Gold

During recent market stress gold staged a six‑month rally that echoed parts of the 2019 cycle while Bitcoin experienced heavy outflows and rotation. This piece explains the drivers behind the shift and offers practical portfolio allocation frameworks for balancing BTC and precious metals in 2026.

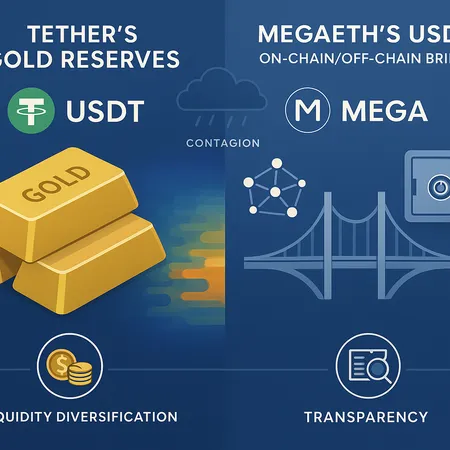

Tether’s large-scale accumulation of physical gold and the launch of USAT change the balance of reserve composition and competitive dynamics between stablecoins. This analysis examines custody, market impact, credibility implications for USDT/XAUT, and how USAT pressures USDC in U.S. corridors.

A strategic explainer for macro-focused investors on why capital rotated into gold and silver recently, and which macro and on-chain catalysts could reverse the narrative in favor of BTC.

In 2026 the concept of scarcity is shifting from fixed supply to access and liquidity — a change driven by ETFs, derivatives, and institutional custody that reshapes price discovery for Bitcoin relative to gold. This article explains the mechanics and offers practical allocation frameworks for wealth managers and long-term investors.

As 2026 approaches, investors must parse competing narratives — Bitcoin vs gold, BoJ-driven carry trades, and vocal critics like Peter Schiff — to understand where flows might land. This piece maps the arguments, the flow mechanics, and the practical signals macro allocators should watch.

In 2025 a clear ‘metal season’ unfolded: gold‑ and silver‑linked crypto derivatives outpaced BTC as macro and flow dynamics favored metal exposures. This analysis examines drivers, on‑chain and derivatives evidence, implications for the digital gold debate, and practical allocation frameworks for wealth managers.

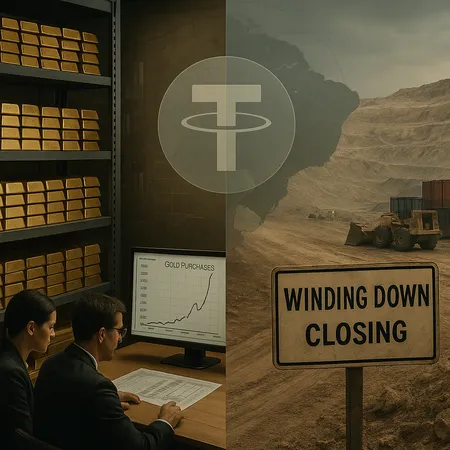

Tether’s simultaneous accumulation of gold and wind-down of mining operations in Uruguay presents a deliberate pivot in reserve strategy and operational focus. For treasury managers and macro traders, the moves raise questions about liquidity, transparency and how to size short-term exposure to USDT.

Tether's growing gold stockpile and MegaETH's USDm pre-deposit bridge reflect a shifting playbook for stablecoin reserves. This article analyzes why issuers diversify (gold vs cash), how on‑chain/off‑chain bridges work, and the systemic implications for liquidity, transparency, and contagion risk.

Explore the anticipated surge of gold in 2025 compared to the S&P 500 and how integrating crypto through Bitlet.app's installment service can enhance your portfolio diversification strategy.

In 2025, rising inflation is changing the investment landscape. Investors increasingly rely on gold, Bitcoin, and tech stocks to protect and grow their wealth. Platforms like Bitlet.app make investing in Bitcoin easier by offering crypto installment plans, allowing you to buy now and pay monthly.