What Tether’s Bold Juventus Bid Reveals About Stablecoins Betting on Real-World Assets

Summary

A headline that landed like a splash

In late 2024 and early 2025, reports surfaced that Tether — the issuer of USDT, the world’s largest stablecoin by market cap — tabled an all-cash offer to buy Juventus in the region of €1 billion (widely reported as $1.1 billion). The initial coverage noted a decisive, cash-heavy approach Blockonomi reported the €1B offer, while follow-ups indicated the bid was rejected and described the $1.1B figure in more dollar-centric terms (CryptoNews).

That alone would have been newsworthy: a stablecoin issuer making a play for a globally recognized football club. But framed against Tether’s wider corporate moves — from tokenized gold exposure to investments in AI robotics — the bid reads less like a one-off media stunt and more like a deliberate pivot into real-world corporate playbooks. Coinpedia’s coverage also captured the immediate market reaction, where JUV fan tokens spiked on the news, signaling how tokenized fan economies can react to M&A rumors (Coinpedia).

Why would a stablecoin issuer want a football club?

Acquiring a sports franchise is not simply about trophies and brand logos. For a company like Tether, the strategic rationales are layered:

Brand, trust and mainstream legitimacy

A global club gives a deep, consumer-facing brand that can normalize a company’s name beyond crypto circles. Mainstream finance observers tend to look at such moves as attempts to buy social legitimacy — useful for a firm whose core product, USDT, sits under persistent regulatory and accounting scrutiny.

Payments rails, commerce and fan tokens

Sports clubs are commerce engines: matchday payments, merchandising, hospitality, broadcasting rights. Owning such an asset offers a live testing ground for alternative rails — whether processing revenues in stablecoins, offering crypto-denominated memberships, or integrating tokenized loyalty. We already saw fan token prices react to the news, which underscores how sports assets and tokenized fan economies can amplify each other. For traders who follow Bitcoin and related markets, these quick feedback loops are familiar.

Data and network effects

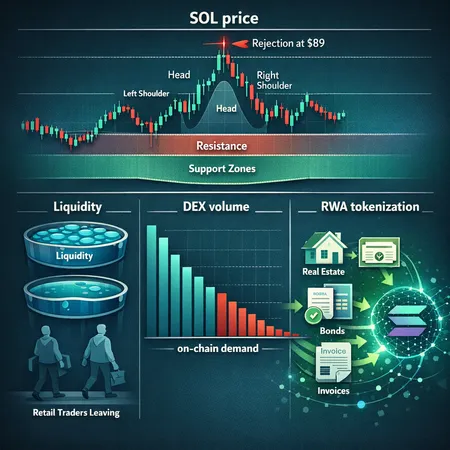

Matchday interactions, ticketing flows and consumer spending create datasets that can feed personalized offers, tokenized rights or loyalty programs. In the hands of a deep-pocketed stablecoin issuer, those data flows become leverage points for new financial products and RWA tokenization strategies.

Diversification and RWA exposure

Owning high-profile real assets is one path to diversify balance sheets and increase exposure to real-world assets (RWA). Tether’s interest in tokenized gold and other non-crypto ventures suggests it is looking to anchor some economic value outside purely on-chain instruments.

The broader corporate picture: tokenized gold, AI robotics and huge USDT flows

The Juventus story sits alongside other moves that indicate Tether’s ambition to expand into tangential industries. Reporting summarized how the company has explored tokenized gold exposure and even investments in AI robotics — efforts that reframe the issuer as a diversified corporate actor, not solely a payments infrastructure provider. AmbCrypto reported heavy internal USDT movement and mentioned a valuation target signaling very large ambitions (AmbCrypto).

These pieces fit a pattern: large stablecoin issuers are seeking to anchor their digital-liquidity businesses with tangible operations or collateralizable assets. If a firm can bring tokenized gold holdings, robotics revenue streams, or even a sports club under one roof, it can argue for broader economic resilience — at least in corporate messaging.

Regulatory and PR risks: ownership under the microscope

A stablecoin issuer operating a football club would force multiple domestic and international regulators to pay closer attention. Consider the risk vectors:

Reserve transparency and conflicts of interest

Tether has long faced scrutiny about the composition and transparency of USDT reserves. Owning or operating high-profile consumer assets raises questions: are corporate funds and customer-pegging reserves clearly separated? Could revenue streams be blended in ways that complicate audits? Regulators are likely to ask for clearer reporting if a payments utility becomes a major sports owner.

