarding checklists and product priorities

For creators and product leads building or adopting a creator wallet, here are practical next steps:

- Prototype the custody UX: run usability tests for seed phrase, social recovery and device‑backed keys. Track support volume and recovery success.

- Define cash‑out flows early: pick partners for fiat conversion and agree SLAs and fee schedules. Make those visible to creators.

- Implement tiered KYC: light for low limits, stronger for high volumes or instant fiat. Measure conversion impacts.

- Build clear revenue experiments: try platform fee vs premium payout vs conversion fee and run short A/B tests. Use cohorts to measure long‑term ARPU impact.

- Educate creators: provide simple guides on USDT handling, tax reporting, and pros/cons of retaining vs cashing out. Creators will value predictability.

- Monitor ecosystem standards: integrate with WalletConnect for interoperability or offer it as an option to power external wallets for power users.

For creators specifically: start small. Accepting USDT tips can be a low‑friction way to test demand, but creators should track tax obligations and consider whether to cash out regularly or adopt a dollar‑peg treasury plan.

Closing thoughts

Rumble’s built‑in, noncustodial wallet with USDT settlement is a meaningful test case for how video platforms can bake crypto into creator monetization without full custodial risk. It’s not a panacea — onboarding friction, KYC tradeoffs and liquidity arrangements will determine how broadly creators and mainstream audiences adopt the flow. Still, the core idea — direct, programmable, dollar‑pegged payments inside the platform — is powerful and worth experimenting with for any product lead or creator thinking about the next evolution of fan monetization.

For teams exploring similar builds, watching how WalletConnect, merchant rail projects and wallet vendors evolve their UX and compliance stacks will be instructive as the market decides whether in‑app noncustodial wallets or connector‑based models become the dominant pattern. And if you want to see similar product thinking in action, platforms like Bitlet.app are building around integrated crypto payment and P2P flows that echo these design choices.

Sources

- Rumble and Tether launch wallet: AltcoinBuzz announcement

- Wirex and Tron on‑chain merchant rails: AltcoinBuzz coverage

- WalletConnect mainstream payments context: Cryptonomist coverage