CryptoGPT: How Generative AI Could Rewire Crypto Research and Trading

Summary

Introduction: CryptoGPT in context

Husky Inu AI’s announcement of CryptoGPT ahead of HINU’s March 2026 launch presents a notable moment: a memecoin‑adjacent project positioning itself as an AI‑native analytics provider. According to the platform brief, CryptoGPT will combine large language models with on‑chain feeds, sentiment streams, and proprietary feature engineering to produce signals, scenario summaries, and probabilistic forecasts for traders and researchers. For technically minded quants the question isn’t hype vs. reality — it’s how generative AI changes workflows, where it truly adds value, and how to manage the new classes of model risk that follow.

For many traders, Bitcoin remains the primary market bellwether; any AI product that claims to improve timing or detect regime shifts will be judged on whether it actually improves forward out‑of‑sample performance rather than just producing convincing backtests.

What CryptoGPT claims to offer

CryptoGPT is framed as a stack of capabilities rather than a single signal:

- Automated synthesis: human‑readable summaries of evolving narratives across chains, social channels, and news. This is pitched as a time‑saver for analysts who currently triage multiple dashboards.

- On‑chain signals: LLM‑assisted feature generation from transfers, exchange flows, token holder concentration, and more — with the goal of extracting higher‑order indicators that classic dashboards might miss.

- Sentiment and NLP insights: embeddings and topic models built from social data, technical threads, and developer updates to quantify market narrative momentum.

- Probabilistic forecasting: calibrated short‑term probability curves for price moves, volatility spikes, and event likelihoods.

Husky Inu AI’s product framing mirrors a broader industry push to combine model inference and domain knowledge into a single layer; their announcement describes both automated pipelines and an interactive interface for hypothesis testing. The original platform announcement provides product detail and timelines CryptoGPT announcement.

Use cases: where generative AI helps most

AI isn’t magic; it’s a different toolset. The clearest use cases for platforms like CryptoGPT are:

1) Accelerating research and hypothesis formation

Quant researchers spend a lot of time feature‑engineering and writing natural‑language notes on why a signal might work. Generative AI can propose candidate features (e.g., normalized whale flow rates, time‑weighted exchange inflows) and summarize counterarguments. That cuts iteration time on new strategies.

2) Multimodal on‑chain signal augmentation

Traditional on‑chain analytics compute primitives (active addresses, transfer volumes, exchange balance deltas). Generative systems can join these primitives into higher‑order descriptors (e.g., “sustained accumulation by top 1% addresses combined with exchange outflows and developer inactivity”), which can be tested quantitatively.

3) Signal triage and priority alerts

When markets move, traders want a short list of plausible drivers. NLP‑based summarization of tweets, GitHub commits, and on‑chain anomalies can prioritize investigations faster than manual triage.

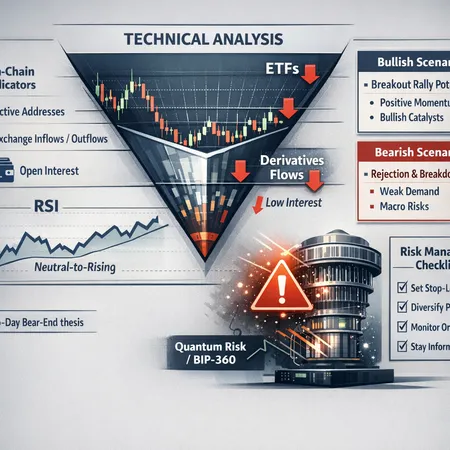

4) Probabilistic scenario generation and stress narratives

Generative models can produce plausible event scenarios (e.g., fork risk, exploit narratives) that a risk team can then quantify. These are less about point forecasting and more about surfacing tail risks.

Across these uses the practical win is faster idea throughput and the ability to capture nonlinear interactions that rule‑based heuristics might miss.

How AI complements — and sometimes replaces — traditional on‑chain analytics

On‑chain tools such as Glassnode have made rigorous metric design and visualization mainstream; recent innovations like collaborative analysis tools and SwissBlock partnerships show how specialized on‑chain analytics evolve into productized workflows. For a useful contrast, see examples of on‑chain analytics innovation and tooling in industry reporting on collaborations like the Glassnode‑SwissBlock integration Glassnode SwissBlock example.

AI complements these systems by:

- Automating feature invention and suggesting composite metrics built from primitives.

- Providing human‑readable narratives that bridge the gap between numeric signals and trader action.

- Enabling faster cross‑dataset joins (on‑chain + social + derivatives open interest) where manual joins are slow and error‑prone.

But AI will not suddenly make raw on‑chain metrics irrelevant. Robust, debiased primitives are the substrate for any reliable model. Generative models operate on the quality of inputs; if exchange flow data or holder labels are noisy, the AI’s narratives and forecasts will reflect that noise.

Key model risks: overfitting, bias, and false signals

Generative AI introduces familiar and new risks. Quant teams must recognize and mitigate them.

Overfitting and backtest selection bias

LLMs can help produce hundreds of candidate features. Without disciplined walk‑forward testing and proper multiple‑hypothesis correction, you will overfit. Common traps: feature leakage from future timestamps, reusing the same lookahead windows for many correlated features, and implicitly tuning hyperparameters to past crashes.

Mitigations: strict out‑of‑sample windows, nested cross‑validation, and the use of Purged CV or gap‑based validation to remove leakage in time series.

Model bias and spurious correlations

Language models trained on social data will encode platform biases (bots, geographic skew, influencer amplification). This produces biased sentiment signals that can mislead allocators. NLP embeddings may overemphasize vocal minorities.

