Tether’s Paradox: Buying Gold While Exiting Uruguay Mining — What It Means for USDT Risk

Summary

Executive snapshot

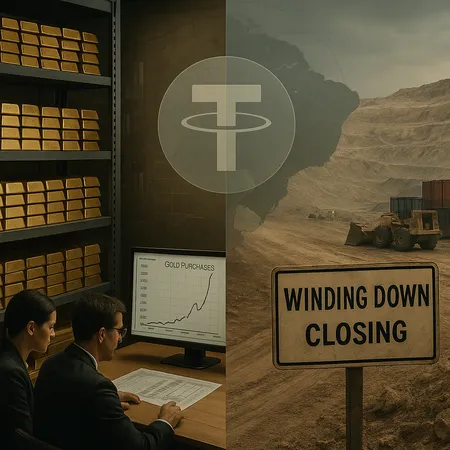

Tether’s recent moves — buying large quantities of gold while simultaneously winding down its mining operations in Uruguay — create an apparent paradox: one hand adding illiquid, non-cash assets to reserve coffers; the other exiting an operational, capital-intensive business. Both actions speak to a strategic reshaping of risk profile that matters for anyone sizing short-term stablecoin exposure: traders, corporate treasurers and macro desks.

The evidence: Tether the big gold buyer, and the Uruguay exit

In Q3, market reporting identified Tether as the world’s largest buyer of physical gold, a signal of active reserve diversification rather than static holding patterns. Coverage summarizing bullion flows places the company at the top of Q3 purchases, highlighting an unexpected presence in bullion markets Tether was the world's largest gold buyer in Q3.

At the same time, Tether publicly wound down its mining operations in Uruguay, a discrete operational retrenchment described in reporting on the company’s exit from local crypto-mining investments Tether finally winds down mining operations in Uruguay. The juxtaposition is striking: adding passive, store-of-value assets while removing direct involvement in energy- and infrastructure-heavy mining.

Why would a stablecoin issuer accumulate gold reserves?

There are several plausible rationales, individually and combined:

Diversification away from cash- and short-term paper concentration. Holding physical gold reduces exposure to bank runs, commercial paper freezes, and sovereign risk concentrated in fiat instruments. For an issuer of USDT, which must defend a one-to-one peg in stress, this is a way to spread macro risk across asset classes.

Public signaling and perception. Gold is widely recognized as a long-term store of value. Accumulating bullion can be framed as prudential stewardship to reassure markets and counterparties that reserves are not narrowly concentrated in potentially volatile or bail-in-able bank liabilities.

Inflation and macro hedge. In environments where fiat debasement is a concern, gold offers a non-sovereign hedge. While not a perfect liquidity substitute for USD cash, it can complement cash buffers.

Regulatory optics. Showing a reserve comprised partially of tangible assets can be used to counter narratives that stablecoins are backed only by opaque commercial paper or risky assets — though that depends on disclosure quality.

That said, gold is not a drop-in substitute for cash in clinic liquidity events: selling large amounts of physical bullion under stress can be costly and slow, and repo markets for gold differ from money markets.

Why exit mining in Uruguay? Reading the operational signal

Mining operations are capital- and operationally-intensive, exposed to energy markets, regulatory friction, and local political dynamics. Winding down those activities could indicate a few things:

Capital reallocation. Tether may be moving capital from operational ventures into balance-sheet assets it can control more tightly, such as bullion or marketable securities.

De-risking of non-core operations. Operating mines invites discrete operational and reputational risks (accidents, disputes, environmental scrutiny). Exiting reduces the attack surface.

Regulatory and geopolitical prudence. Mining in jurisdictions with evolving crypto policy can create compliance and legal complexity. Pulling back is a way to reduce future regulatory friction.

Together with large gold purchases, the exit suggests a pivot from an active physical-ops playbook toward a financial-reserve posture: fewer on-the-ground operations, more reserve-layer asset management.

Implications for USDT’s reserve strategy and market trust

These moves have nuanced effects on how market participants should view USDT’s resilience.

Pros: Diversification into gold can reduce some single-point concentration risks (bank counterparty and short-term funding exposures). The mining exit reduces operational tail risk and simplifies corporate structure.

Cons: Gold is less liquid than cash in panic scenarios; heavy allocations to bullion increase market liquidity risk even as they lower credit risk. The benefit to trust depends critically on disclosure: if the market knows gold weightings, storage, insurers, and disposal plans, then confidence can improve. If not, the change may simply add opacity.