AML/KYC and cross-border payment friction

Clubs are hubs for international payments: ticketing, transfers, broadcasting — each introduces AML and KYC requirements in multiple jurisdictions. Regulators will want assurance that a stablecoin issuer’s crypto rails won’t be used to bypass standard compliance controls.

Political and reputational risk

Sports owners face public and political pressure over transfers, stadium deals, and local investments. If a stablecoin issuer becomes associated with controversial moves, the reputational damage could cascade back to its core financial products. That’s especially perilous when a token like USDT is relied on for everyday liquidity across exchanges.

Sports governance and fan backlash

Fans and club stakeholders often resist opaque ownership. A corporate player with perceived conflicting incentives — such as prioritizing tokenized monetization over club culture — risks consumer and regulatory pushback. The fan token surge after the initial news shows how quickly supporters can react financially; they can also mobilize politically.

Stablecoin M&A as a new battlefield

Tether’s audacious bid highlights an emerging theme: stablecoin issuers are not content to remain purely infrastructure providers. They are eyeing M&A and direct acquisitions to broaden economic moats. That trend raises several implications:

Competition over RWA: If issuers pursue tokenized assets (gold, debt, property), the market could bifurcate between liquid-backed stablecoins and crypto-native credit facilities. This competition will affect how exchanges and custodians choose reserve partners.

Strategic partnerships over outright ownership: Other issuers might prefer sponsorship, payment partnerships, or minority stakes to test the waters without the governance burdens of ownership.

Brand vs. compliance calculus: The Juventus episode shows the payoff of instant mainstream recognition — and the simultaneous risk of regulatory escalation. Firms will have to weigh brand wins against potential license or banking relationship losses.

For crypto observers focused on tokenized markets and DeFi linkages, the key question is whether M&A will be used to create off-chain collateral pools that back on-chain stablecoins, or whether these moves are largely marketing-driven.

What to watch next

For analysts and mainstream finance readers assessing the sector, monitor these signals:

- Disclosures around reserve segregation: Any acquisition moves should be accompanied by independent attestations clarifying how customer-facing reserves are insulated from corporate M&A activity.

- Regulatory filings and statements: Pay attention to banking partners, AML/KYC procedures tied to sports commerce, and any cross-border licensing inquiries.

- Tokenization roadmaps: If a stablecoin issuer ties RWA (gold, property, club revenues) to on-chain tokens, auditability and legal structuring will be decisive.

- Market behavior in fan tokens and related instruments: Fan token volatility after the bid shows how fast on-chain financial products can amplify corporate maneuvers.

Bitlet.app and other ecosystem participants will be watching these signals closely as they evaluate custody, payment integrations, and tokenized-asset product design.

Final read: bold move, bigger questions

Tether’s reported €1B/$1.1B bid for Juventus — and its rejection — is more than a quirky storyline. It serves as an early, high-visibility experiment in how stablecoin issuers might translate on-chain liquidity into mainstream corporate strategies and RWA exposure. Whether it proves to be a first step toward vertical integration or an overreach that attracts regulatory blowback remains to be seen.

For now, the episode forces a sharper conversation about governance, transparency and the role of stablecoins in bridging crypto markets with traditional industries. As issuers chase brand, transactional volume and tokenized assets, the boundaries between financial utility, corporate ownership and public-facing brands will only get more blurred — and more consequential.

Sources

- Blockonomi — Initial report on Tether's €1B all-cash offer: https://blockonomi.com/crypto-giant-tether-attempts-juventus-buyout-in-bold-cash-offer/

- CryptoNews — Follow-up reporting on the $1.1B bid and reported rejection: https://cryptonews.com/news/tether-makes-all-cash-1-1b-bid-to-buy-juventus-but-offer-rejected/

- AmbCrypto — Reporting on USDT movements, tokenized gold and Tether valuation aims: https://ambcrypto.com/usdt-moves-156b-in-small-transfers-as-tether-eyes-a-500b-valuation/

- Coinpedia — Coverage of the planned acquisition and fan token market reaction: https://coinpedia.org/news/tether-plans-1-billion-acquisition-of-juventus-crypto-firm-eyes-major-football-club/