Mitigations: debiasing techniques, weighting by verified actor reliability, and cross‑checking with on‑chain economic indicators.

False signals and overconfidence

Generative systems often output confident prose even when uncertain — the classic “plausible but false” issue. That’s particularly dangerous when AI outputs get converted directly into automated execution rules.

Mitigations: require calibrated probability estimates, maintain uncertainty bands, and avoid deterministic rule extraction from single model outputs.

Regime shifts and nonstationarity

Crypto markets evolve fast. A model that works in a high‑leverage, low‑liquidity regime may fail in an insulated bull market. Past performance is not proof of future behavior.

Mitigations: frequent retraining, concept‑drift detectors, and meta‑models that detect regime shifts.

Commercial and ethical questions

AI analytics change the market structure in subtle ways.

Paid signals, information asymmetry, and democratization

Paid AI signal services could concentrate high‑quality analysis behind paywalls, widening retail vs institutional asymmetry — unless platforms adopt tiered access. Conversely, well‑packaged AI products could lower the technical barrier, enabling more retail participation. The net effect depends on pricing and distribution.

Front‑running and latency risk

Once an AI service produces actionable signals, execution latency and access parity matter. Providers must decide whether to offer raw signal streams, delayed summaries, or only human‑mediated reports. Selling deterministic, high‑frequency signals creates a front‑running risk, especially if institutional clients can act milliseconds faster than retail subscribers.

Data quality, provenance, and commercial incentives

Generative models are only as good as their data. Proprietary enrichment (e.g., cleaned entity labeling, de‑duplication of social bots) becomes a commercial moat. That raises questions around reproducibility and auditability: can a user independently validate a claim made by a closed‑box AI?

Ethical governance

When models influence markets, platform governance matters: conflict‑of‑interest disclosures, model cards, and periodic external audits should be standard. Traders and firms should ask for model documentation outlining training data, retraining cadence, and known failure modes.

Practical advice for technical traders and quant researchers

If you are deciding whether to adopt CryptoGPT or similar AI crypto analysis tools, take a staged, engineering‑minded approach.

1) Treat AI outputs as hypothesis generators

Use outputs to produce testable features rather than trading rules. Convert narratives into numeric factors and validate them through rigorous backtests.

2) Build a robust validation pipeline

Implement walk‑forward testing, nested CV, and out‑of‑sample stress tests. Use purging and time gaps to avoid leakage. Maintain a leaderboard of features with conservative penalties for reusing the same data slices.

3) Quantify uncertainty and use ensembles

Require models to provide calibrated probabilities and error bars. Combine LLM‑generated features with classical econometric models and tree‑based ensembles; ensembles often reduce single‑model failure modes.

4) Monitor model health in production

Instrument model drift metrics, data distribution monitors, and a rapid rollback plan. Track forward P&L attribution to isolate whether AI‑driven decisions are contributing or harming returns.

5) Maintain a human‑in‑the‑loop governance

Avoid handing execution keys to end‑to‑end generative pipelines. Humans should vet high‑impact signals, especially those that will change position sizes materially.

6) Evaluate latency and data refresh needs

Decide if you need real‑time API access or if near‑real‑time summaries suffice. High‑frequency trading needs lower latency and deterministic primitives; narrative‑driven alpha often tolerates higher latency.

7) Ask vendors for transparency

Request model cards, data lineage, feature definitions, and a sandbox environment. Where possible, replicate a vendor’s top claims in your own environment before production deployment.

Operational checklist: short practical steps

- Ingest vendor signals into a feature store, not directly into execution systems.

- Tag all model features with provenance and refresh cadence.

- Run automated counterfactuals: what happens to returns if a signal’s timing is offset by X minutes/hours?

- Implement position‑sizing limits on AI‑sourced signals until they pass a defined validation period.

Where CryptoGPT might find durable advantage

Platforms that combine cleaned, audited on‑chain primitives with high‑quality social data enrichment, interactive diagnostics, and explicit uncertainty estimates can be useful. If CryptoGPT offers a sandbox and model documentation, it could accelerate R&D for smaller quant teams. But the durable edge will come from disciplined engineering: data provenance, rigorous testing, and conservative production controls — not just prettier narratives.

One practical way to think about adoption: use generative AI for idea discovery and triage, but rely on classical signal engineering and statistical validation for portfolio construction. That hybrid approach mirrors how many firms use new toolchains: AI to amplify human creativity, human rules to constrain risk.

Conclusion: measured adoption, not wholesale replacement

Generative AI platforms like CryptoGPT will change research workflows by speeding feature discovery, summarizing narratives, and joining disparate datasets more quickly than manual methods. However, they do not eliminate the core work of rigorous validation, risk management, and feature hygiene. For quants and traders the right posture is cautious experimentation: leverage AI to expand idea velocity, instrument robust validation and monitoring, and insist on transparency from vendors.

For teams exploring adoption, Bitlet.app’s ecosystem and APIs can be a useful integration point for testing new signal sources within existing execution and portfolio systems. The endgame is not AI replacing traders but AI enabling better, faster trade hypotheses — provided teams respect model risk and design defensively.

Sources

- Introducing CryptoGPT — a new AI‑driven crypto analysis platform (Husky Inu AI announcement): https://cryptodaily.co.uk/2025/12/introducing-cryptogpt-a-new-ai-driven-crypto-analysis-platform

- Glassnode and SwissBlock collaboration example (on‑chain analytics innovation): https://blockchain.news/news/glassnode-swissblock-bitcoin-analysis-tool