Tether Solvency Debate Explained: Hayes’ Alarm, AI Probes, and What Investors Should Do

Summary

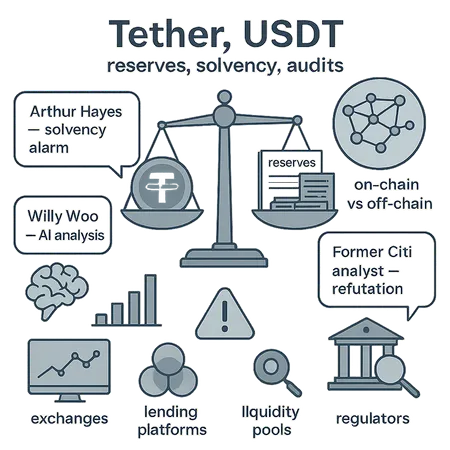

The trigger: Hayes’ solvency alarm and the immediate market context

In late commentary on X (formerly Twitter), Arthur Hayes — a high-profile crypto commentator and former exchange executive — asked sharp questions about whether Tether (USDT) was fully solvent. The post prompted renewed public scrutiny because Tether is the largest fiat-pegged stablecoin by market cap and because questions about its reserves have resurfaced intermittently over the years. Media coverage captured how a single social-media prompt can cascade into broader concern: one recap described Hayes’ post as the spark for people to re-examine Tether’s Q3 attestation and other disclosures Arthur Hayes’ solvency alarm.

That alarm coincided with broader market turbulence: during big intraday selloffs, stablecoin-related fears often amplify leverage-driven liquidations. Reporting on a recent crash highlights how worries about stablecoins can form part of a multi-causal sell-off that triggers large liquidations across exchanges and derivatives venues market impact and liquidations.

How analysts probed the claim: on-chain heuristics, AI, and human judgment

When public figures raise solvency concerns, analysts respond in several ways: (1) on-chain forensic work, (2) balance-sheet reconstruction from public filings, and (3) natural-language/AI searches across public records and social posts. Some well-known on-chain analysts — who typically track flows, exchange balances, and concentration metrics — applied their heuristics to see if behaviour matched insolvency stress (for example, unusual large transfers to exchanges, or spikes in redemptions). Others augmented that work with generative-AI tools (search agents or LLMs) to cross-check public attestations, news, and court documents.

A notable element of the recent debate was a public back-and-forth: some participants used AI tools to compare stablecoin disclosures and flag anomalies, while other experts cautioned that AI or on-chain signals alone cannot prove or disprove the contents of off-chain bank accounts. The Benzinga piece capturing Hayes’ prompt also notes that analysts asked AI to compare stablecoin reserve claims — a useful but incomplete technique when the ultimate evidence is held off-chain.

What Tether’s attestations show — and what they don't

Tether regularly issues third-party attestations of reserve snapshots rather than the kinds of full-scope financial audits used by public companies under PCAOB/GAAP frameworks. An attestation generally confirms the existence of certain assets at a point in time and that the numbers reported reconcile with the issuer’s records, but it does not provide the same level of assurance, scope, or ongoing testing as a full audit.

Key limitations of attestations vs audits:

- Scope: attestations usually cover specific accounts or asset categories at a snapshot date; they do not necessarily include exhaustive testing of internal controls.

- Timing: snapshots can become stale between reporting dates; rapid redemptions can stress liquidity between attestations.

- Third-party independence: while reputable accounting firms perform attestations, the work is limited by the engagement letter and the data provided.

A vocal rebuttal to Hayes’ implication came from a former Citi analyst who explained how Tether’s balance-sheet mechanics can include a mix of cash, cash equivalents, commercial paper, secured loans, and other short-term instruments — and why a seemingly puzzling on-chain pattern is not, on its own, proof of insolvency analyst refutation and technical explanation. That refutation is a reminder that interpreting reserves requires accounting know-how and access to off-chain documentation.

On-chain vs off-chain visibility: what you can reliably see

On-chain analysis is powerful for understanding flow behavior and counterparty patterns. For example, you can observe:

- Total circulating USDT supply and changes to it.

- Token movements between addresses, smart contracts, and known exchange or custodian wallets.

- Timing correlations between large transfers and price moves.