Net effect is conditional. If Tether couples gold purchases with regular, independently attested disclosures and a clear liquidity framework (e.g., defined cash buffers, committed lines, gold repo options), the diversification is constructive. If holdings are opaque, the narrative shifts toward complexity without the transparency necessary for market confidence.

For many desks, Bitcoin remains the bellwether for on-chain liquidity and risk sentiment; how USDT is seen relative to cash alternatives will feed into collateral haircuts and funding choices.

How to interpret these moves for sizing short-term stablecoin exposure

Risk officers and treasurers should translate corporate posture into actionable sizing and policy changes. Practical steps:

Revisit concentration limits. Do not treat USDT the same as cash simply because it pegs to USD. Define explicit counterparty exposure caps (e.g., maximum % of liquid treasury assets in any single stablecoin).

Increase scenario-based haircuts. In liquidity stress tests, model the impact of a run where gold cannot be monetized at fair value within 7–30 days. Assign larger haircuts to reserves you believe include illiquid assets.

Assess redeemability mechanics. Review how fast and at what cost large redemptions of USDT have been handled historically. Counterparty redemption windows and settlement rails matter far more when reserves tilt away from immediate cash.

Use rolling liquidity buffers. Keep a mix: high-quality cash, highly transparent and regulated stablecoins, and a smaller allocation to USDT sized by your institution’s tolerance and immediate cash needs.

Watch on-chain indicators. Net flows, on-chain balances on exchanges, and premium/discounts versus USD are high-frequency signals of stress in USDT supply/demand.

Counterparty due diligence. Monitor disclosures, attestations, and any third-party proofs about gold custody, insurance and whether gold is held segregated and available in practice.

A pragmatic allocation rule for treasury managers: treat a portion of USDT as ‘operational liquidity’ (for fast rails and trading), but cap the portion used for overnight or immediate needs unless disclosures substantiate the cash-convertibility of reserves.

Regulatory and reputational risks to monitor

A pivot in reserve composition and operational focus flags several oversight and market-perception vectors:

Audit and attestation scrutiny. Regulators and counterparties will demand clearer, periodic proof of reserves. The absence of timely, independent attestations increases reputational and regulatory risk.

Questions about valuation and realizability. How is gold valued on the balance sheet? Are fair-value estimates conservative? Are there repurchase or custody encumbrances? These are questions auditors and supervisors will ask.

Cross-border compliance and sanctions risk. Commodity purchases and custody arrangements span jurisdictions. Any sanctions exposure in custody or liquidity channels becomes a compliance focal point.

Market narratives and contagion fears. If the market interprets gold purchases as a sign of stress (i.e., moving away from fiat due to bank concerns), it could paradoxically accelerate runs across other stablecoins. Messaging and transparent disclosure are crucial to avoid misinterpretation.

Reputational risk tied to operational exits. Exiting mining can be positive (de-risking) or negative (abandoning projects after losses). How Tether communicates the rationale will shape market reaction.

Regulators are increasingly focused on stablecoin reserves and redemption mechanics; issuers that can’t explain liquidity timelines and monetization channels will face higher scrutiny.

Practical checklist for risk teams (short)

- Update redemption and liquidity stress tests with a gold-monetization leg.

- Recalculate haircuts and concentration limits for USDT.

- Demand or request periodic, detailed attestations showing gold custody arrangements, insurers, and repo availability.

- Maintain a diversified stablecoin allotment and larger cash buffers for settlement-critical needs.

- Monitor on-chain flows and secondary market spreads for early signs of stress.

Final read: not a simple de-risk, but a re-shape

Tether’s simultaneous accumulation of gold and exit from Uruguay mining is less a contradiction and more an intentional reshaping of corporate and balance-sheet risks: trading operational complexity for asset diversification. That re-shape can improve or worsen the practical resilience of USDT depending on transparency, liquidity execution plans, and regulatory responses.

For treasury managers and macro traders, the right posture is pragmatic skepticism combined with diligence: assume partial illiquidity, demand clarity, and size exposures so your desk can operate through both redemption spikes and episodic market dislocations. Keep an eye on disclosures and regulatory signals — those will determine whether these moves are a genuine strengthening of reserve strategy or simply a rearrangement that leaves the peg and market trust vulnerable.

Bitlet.app users and institutional clients monitoring stablecoin counterparty risk should integrate these points into their treasury policies and monitoring dashboards.