What on-chain data cannot show is the composition and legal status of the off-chain assets backing a stablecoin: bank account balances, commercial-paper holdings, repo agreements, or the contractual terms of loans and collateral. Those live in bank statements, custody agreements, and internal ledgers.

So while on-chain work can identify patterns that suggest stress (e.g., heavy movement of reserves toward exchanges), it cannot provide definitive proof of solvency or a detailed reserve mix without off-chain audit evidence.

Historic precedents and why they matter

Two categories of past events inform this debate:

- Algorithmic-stablecoin failures (Terra/Luna): those collapses taught the market that peg mechanisms matter — failure modes are rapid and self-reinforcing when market confidence evaporates.

- Reserve-opacity controversies (previous Tether episodes and stablecoin redemptions): historically, questions about backing and reserve mixes have driven regulatory and market responses, including settlements and heightened disclosure demands.

Together these precedents show that stablecoins with opaque reserve practices face both market and regulatory risk. During bouts of stress, even well-capitalized entities can suffer rapid liquidity strain if counterparty access to cash is restricted or if redemption demands concentrate in short windows.

What the controversy implies for market structure, liquidity risk, and regulation

Market-structure implications:

- Concentration risk remains critical: if most trading rails and protocols rely on a single large issuer, any question about that issuer’s backing raises systemic concerns.

- Redemption mechanics matter: a stablecoin that promises instant on-chain redemption but relies on off-chain settlement is exposed to time-lag risk.

Liquidity risk:

- Assets can be solvent on paper but illiquid in practice. A reserve heavy in commercial paper or less liquid instruments may not be immediately convertible to cash at par during stress.

- Counterparty limits, bank relationships, and legal jurisdictional issues can all slow redemptions.

Regulatory implications:

- Expect renewed focus from regulators on reserve transparency, frequency of attestations, and standardization (for example, defining acceptable reserve assets and requiring rapid, verifiable proof of liquidity).

- Compliance regimes will likely be asked to stress-test stablecoin issuers and to require clearer redemption rights for users.

Policymakers are already debating frameworks that could mandate higher-frequency attestations, regulated custodians for cash reserves, or full audits under recognized standards. That process will involve trade-offs between operational privacy and consumer protection.

Practical guidance for investors and compliance professionals

For investors and compliance teams assessing counterparty risk in stablecoins such as USDT, consider these actions:

- Demand clarity on redemption mechanics: understand whether on-chain burns/redemptions map to immediate fiat settlement or to a delayed off-chain process.

- Monitor attestation cadence and the engaged firm’s scope: more frequent, broader attestations increase confidence.

- Diversify stablecoin exposure: holding a mix of issuers reduces single-point-of-failure risk.

- Use on-chain monitoring to detect anomalous flows, but pair it with review of off-chain disclosures and legal terms.

- Stress-test assumptions: run scenarios where a percentage of holders redeem simultaneously and map how reserves would convert to cash.

- For compliance teams: map jurisdictional bank links, custody arrangements, and contractual terms that would determine how reserves are accessed in a crisis.

Tools and platforms that combine on-chain analytics with legal and accounting review can speed decisions — Bitlet.app is an example of industry tooling that helps traders and compliance teams manage exposure without relying on a single stablecoin provider.

A pragmatic conclusion: evidence, skepticism, and the limits of each tool

The Hayes episode was a useful reminder that public doubt can drive intense scrutiny — and that scrutiny benefits from both technical on-chain work and careful reading of off-chain accounting. AI tools and on-chain analysts can surface anomalies quickly, but they do not replace the evidentiary value of verifiable attestations, audits, and audited custody confirmations.

For market participants, the right posture is skeptical but evidence-driven: watch reserve disclosures, insist on transparency about liquidity composition, and plan for redemption stress scenarios. Regulators will likely push for clearer standards, and market participants who prepare will reduce both financial risk and compliance friction.

Sources

- Arthur Hayes’ solvency prompt and analyst AI comparisons: Benzinga report

- Former Citi analyst refutation and balance-sheet explanation: Coinpedia analysis

- Market impact and liquidations context during selloffs: Decrypt coverage

For additional context on blockchain flow analysis and market indicators, see on-chain research on Bitcoin and broader DeFi liquidity studies.